Digital marketing and media solutions provider Adobe (NASDAQ:ADBE) soared about 15% in the extended trading session yesterday. The upside came after the company reported upbeat results for the second quarter of Fiscal 2024. Interestingly, the company’s performance would not have surprised users who closely monitored the company’s website traffic using TipRanks’ Website Traffic Tool.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The tool helps enhance stock research by providing data about the performance of a company’s website domain. This information can be used to predict the upcoming earnings report, as a growth in online usage may point to higher sales in the concerned period.

Learn how Website Traffic can help you research your favorite stocks.

Website Traffic Showed Uptrend

Ahead of the company’s Q2 results, the tool showed that website traffic for adobe.com witnessed a 15.42% year-over-year increase in total estimated visits. The increase in website traffic already pointed to top-line growth during the quarter.

Interestingly, ADBE reported revenues of $5.31 billion, up 10% from the year-ago quarter. Also, it surpassed the average consensus estimate of $5.29 billion. The company’s top-line growth was primarily attributable to strong demand for Adobe’s generative artificial intelligence (AI) digital media offerings.

According to the TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” analysts bullish on ADBE are confident about the company’s potential to monetize its Generative AI innovations going forward.

A Top-rated Analyst Expects Upside in ADBE Stock

Following the release of Q2 earnings, five-star analyst Kash Rangan from Goldman Sachs (GS) reiterated a Buy rating on the stock with a price target of $640, implying about 39.5% upside potential from the current level. (To watch Rangan’s track record, click here).

The analyst believes that Adobe’s ongoing innovation efforts enable it to stay competitive in the evolving generative AI industry.

Is Adobe Stock a Buy, Sell, or Hold?

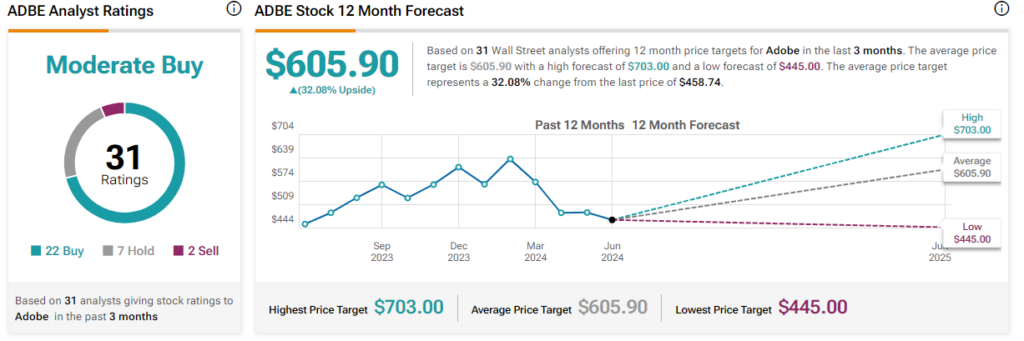

Overall, Wall Street is cautiously optimistic about the company. It has a Moderate Buy consensus rating based on 22 Buy, seven Hold, and two Sell ratings. The analysts’ average price target on Adobe stock of $605.90 implies 32.08% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue