Activision Blizzard (ATVI) has raised its full-year outlook after delivering record Q1 results. The company delivered strong growth across its largest franchises, shrugging off the challenges presented by the pandemic.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The video game company reported net revenues of $2.28 billion, an increase of 27.37% year-over-year compared to $1.79 billion in Q1 2020. Net revenues from digital channels totaled $2.01 billion, with a non-GAAP operating margin coming in at 43%.

Diluted EPS increased to $0.79 from the $0.65 share price reported in 1Q 2020. Activision Blizzard operating cash flow soared to $844 million, from $148 million in the same period last year. Net bookings were $2.07 billion, as in-game net bookings totaled $1.34 billion.

Q1 results exceeded expectations on Activision Blizzard’s outlook, benefiting from strong growth across its franchises. Investments in franchises are allowing the video game company to connect and engage with more people than in the past.

Furthermore, the company’s creative and commercial teams are performing well, driving growth across key segments. For instance, revenues in the Activision segment, including Call of Duty: Black Ops Cold War and Warzone, were up 72% year-over-year. (See Activision Blizzard stock analysis on TipRanks).

Activision Blizzard remains well positioned for stellar financial results for the remainder of the year and into 2022. Management expects to see revenue of $2.14 billion and EPS of $0.91 in Q2. For the full year, net revenues should total $8.37 billion with earnings per share of $3.42.

Baird Equity Research analyst Colin Sebastian has reiterated a Buy rating on Activision Blizzard, beating expectations in 1Q on strong monetization trends.

“More surprising was management’s commentary that usage and monetization trends remained steady through April even as regional lockdowns ease. Overall, we continue to like the stock and believe that further upside is likely from positive usage trends, strong online/mobile pipeline (investing in more developer talent), and continuing positive secular growth trends,” Sebastian wrote.

The analyst has a $118 price target on the stock, implying 33.05% upside potential to current levels.

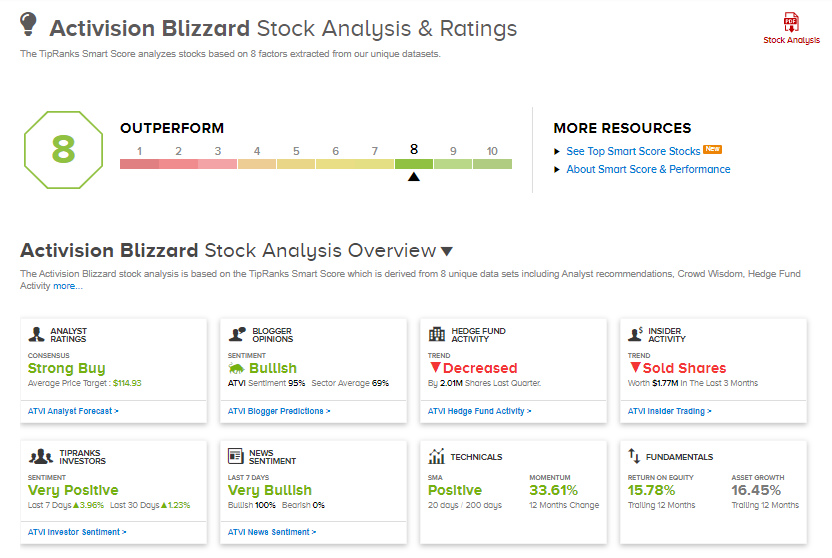

The consensus among analysts on Wall Street is that Activision Blizzard is a Strong Buy based on 14 Buy and 2 Hold ratings. The average analyst price target of $115.88 implies 30.66% upside potential to current levels.

ATVI scores an 8 out of 10 on TipRanks’ Smart Score rating system, suggesting it is likely to outperform the overall market.

Related News:

Twitter Acquires Scroll and Opens Space To Enhance Communication

Intel Announces Massive Investments In Improving Its Products

AbbVie Raises EPS Guidance After 1Q Earnings Beat