Activist hedge fund Jana Partners disclosed the acquisition of a 5.9% stake in Perspecta Inc. (PRSP) sending the company’s shares up more than 9% in pre-market trading.

The stock advanced 9.3% in pre-market trading to $23.01 after the hedge fund said “shares are undervalued and represent an attractive investment opportunity”. According to a SEC filing, Jana Partners bought 9.46 million of Perspecta shares for a total of $190.1 million and now owns a 5.9% stake.

As a stake owner, Jana Partners may hold talks with Perspecta’s board of directors and its management team to maximize shareholder value, including discussing industry consolidation, capitalization, capital allocation, operations and board composition.

The hedge fund started to build a position in the provider of information technology services to government customers, back in April and continued buying through Thursday when the stock closed down 8.8% to $21.06.

Shares have surged some 37% since hitting a low at the end of March. However, the stock is still trading about 20% below its start of the year level.

Five-star analyst Gautam Khanna at Cowen & Co. believes that the stock is “apt to see some re-rating upside given its increasing ‘special situation’ appeal, as an activist has taken a stake”.

“The stock’s low relative valuation reflects subpar organic growth prospects, very high margins which may come under pressure, and a levered balance sheet,” Khanna wrote in a note to investors.

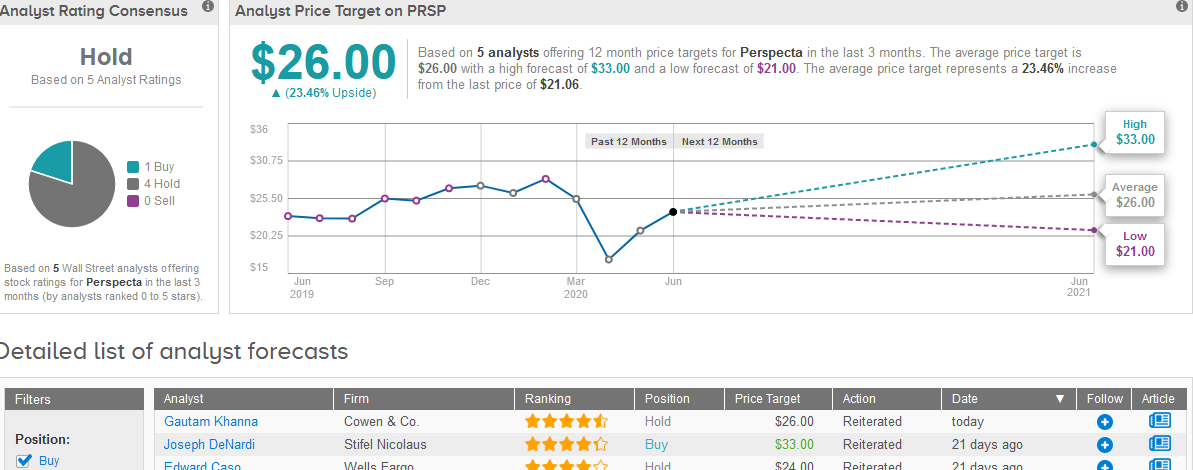

So for now Khanna reiterates a Hold rating on the company with a $26 price target.

The Street’s outlook is in line with Khanna’s take. Perspecta’s Hold analyst consensus breaks down into 4 Hold ratings versus 1 Buy rating. With the average price target coming in at $26, analysts foresee 23% upside potential in the year ahead. (See Perspecta stock analysis on TipRanks).

Related News:

Billionaire Ackman Exits Berkshire Hathaway, Blackstone To Fund Opportunities

Gates Foundation Buys Up Amazon, Apple, Twitter Stock; Trims Berkshire Hathaway Stake

Buffett’s Berkshire Shaves Off 84% Of Its Goldman Sachs Stake