Software company Adobe (NASDAQ:ADBE) is in a legal soup. The Federal Trade Commission (FTC) has taken action against the company and two of its top executives, Maninder Sawhney and David Wadhwani, for deceptive practices related to their subscription plans. The FTC accused Adobe of hiding hefty early termination fees (ETFs) and making subscription cancellations unnecessarily difficult for consumers.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The Department of Justice (DOJ) filed a federal court complaint after an FTC referral. The complaint accuses Adobe of failing to adequately disclose the costly consequences of canceling its annual, paid-monthly subscription plan. This particular plan, which often appears as the default option, imposes an ETF equivalent to 50% of the remaining monthly payments if a consumer cancels his/her subscription within the first year.

Obstacles to Subscription Cancellations

The legal complaint highlights that Adobe’s subscription model is key to revenue growth. However, numerous consumer complaints to the FTC indicate that many consumers are unaware of the ETF and the required year-long commitment.

While Adobe was aware of these issues, it continued to take steps that would create obstacles and complicate the cancellation process. For instance, the complaint emphasized that customers attempting to cancel their subscriptions online reportedly encountered numerous hurdles. These included navigating multiple web pages and dealing with uncooperative customer service representatives.

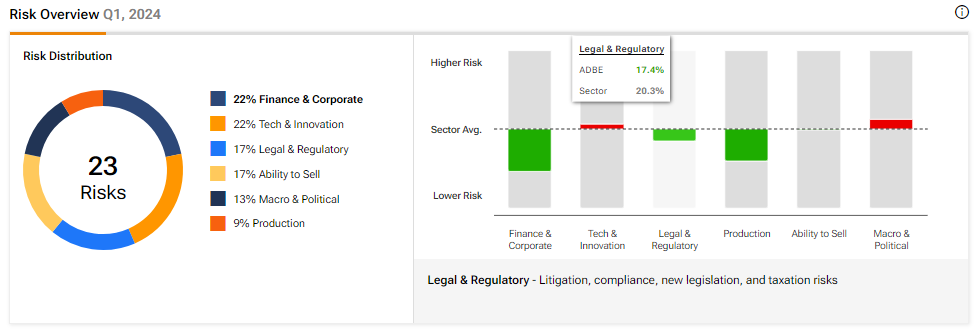

Adobe’s Risk Analysis

Adobe’s practices allegedly violate the Restore Online Shoppers’ Confidence Act, raising legal and ethical concerns. However, the company has been managing its legal and regulatory risks well.

While the outcome of the complaint and its implications for Adobe are uncertain, the company’s exposure to legal and regulatory risks is well below the industry average. According to TipRanks’ Risk Analysis tool, legal and regulatory risks account for 17.4% of Adobe’s total risks, compared to the industry average of 20.3%.

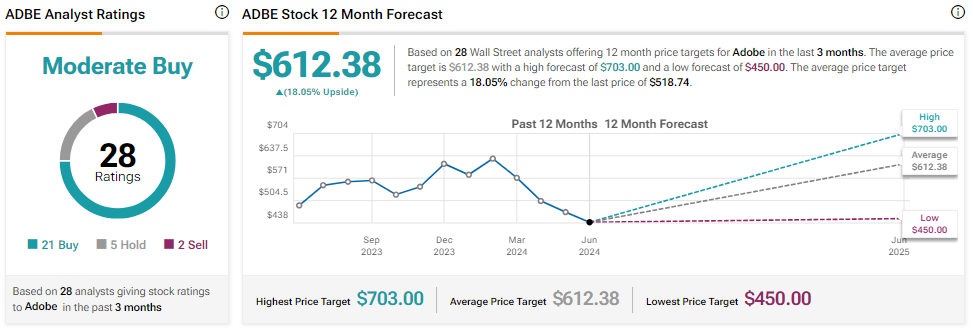

Is Adobe Stock a Buy?

Wall Street analysts are cautiously optimistic about Adobe stock. It has a Moderate Buy consensus rating based on 21 Buys, five Holds, and two Sell recommendations. Adobe stock is down about 13% year-to-date. The analysts’ price target on ADBE stock is $612.38, implying 18.05% upside potential from current levels.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.