Shares of Affirm Holdings (AFRM) surged today after research firm Hedgeye added the fintech company as a new long idea, while Morgan Stanley upgraded the stock.

Analyst Josh Steiner from Hedgeye pointed out that today’s value-conscious shoppers are leaning toward buy now, pay later (BNPL) options, which makes Affirm a go-to for discretionary purchases since it specializes in these types of loans. Plus, the analyst believes that the rollout of the Affirm Card couldn’t be timed better and will extend the appeal of BNPL to everyday spending and smaller purchases.

Steiner also noted that Affirm could see an increase in business as gas prices climb since higher fuel costs often push consumers toward installment financing like BNPL. This trend shows that people tend to turn to Affirm’s services as a safety net for their buying habits during times when their wallets feel the pinch. Steiner added that the outlook for Q4 looks promising thanks to strong GMV growth, controlled credit risks, and the potential for higher profitability due to the Fed’s recent rate cuts.

Morgan Stanley Upgrades Affirm

Separately, Morgan Stanley, led by 4.6-star analyst James Faucette, upgraded Affirm from Sell to Hold. The analyst cited better strategies around distribution and promotions, as well as pricing aimed at higher-income customers. In addition, he increased his price target from $20 per share to $37 per share.

Previously, the investment firm had concerns that the company’s user base was skewing toward lower-income customers, which could have hindered long-term growth. However, Affirm’s integration with Apple Pay has broadened its appeal to a younger and more affluent demographic, and Morgan Stanley now forecasts this partnership could add $1.94 billion in transaction volume by FY26. For reference, the previous estimate was $1-1.5 billion.

It’s worth noting that, so far, Faucette has enjoyed a 64% success rate on his stock ratings, with an average return of 6.1% per rating.

Is Affirm Stock Worth Buying?

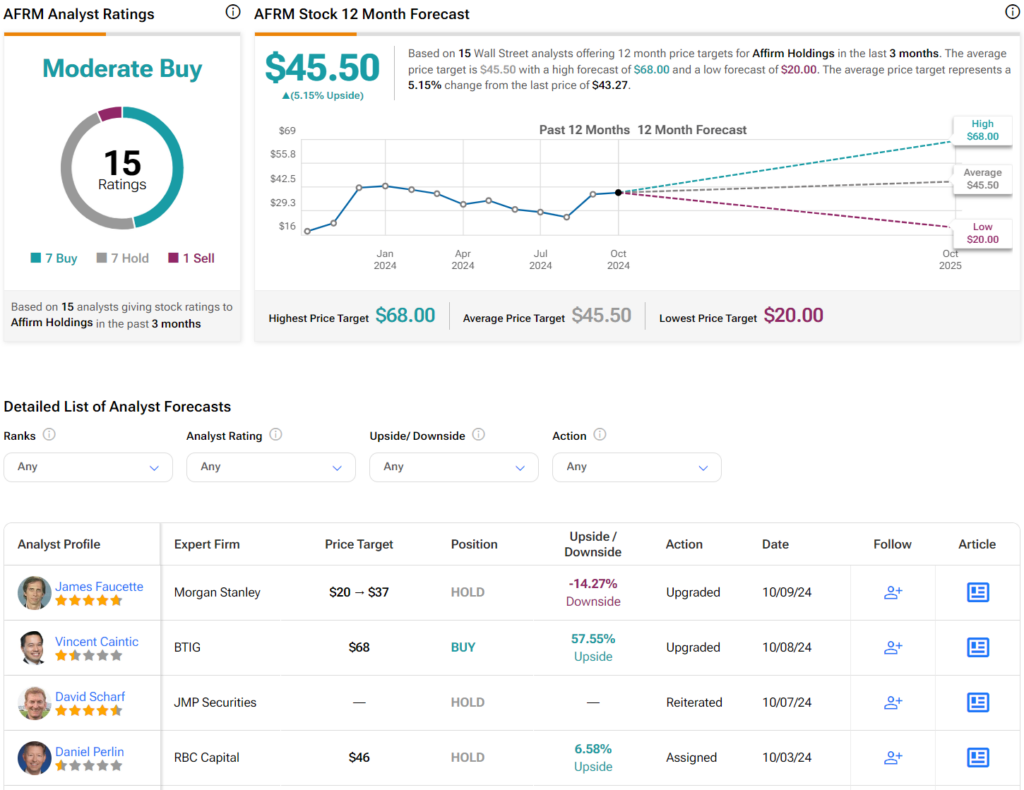

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AFRM stock based on seven Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 119% rally in its share price over the past year, the average AFRM price target of $45.50 per share implies 5.15% upside potential.