Shares of Agilent (NYSE:A) gained in after-hours trading after the company, reputed as a leader in the life sciences, diagnostic, and applied chemical markets, reported earnings for its fourth quarter of Fiscal Year 2023. Earnings per share came in at $1.38, beating analysts’ consensus estimate of $1.34.

Sales decreased by 8.6% year-over-year, with revenue hitting $1.69 billion. This beat analysts’ expectations by $10 million.

Looking forward, management now expects revenue and adjusted earnings per share for Q1 2024 to be in the ranges of $1.555 billion to $1.605 billion and $1.20 to $1.23, respectively. For the Fiscal Year 2024, the company predicts revenue of $6.71 billion to $6.81 billion and earnings in the range of $5.44 to $5.55 per share.

Is Agilent a Buy or Sell?

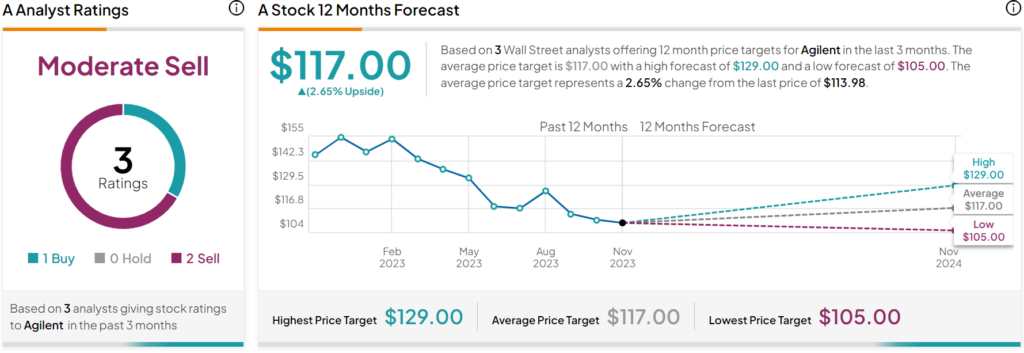

Turning to Wall Street, analysts have a Moderate Sell consensus rating on Agilent stock based on one Buy, zero Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 21% decline in its share price over the past year, the average Agilent price target of $117 per share implies 2.65% upside potential.