AdaptHealth on Jan. 5 announced the pricing of its underwritten public offering of 8 million shares at a price of $33 per share. Shares of the home medical equipment company lost 5.3% and closed at $33.89 on Tuesday.

AdaptHealth’s (AHCO) offering consists of 7.25 million shares and an additional 0.75 million shares being sold by a selling stockholder. The company expects to raise gross proceeds of $239.25 million from the share sale. AdaptHealth said that it will not receive any sale proceeds from the selling stockholder.

The offering was raised from the underwritten public offering of 7 million shares and the additional 1 million shares being sold by certain selling stockholders announced on Jan. 4.

As part of the offering, the company has granted the underwriters a 30-day option to purchase up to 1.2 million additional shares. The share sale is expected to close on Jan. 8 subject to closing conditions.

AdaptHealth expects to use half of the net proceeds of the sale to fund the company’s previously announced acquisition of AeroCare Holdings, related fees and expenses, and the remainder for general corporate purposes, including upcoming acquisitions and other business opportunities, capital expenditures and working capital.

Deutsche Bank Securities, Jefferies, BofA Securities and Truist Securities are the lead book-running managers for the offering.

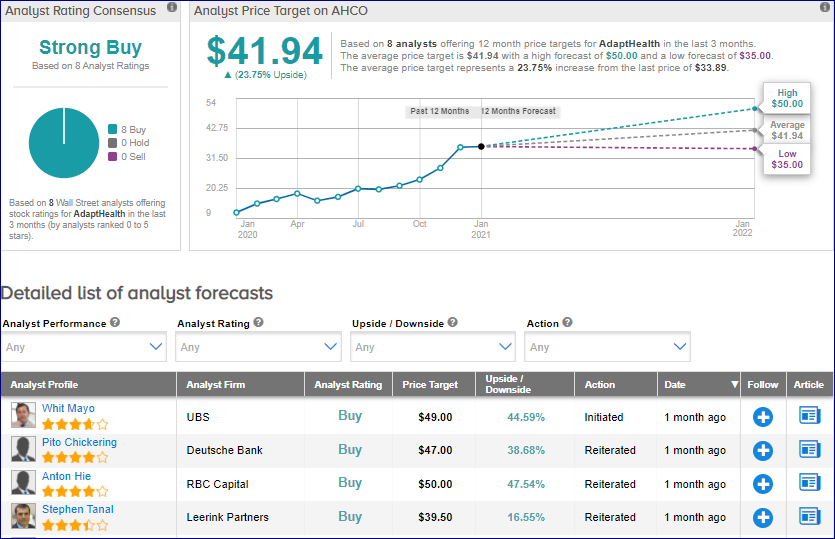

On Dec. 10, UBS analyst Whit Mayo initiated coverage on the the stock with a Buy rating and a price target of $49 (44.6% upside potential).

Mayo cited AdaptHealth’s leading position as a supplier of medical equipment in the U.S., and anticipated the company’s long-term organic revenue to grow at a “sustainable” rate of between 8% and 10%.

The analyst added that AdaptHealth is the “least expensive” stock that he covers relative to his “durable” organic growth rate assumptions. (See AHCO stock analysis on TipRanks)

From the rest of the Street, the stock scores an analyst consensus of a Strong Buy based on 8 unanimous Buys. The average analyst price target of $41.94 implies upside potential of 23.8% to current levels.

Press Release:

Life Storage Ramps Up Dividend By 3.7%, Plans Stock Split

Palomar Appoints Chief Talent & Diversity Officer; Street Sees 14% Upside

New Mountain Finance Okays $50M Share Buyback Plan; Street Sees 7% Upside