Air Canada (AC) and Edmonton International Airport (EIA) have signed a historic green partnership to reduce carbon emissions and promote a more sustainable and greener aviation industry. Shares of Canada’s largest airline jumped 3% after the announcement.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The IEA-Air Canada Sustainability Partnership is the first agreement in Canada intended to reduce the carbon footprint of air travel. The two organizations will work together and focus on initiatives promoting a greener environment in various areas.

Myron Keehn, Vice President of Air Service and Business Development at Edmonton International Airport said, “Finding good partners who share our core values is critical. Air Canada is passionate about reducing its environmental impact and our partnership shows how airlines and airports can work together to promote a sustainable future. This is only the beginning as we know that there are tremendous opportunities to lead in both an environmentally and economically sustainable way.”

Samuel Elfassy, Vice President of Safety at Air Canada said, “This partnership with Edmonton Airports is an important step towards our midterm 2030 objectives that roll up into our overall net-zero by 2050 emissions goal. We look forward to working together in developing innovative, long term, sustainable airport and ground operations emission reductions that could potentially be scaled at other airports in Canada and internationally.”

These commitments will attract further investment to the Edmonton Metropolitan Region and create highly skilled jobs as the region moves towards a greener economy. (See Air Canada stock analysis on TipRanks)

Last week, TD Securities analyst Tim James upgraded AC to Buy from Hold and raised its price target to C$30.00 (from C$28.00), for 15.4% upside potential.

James believes that the decline in COVID-19 cases in Canada and a “rapidly increasing” portion of the population that is vaccinated are positive catalysts for Air Canada’s stock.

The rest of the Street is cautiously optimistic on AC with a Moderate Buy consensus rating based on 7 Buys and 3 Holds. The average analyst price target of C$30.10 implies 17% upside potential from current levels. Shares have risen nearly 15% year-to-date.

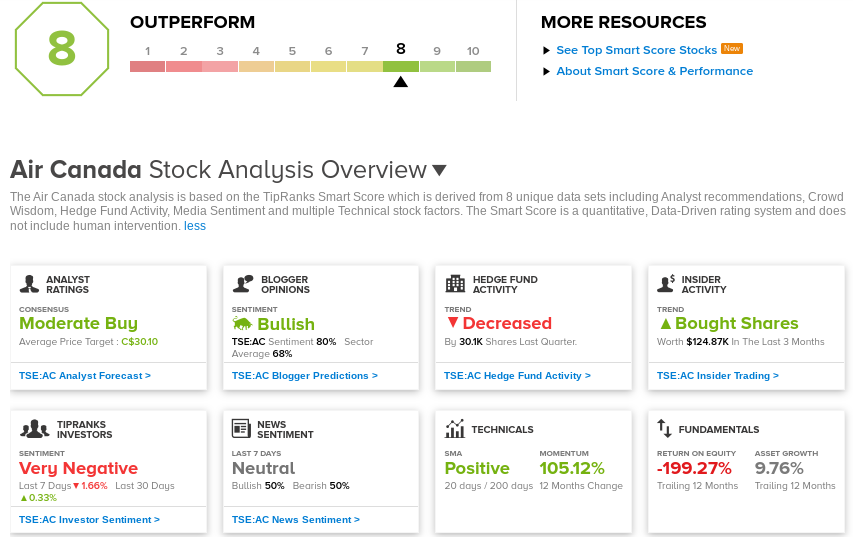

TipRanks’ Smart Score

AC scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock’s returns are likely to outperform the overall market.

Related News:

Whitecap Resources Closes Kicking Horse Oil & Gas Acquisition; Hikes Dividend 8%

Crescent Point Energy Swings To A 1Q Profit On Higher Oil Prices; Shares Pop 4%

Air Canada Posts C$1.3B 1Q Loss On Lower Traffic