Adobe (NASDAQ: ADBE) reported upbeat first-quarter fiscal 2022 results, surpassing both earnings per share and revenue expectations. Meanwhile, the company provided disappointing second-quarter guidance impacted by competitive pressures.

Following the update, shares of the American multinational computer software company declined almost 2.7% in the extended trading session on Tuesday.

Results in Detail

Adobe reported adjusted earnings of $3.37 per share, surpassing the consensus estimate of $3.34. The company reported adjusted earnings of $3.14 per share in the same quarter last year.

Record total revenue of $4.26 billion grew 17% year-over-year and beat analysts’ expectations of $4.24 billion. The outstanding performance of all segments drove the results.

Quarterly Segmental Revenue

Digital Media segment revenue stood at $3.11 billion, up 17% year-over-year, while Creative revenue surged 16% to $2.55 billion. Additionally, Document Cloud revenue came in at $562 million, up 26%.

Furthermore, Digital Experience segment revenue was $1.06 billion, up 20%, with subscription revenue growing 22% to $932 million.

Remarkably, Digital Media Annualized Recurring Revenue (ARR) grew $418 million sequentially to $12.57 billion, while Creative ARR increased to $10.54 billion. Also, Document Cloud ARR jumped to $2.03 billion.

Other Metrics

At the end of the first quarter, Remaining Performance Obligations (“RPO”) stood at $13.83 billion, up 19% year-over-year. Also, cash flow from operations was $1.77 billion.

During the reported quarter, Adobe repurchased approximately 3.82 million shares at a total cost of $2.1 billion. The company has remaining repurchase authorization worth $10.7 billion out of $15 billion authorized in December 2020.

In response to encouraging results, Adobe CFO Dan Durn commented, “Our momentum, product innovation and immense market opportunity position us for success in 2022 and beyond.”

Outlook

For the second quarter of fiscal 2022, the company projects net revenue to be $4.34 billion versus analysts’ expectations of $4.41 billion. Furthermore, adjusted earnings are forecast to be $3.30 per share, compared to the Street’s estimate of $3.35 per share.

Following the war in Ukraine, Adobe ceased all new sales of Adobe products and services in Russia and Belarus. Furthermore, the impact on business is expected to result in a total ARR reduction of $87 million and impact revenue by $75 million in FY 2022.

Wall Street’s Take

Consensus among analysts is a Strong Buy based on 12 Buys and three Holds. The average Adobe price target of $586.38 implies 25.71% upside potential. Shares have gained 1.36% over the past year.

Bloggers Weigh In

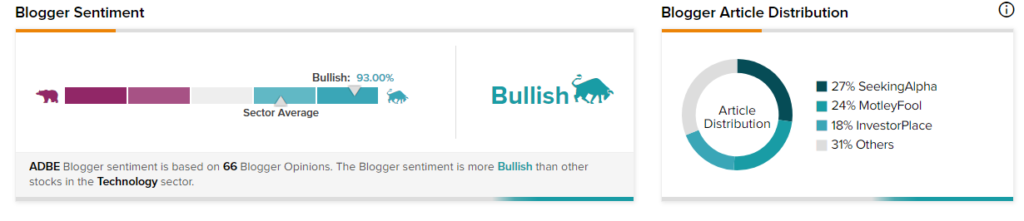

Bloggers seem enthused by the company’s earnings results. TipRanks’ data shows that financial blogger opinions are 93% Bullish on ADBE, compared to a sector average of 69%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

FDA Approves Bristol Myers Squibb’s Opdualag Therapy

Ford’s European Production to Take the Brunt of Macro Issues – Report

Anaplan Signs $10.7B Takeover Deal