Multinational food processing company Archer-Daniels-Midland (ADM) announced that it has entered into a definitive agreement to acquire Sojaprotein, a leading European provider of non-GMO soy ingredients. The terms of the deal have not been disclosed so far.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Following the news, shares of the company gained marginally to close at $58.44 in the extended trading session.

With this acquisition, ADM is expected to strengthen its position in the meat alternative space and have a foothold in the European market. The company will also gain access to Sojaprotein’s extensive offerings in non-GMO vegetable protein ingredients.

The President of Global Foods at ADM, Leticia Gonçalves, said, “The addition of Sojaprotein — the largest producer of plant-based protein in southern Europe — adds production capacity in addition to an impressive network of customers who are leading the way in meeting consumer needs for nutritious and responsible plant-based foods and beverages.” (See ADM stock chart on TipRanks)

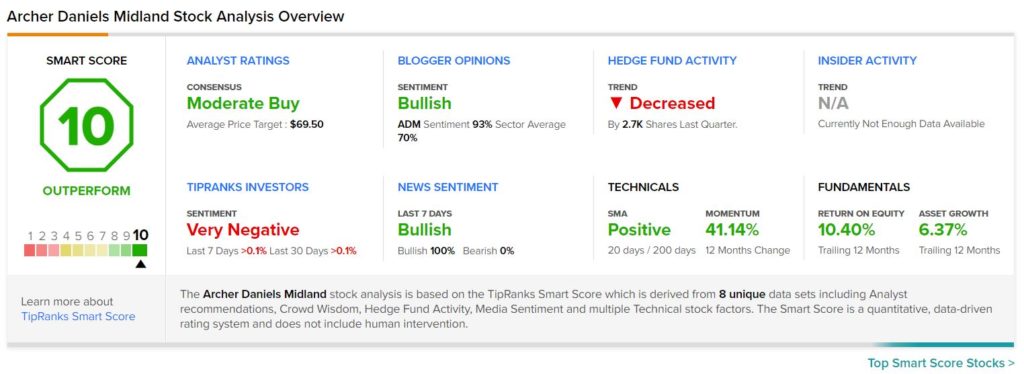

Recently, Jefferies analyst Robert Dickerson reiterated a Hold rating on the stock with a price target of $55. The analyst’s price target implies downside potential of 5.9% from current levels.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus based on 7 Buys and 4 Holds. The average ADM price target of $69.50 implies 18.9% upside potential.

ADM scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained 38.7% over the past year.

Related News:

Meridian to Acquire Otsuka’s North American BreathTek Business for $20M

Lumen Expands Fiber Network Infrastructure in Europe

Cortexyme Develops 3CLpro Inhibitor to Treat COVID-19 Infection

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue