Shares of creative software provider Adobe (NASDAQ:ADBE) plunged in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2024. Adjusted earnings per share came in at $4.48, which beat analysts’ consensus estimate of $4.38 per share.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Sales increased by 11.2% year-over-year, with revenue hitting $5.18 billion. This beat analysts’ expectations of $5.145 billion.

Looking forward, management now expects revenue and adjusted earnings per share for Q2 2024 to be in the ranges of $5.25 billion to $5.3 billion and $4.35 to $4.40, respectively. For reference, analysts were expecting $5.31 billion in revenue along with an adjusted EPS of $4.37.

Is Adobe a Buy, Hold, or Sell?

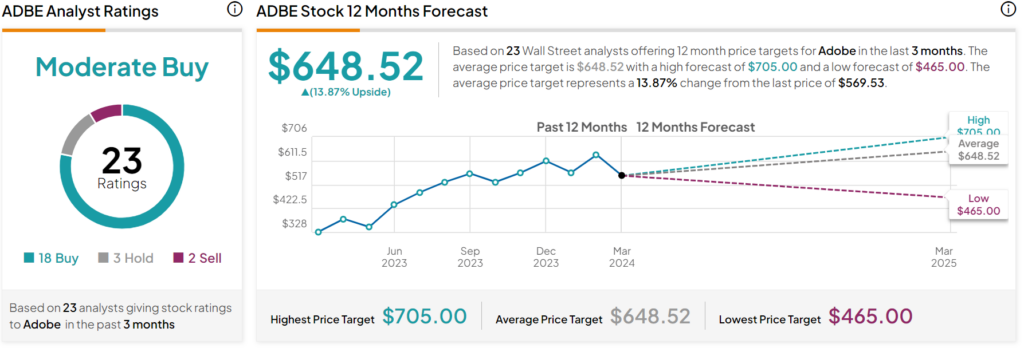

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ADBE stock based on 18 Buys, three Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 70% rally in its share price over the past year, the average ADBE price target of $648.52 per share implies 13.9% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue