Accenture (NYSE:ACN) gained in pre-market trading as the company’s new bookings surged by 22% year-over-year to $21.1 billion in the fiscal third quarter. The management consulting and tech company’s generative AI bookings reached over $900 million, contributing to a total of $2 billion in bookings for the fiscal year to date. The company defines bookings as the value of customer contracts with a spending commitment.

ACN’s Fiscal Q3 Results

Meanwhile, Accenture reported Q3 adjusted earnings of $3.13 per share, a decline of 2% year-over-year, falling short of consensus estimates of $3.16 per share. The company posted revenues of $16.5 billion, a drop of 1% year-over-year, but in line with Street estimates.

Dividends and Stock Buyback

Furthermore, Accenture declared a quarterly cash dividend of $1.29 per share for shareholders of record at the close of business on July 11. This dividend will be payable on August 15 and represents a 15% increase over the quarterly dividend in FY23.

Moreover, during the third quarter of FY24, the company repurchased 4.3 million shares for $1.4 billion, including around 4.1 million in the open market. The company had total stock buybacks of $3.3 billion remaining as of May 31, 2024.

Accenture’s Business Outlook

In the Fiscal fourth quarter, ACN expects revenues to be in the range of $16.05 billion to $16.65 billion, indicating a growth rate between 2% and 6% in local currency, reflecting a negative foreign exchange impact of 2%.

For FY24, Accenture has projected adjusted earnings between $11.85 and $12 per share, below its previous estimate of $11.97 to $12.20 per share. These projections are lower than analysts’ expectations of $12.12 per share.

Furthermore, the company anticipates that its FY24 revenues will grow between 1.5% and 2.5%, compared with its previous estimate of 1% to 3% growth.

Is ACN a Good Stock to Buy Now?

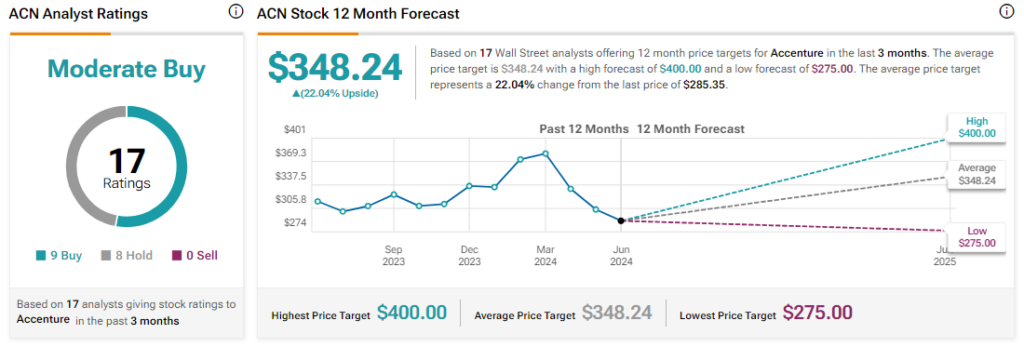

Analysts remain cautiously optimistic about ACN stock, with a Moderate Buy consensus rating based on nine Buys and eight Holds. Year-to-date, ACN has declined by more than 15%, and the average ACN price target of $348.24 implies an upside potential of 22% from current levels. These analyst ratings are likely to change following ACN’s Q3 results today.