Shares of Adobe (NASDAQ: ADBE) plunged 10.2% to close at $566.09 on Thursday after the American multinational computer software company provided disappointing Fiscal Q1 and Fiscal 2022 guidance. Meanwhile, the company reported upbeat Fiscal fourth-quarter 2021 (ended December 3) revenue results.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Results in Detail

Adobe reported adjusted earnings of $3.20 per share, which came in line with the consensus estimate. The company reported adjusted earnings of $2.81 per share in the same quarter last year.

Record total revenue of $4.11 billion grew 20% year-over-year and topped analysts’ expectations of $4.09 billion. Growth in all segments acted as tailwinds.

At the end of the fourth quarter, Remaining Performance Obligations (“RPO”) stood at $13.99 billion, up 23% year-over-year.

Quarterly Segmental Revenue

Digital Media segment revenue came in at $3.01 billion, up 21% year-over-year, while Creative revenue grew 19% to $2.48 billion. Additionally, Document Cloud revenue stood at $532 million, up 29%.

Furthermore, Digital Experience segment revenue was $1.01 billion, up 23%, with subscription revenue growing 27% to $886 million.

Fiscal 2021 Results

For Fiscal 2021, Adobe reported total revenue of $15.79 billion, up 23% year-over-year. Adjusted earnings came in at $12.48 per share, up from $10.10 per share recorded in the prior year.

During the year, cash flows from operations generated were a record $7.23 billion.

Capital Deployment

In Fiscal 2021, Adobe repurchased approximately 7.2 million shares, including a buyback of 1.6 million shares during the fourth quarter.

CFO Comments

In response to encouraging results, Adobe CFO Dan Durn commented, “Adobe’s financial performance in fiscal 2021 was outstanding, with top-line acceleration resulting in more than $7 billion in operating cash flows. With an estimated $205 billion addressable market, we are well positioned for significant growth in the years ahead with our industry-leading products and platforms.”

Guidance

For the first quarter of Fiscal 2022, the company projects net revenue to be $4.23 billion versus the consensus estimate of $4.34 billion. Furthermore, adjusted earnings are expected to be $3.35 per share, compared to analysts’ expectations of $3.38 per share.

For Fiscal 2022, total revenue is forecast to be $17.9 billion versus the consensus estimate of $18.16 billion. Additionally, adjusted earnings are projected to be $13.70 per share, below analysts’ expectations of $14.26 per share.

Wall Street’s Take

Following the Adobe earnings report, Stifel Nicolaus analyst Parker Lane maintained a Buy rating on the stock but lowered the price target to $700 (23.66% upside potential) from $750.

According to Lane, the impact of foreign exchange rates, one week less in FY22 compared to FY21, and increasing tax rates are some of the factors which led to disappointing guidance, despite strong results.

However, based on expected strong demand trends, the analyst maintained his positive stance.

Consensus among analysts is a Strong Buy based on 15 Buys versus 5 Holds. The average Adobe price target of $721.83 implies 27.51% upside potential. Shares have gained 14.3% over the past year.

Website Traffic

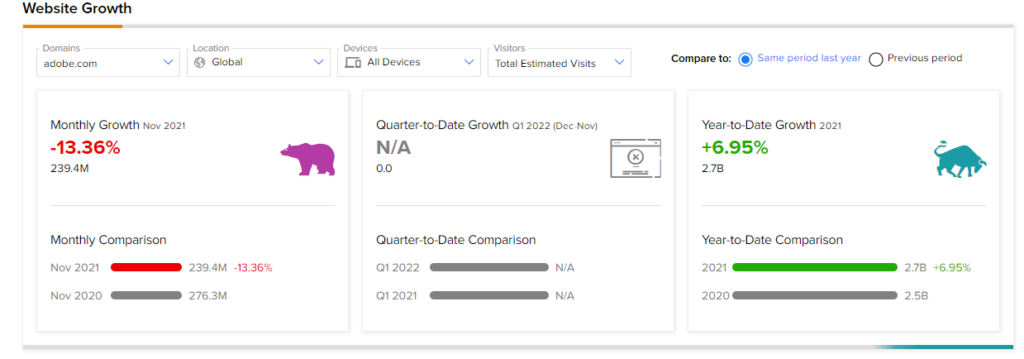

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Adobe’s performance this quarter. According to the tool, the Adobe website recorded a 13.36% decrease in global visits in November compared to the same period last year. In contrast, year-to-date website traffic growth stands at 6.95%.

Related News:

Biogen & TheraPanacea Join Forces to Advance Digital Health Solutions

Deere to Buy Majority Stake in Kreisel Electric

Vir Releases Promising Data on Sotrovimab Against Omicron; Shares Jump