Analog Devices (ADI) stock gained about 2% yesterday. The upside came after the company reported better-than-expected results for the third quarter of Fiscal 2024 and provided a positive outlook for the fourth quarter.

It is worth mentioning that during the earnings call, CFO Richard Puccio expressed optimism about the market’s recovery, stating that “we are past the trough of this cycle.” Further, he said that improved customer inventory levels and increased order momentum across various markets position ADI well for sequential growth in the fourth quarter.

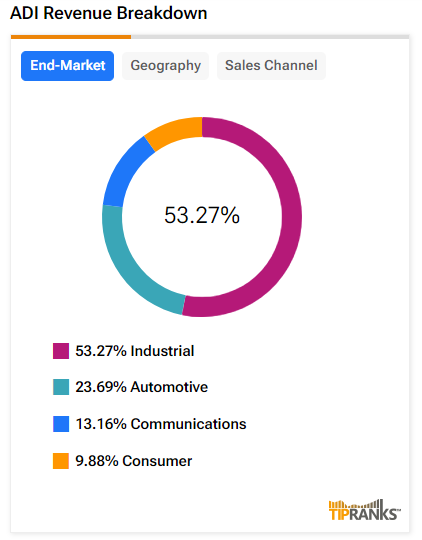

Analog Devices manufactures integrated circuits. Its products are used in various applications, including communications, electric vehicles, and factory automation systems.

ADI: Q3 Highlights

Analog Devices’ Q3 adjusted earnings of $1.58 per share surpassed the consensus estimate of $1.51. However, the reported figure was down 37% year-over-year. Meanwhile, the company’s revenue declined 25% year-over-year to $2.31 billion but surpassed the analysts’ expectations of $2.28 billion.

In terms of segments, revenue from the Industrial and Automotive divisions declined by 37% and 8%, respectively, on a year-on-year basis. Further, the Communication unit’s sales decreased by 26% to $266.6 million. However, the Consumer division’s revenue climbed by 3% from the year-ago quarter.

Q4 Outlook

For the fourth quarter, Analog Devices forecasts revenue of $2.4 billion (plus or minus $100 million) and adjusted earnings of $1.63 per share (plus or minus $0.10).

Top Analysts Remain Bullish

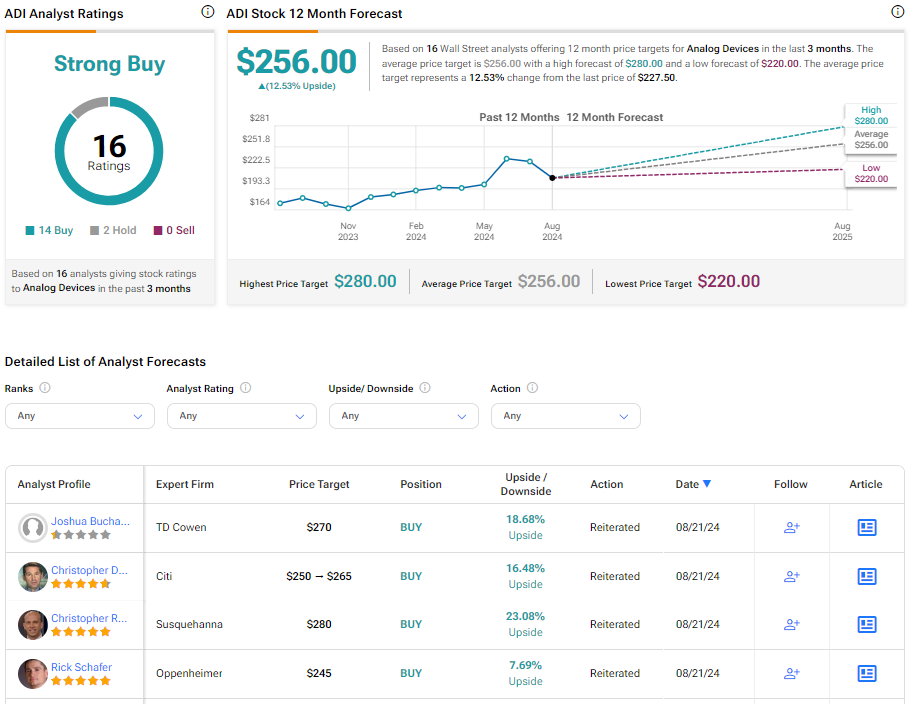

Following the company’s Q3 report, four Top-rated analysts reiterated a Buy rating on ADI stock. Among them, analyst Toshiya Hari from Goldman Sachs (GS) is upbeat about ADI’s recovery in the Industrial segment and its performance in China. He is further encouraged by the company’s strong free cash flow generation and efficient inventory management.

Interestingly, Hari raised the price target to $254 (11.65% upside potential) from $252. According to TipRanks data, the analyst has an average return of 18.09% and a success rate of 76% on ADI (to watch Hari’s track record, click here).

What Is the Price Target for Analog Devices?

On TipRanks, ADI has a Strong Buy consensus rating based on 14 Buy and two Hold ratings. The analysts’ average price target on Analog Devices stock of $256 implies an upside potential of 12.53%. Shares of the company have gained 20% over the past six months.

Questions or Comments about the article? Write to editor@tipranks.com