Shares of Adagio Therapeutics, Inc., (NASDAQ: ADGI) were up more than 22% in the pre-market trading session on Thursday after the clinical-stage biopharmaceutical company’s released positive data related to its lead monoclonal antibody (mAb), ADG20, against SARS-CoV-2 variants. The company presented a summary of its recent findings in three separate publications.

Report Details

The summarized data demonstrated that ADG20 has neutralizing activity against the Omicron (B.1.1.529) variant of SARS-CoV-2. Additionally, Adagio mentioned certain initiatives to address existing and future SARS-CoV-2 variants.

Under Adagio’s ongoing global Phase 2/3 clinical trials, ADG20 is being evaluated for both the prevention and treatment of COVID-19. The company is in talks with the U.S. Food and Drug Administration (FDA) to obtain potential protocol updates for its global Phase 2/3 clinical trials. Additionally, the company has proposed increasing the dosage of the ADG20 to potentially prevent and treat COVID-19 resulting from the Omicron variant.

Along with the clinical trial updates, Adagio is also working on multiple strategies to address both Omicron and potential expected future variants. The company’s research is ongoing and preliminary findings are anticipated to be released in the first quarter of 2022.

CEO Comments

Adagio CEO Tillman Gerngross commented, “SARS-CoV-2 is a quickly evolving virus, and at Adagio, we are committed to adapting just as quickly. It is abundantly clear that no single product will fully address the evolving nature of the COVID-19 pandemic, and that multiple preventative and therapeutic solutions are needed. Based on both in-house data and third-party findings, we are confident that ADG20 can be an important tool in the fight against this virus.”

Wall Street’s Take

On January 6, Morgan Stanley analyst Matthew Harrison downgraded Adagio to a Sell from a Hold and reduced the price target to $6 (2.92% upside potential) from $11.

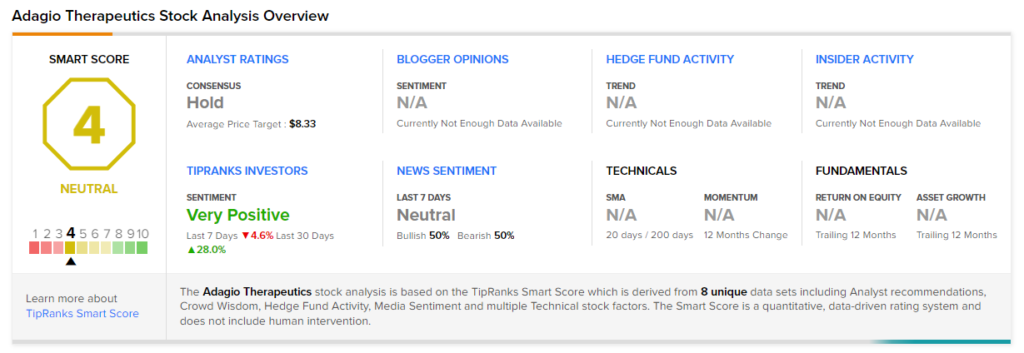

Overall, the stock has a Hold consensus rating based on 3 Holds and 1 Sell. The average Adagio price target of $8.33 implies 42.88% upside potential to current levels. Shares have fallen over 72% over the past year.

Smart Score

According to TipRanks’ Smart Score system, Adagio’s gets a 4 out of 10, which indicates that the stock is likely to perform in line with market averages.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Twitter Acquires Minority Stake in Aleph Group

U.S. Government to Purchase 600,000 Additional Doses of Sotrovimab; Shares Jump

CVS Health Expects Higher Earnings in 2021

Questions or Comments about the article? Write to editor@tipranks.com