Adobe Inc. (ADBE) and IBM Corp. (IBM) have formed a strategic partnership to help accelerate digital transformation and strengthen real-time data security for regulated industries such as banking and healthcare using hybrid cloud solutions.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

The partnership seeks to support companies in regulated industries such as banks in how to protect customer data, whilst they undergo digital transformations and are faced with data-driven marketing and the need to move core workloads to the cloud.

As a result, organizations will be able to manage their content and assets within any hybrid cloud environment – from multiple public clouds to on-premise data centers. IBM will offer clients the flexibility to host, access and leverage data in an environment of their choice.

“Now more than ever companies are accelerating their efforts to engage customers digitally,” said Anil Chakravarthy, executive vice president of Adobe Digital Experience. “We are excited to partner with IBM to enable companies in regulated industries to meet this moment and use real-time customer data to securely deliver experiences across any digital touchpoint, at scale and compliant with regulations.”

Adobe joins as a strategic partner providing customer experience (CX) solutions for the IBM Cloud for Financial Services. Using IBM’s financial services public cloud, IBM will expand Adobe Experience Manager to professionals in regulated industries with the aim of helping them meet the highest security and regulatory requirements when delivering personalized experiences to their customers.

As part of the partnership, IBM will begin using Adobe Experience Cloud and its enterprise applications for its own global marketing. Adobe Experience Cloud customers include the 10 largest U.S. financial institutions.

IBM shares rose less than 1% to $126.86, while Adobe dropped 1.7% to $447.52 in afternoon U.S. trading.

Jefferies analyst Brent Thill last month raised Adobe’s price target to $470 (5% upside potential) from $450 and maintained a Buy rating on the shares saying that digital media was the company’s “source of strength” in its recent Q2 results. He added that he remains confident in Adobe’s superior fundamentals and market leadership.

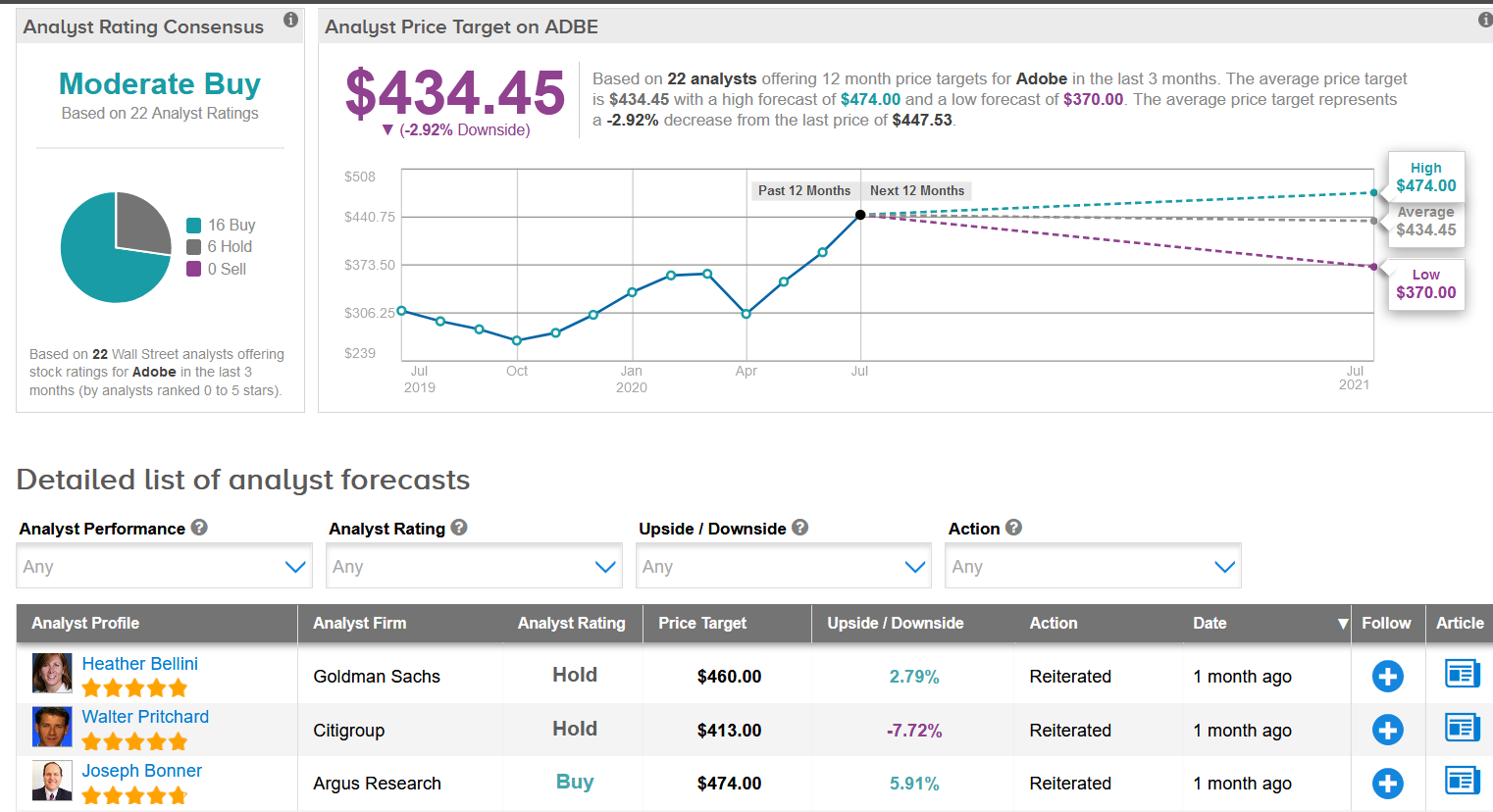

The stock is up 36% year-to-date and has a Moderate Buy analyst consensus that breaks down into 16 Buy ratings versus 6 Hold ratings. The $434.45 average price target now implies 2.9% downside potential for the shares in the coming 12 months. (See Adobe’s stock analysis on TipRanks).

Related News:

Logitech Ramps Up Annual Profit Outlook As Q1 Income Leaps 75%

Synaptics Snaps Up DisplayLink For $305M In All-Cash Deal; Top Analyst Lifts PT

IBM Pops 5% in Extended Trading After Quarterly Profit Beats Expectations