Agree Realty Corp. reported robust top-line performance for 3Q as revenues increased 32.7% to $63.8 million year-on-year, surpassing analysts’ expectations of $61.3 million. The real estate investment trust (REIT) company’s top-line results benefited from continued investments toward acquiring high-quality leasable assets.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Agree Realty (ADC) acquired approximately $458.3 million worth of properties which included 91 properties leased to leading retailers across “off-price retail, home improvement, auto parts, general merchandise, dollar stores, convenience stores, grocery stores and tire and auto service” sectors.

The company’s adjusted funds from operation (AFFO) of $0.80 beat Street estimates by a penny and marked improvement of 3.9% year-over-year. Agree Realty’s aggregate rent collection improved to 97% during 3Q from 90% in 2Q. (See ADC stock analysis on TipRanks)

“We are extremely pleased with our record performance during the quarter as we deployed our war chest into a myriad of high-quality investment opportunities amidst the ongoing disruption caused by COVID-19,” said Agree Realty CEO Joey Agree. “Our rent collections of more than 97% during the third quarter, including 99% in September, are evidence of the stability of our best-in-class retail portfolio.

Buoyed by strong 3Q performance, the company raised its full-year acquisition guidance to a range of $1.25-$1.35 billion from $900 million to $1.10 billion projected earlier.

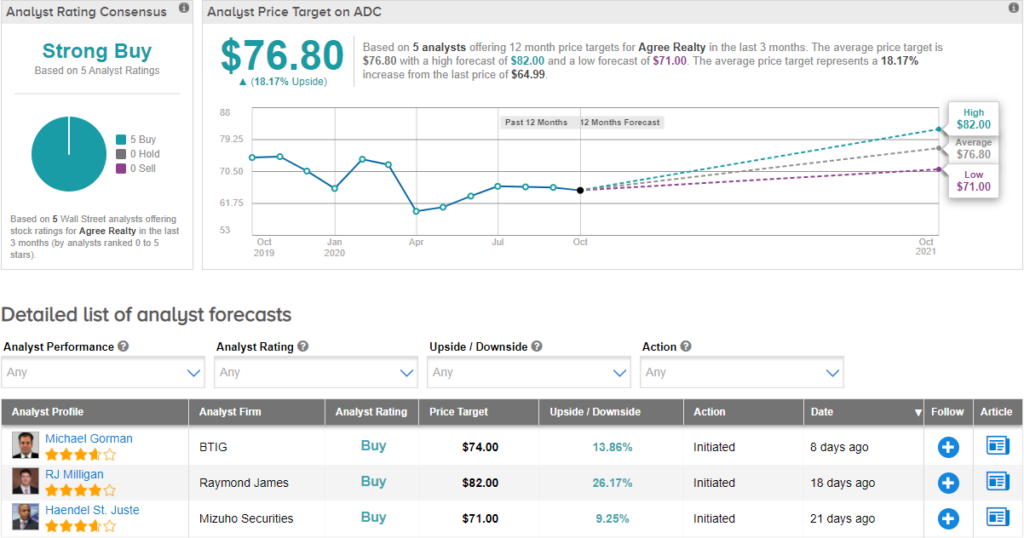

On Oct. 12, BTIG analyst Michael Gorman initiated coverage on the stock with a Buy rating and price target of $74 (13.9% upside potential). In a note to investors, Gorman said that given its sustained focus on partnering with large tenants, the company is a “best-in-class Free standing REIT.” He further noted that the company’s strategy of growing through acquisitions and focus on large investment-grade tenants has helped its stay afloat during the COVID-19 pandemic.

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 5 Buys. With shares down over 7.4% year-to-date, the average price target of $76.80 implies upside potential of about 18.2% to current levels.

Related News:

AMC Spikes 14% As Movie Theatres To Reopen; Street Sees 70% Upside

Ally Financial Tops 3Q Estimates; Street Remains Bullish

Hexcel Drops 8% As Covid-19 Headwinds Trigger 3Q Loss