Shares of Aegion jumped 12.4% on March 12 after the engineering services company received a new buyout offer from another firm. Terms of the unsolicited non-binding proposal were not disclosed.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Aegion’s (AEGN) board of directors, in consultation with financial and legal advisors, is evaluating the new proposal to determine what will be the best fit for the company and its shareholders, the company said.

Last month, Aegion entered into a cash deal with affiliates of New York-based investment firm, New Mountain Capital, to be acquired for an enterprise value of $963 million. Per the terms of the agreement, the buyer will pay $26 per share for all the shares of Aegion common stock. The deal, which awaits certain approvals, is anticipated to close in the second quarter of 2021.

Last week, Aegion reported 4Q results. The company’s 4Q adjusted earnings increased 3.1% year-over-year to $0.33 per share and outpaced Street estimates of $0.28. Meanwhile, revenues decreased 8.6% to $205.5 million and lagged analysts’ expectations of $262.7 million. (See Aegion stock analysis on TipRanks)

On Feb. 17, Maxim Group analyst Tate Sullivan maintained a Hold rating based on the “outlook for AEGN to complete its sale to New Mountain at $26 per share.”

Sullivan believes “the sale will help AEGN continue to develop robotic sealing technology for smaller diameter drinking water pipes, ultraviolet light curing services, and possibly pipeline integrity inspection products.”

The consensus rating on the stock is a Hold. That’s based on 3 unanimous Holds. Looking ahead, the average analyst price target stands at $26, putting the downside potential at about 10.7% over the next 12 months. Shares have gained 55.2% so far this year.

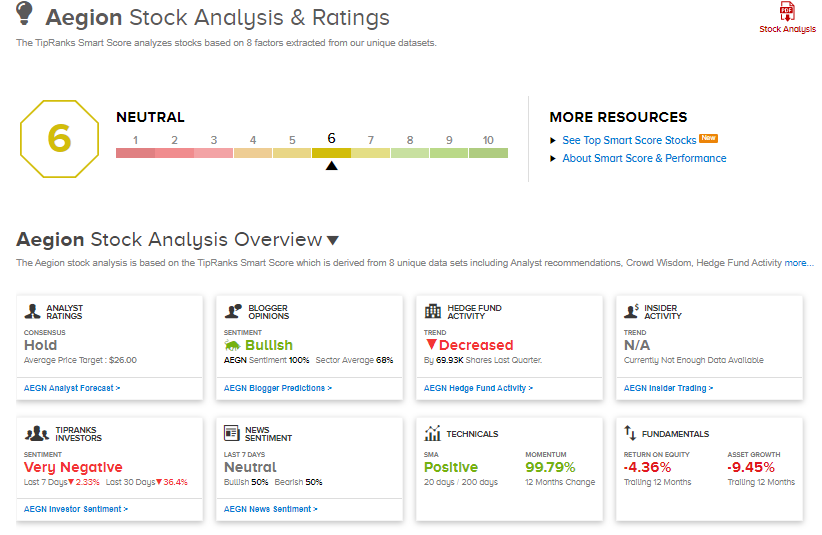

According to TipRanks’ Smart Score system, Aegion gets a 6 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News:

Dropbox To Snap Up DocSend For $165M; Shares Gain 4%

DuPont Inks $2.3B Deal To Snap Up Laird Performance Materials; Shares Gain

Chevron Inks Deal To Buy Noble Midstream Partners; Shares Gain 4%