Air Canada has slashed the price it will pay for tour operator Transat to C$190 million ($144 million) from C$720 million as the coronavirus pandemic triggered a halt in aviation travel and pushed down airline values.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Air Canada (ACDVF) announced on Saturday that it will buy all of Transat shares at a trimmed price of $5 per share, payable at the option of Transat shareholders in cash or shares of Air Canada at a fixed exchange ratio of 0.2862 Air Canada share for each Transat share. The new purchase price represents a premium of 31.6% over the 20-day volume weighted average price (VWAP) of Transat shares on Oct. 8.

The deal translates into a price of $17.47 for Air Canada shares, the company said. Air Canada shares closed down 3.4% at $12.27 on Friday.

The Canadian airline said the reduced deal value reflects the “unprecedented impact of COVID-19 upon the global air transport industry, which has endured a severe decline in air travel since the initial Arrangement Agreement between Air Canada and Transat was concluded”. Back in August last year, Air Canada shareholders had approved the acquisition of Transat, which operates Air Transat, in a deal worth C$720 million.

“COVID-19 has had a devastating effect on the global airline industry, with a material impact on the value of airlines and aviation assets. Nonetheless, Air Canada intends to complete its acquisition of Transat, at a reduced price and on modified terms,” said Air Canada CEO Calin Rovinescu. “This combination will provide stability for Transat’s operations and its stakeholders and will position Air Canada, and indeed the Canadian aviation industry, to emerge more strongly as we enter the post-COVID-19 world.”

The Transat Board of Directors has unanimously agreed that the amended transaction is in the best interests of Transat and its stakeholders, and is recommending that Transat shareholders vote in favour of the transaction. In addition, each of the directors of Transat has entered into a voting support agreement pursuant to which each of them has committed to vote in favour of the transaction.

The transaction remains subject to shareholder approval, court approval, the approval of the Toronto Stock Exchange, certain customary and other conditions, and regulatory approvals including the ongoing approval process of regulatory authorities in Canada and the European Union. The transaction is expected to be completed in late January or early February 2021.

Shares in Air Canada have tanked 67% so far this year as the pandemic-induced global aviation crisis has forced many airlines around the world to ground the majority of their fleets and to sharply reduce spending. (See Air Canada stock analysis on TipRanks)

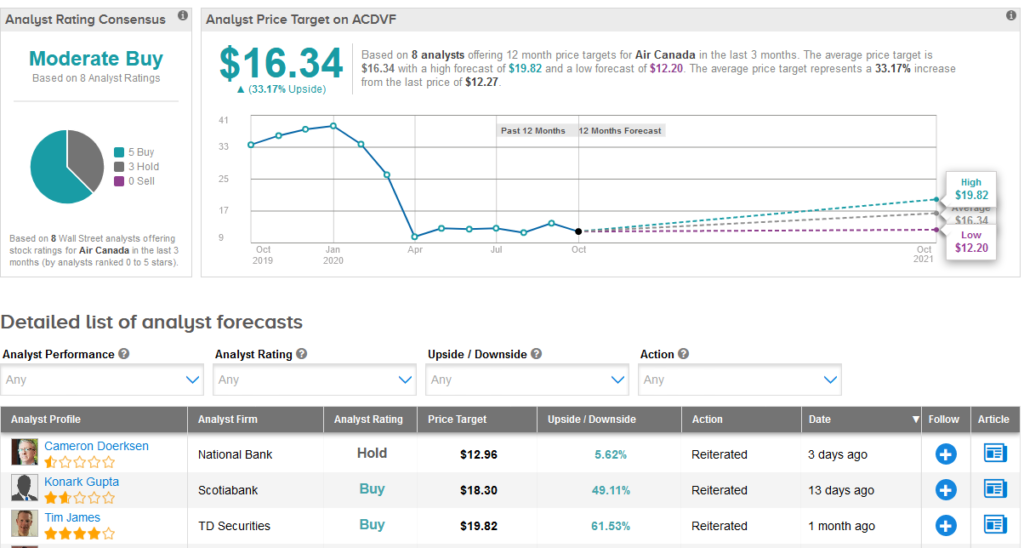

Looking ahead, Wall Street analysts have a cautiously optimistic outlook on the stock. The Moderate Buy consensus is based on 5 Buy ratings and 3 Hold ratings. In light of the recent share plunge, the $16.34 average price target reflects 33% upside potential in the coming 12 months.

Related News:

Airbus Jet Deliveries Show Monthly-High In Sept., No New Orders

AT&T Key Beneficiary Of Defense Dept’s $600M Award For 5G Testing

GameStop Explodes 44% On Major Microsoft Tie-Up, As Trading Resumed