Archer Aviation (NYSE:ACHR) dropped in pre-market trading after the company reported mixed fourth-quarter results. The electric vertical take-off and landing (eVTOL) company’s loss widened to $1.69 per share in Q4 compared to a loss of $1.32 per share in the same period last year. Analysts were expecting the company to report a loss of $0.31 per share. Archer is still not generating any revenues and had cash and cash balances of $625 million at the end of the fourth quarter.

Management announced that its Midnight aircraft is nearing the completion of its certification and the construction of three Midnight aircraft is underway. Archer added that its flight test program has made rapid progress and expects to complete 400 test flights this year.

For the first quarter, ACHR forecasted adjusted operating expenses in the range of $75 million to $95 million.

Is ACHR a Good Stock to Buy?

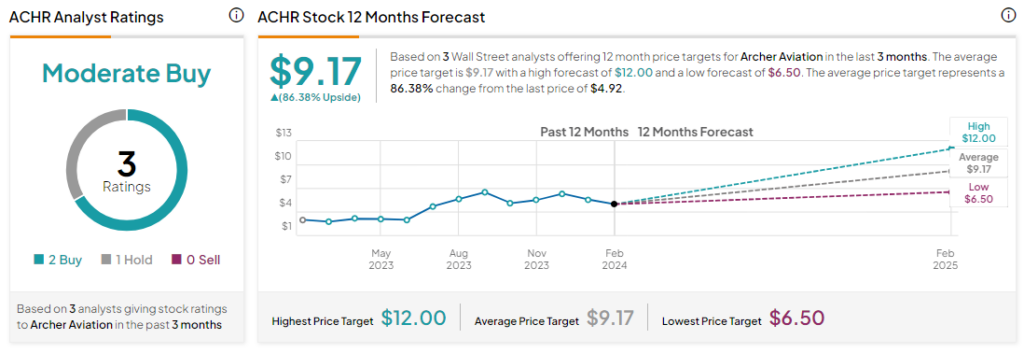

Analysts remain cautiously optimistic about ACHR with a Moderate Buy consensus rating based on two Buys and one Hold. Over the past year, ACHR stock has skyrocketed by more than 70%, and the average ACHR price target of $9.17 implies an upside potential of 86.4% at current levels. However, it’s worth noting that estimates will likely change following today’s earnings report.