Global professional services firm Accenture (ACN) has signed an agreement to acquire Swiss IT service management company Trivadis. The financial terms of the deal have not been revealed so far.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Trivadis offers IT services, IT consultancy, solution engineering, and system integration services. Its solutions help companies accelerate cloud migrations, develop data warehouse solutions, automate operational tasks in databases, and advance data platform lifecycles.

The acquisition will see the Trivadis team of 710 people, located across Romania, Denmark, Austria, Germany, and Switzerland, join Accenture Cloud First group’s Data & AI team. (See Accenture stock chart on TipRanks)

Accenture Cloud First global lead Karthik Narain said, “Acquiring Trivadis will strengthen our ability to help clients blend data from different sources together in real-time, build agile reporting, and leverage analytics and AI to create broadly accessible customer, market and operational insights that deliver meaningful business outcomes.”

Market unit lead for Accenture in Germany, Austria, Switzerland, and Russia, Frank Riemensperger, said, “Having Trivadis’ talented team join Accenture will strengthen our data on cloud capabilities with a strong focus on engineering. Combining these specific technological skills with Accenture’s business strategy expertise and global network, will scale our end-to-end data and analytics offering and reinforce Accenture’s cloud and data-driven reinvention strategies.”

Argus Research analyst Jim Kelleher recently maintained a Buy rating on the stock and raised the price target to $330 (12% upside potential) from $300.

In a research note to investors, Kelleher said, “Accenture appears to have the financial resources, customer presence, and market strength to thrive as companies accelerate digital transformation to a hybrid post-pandemic world.”

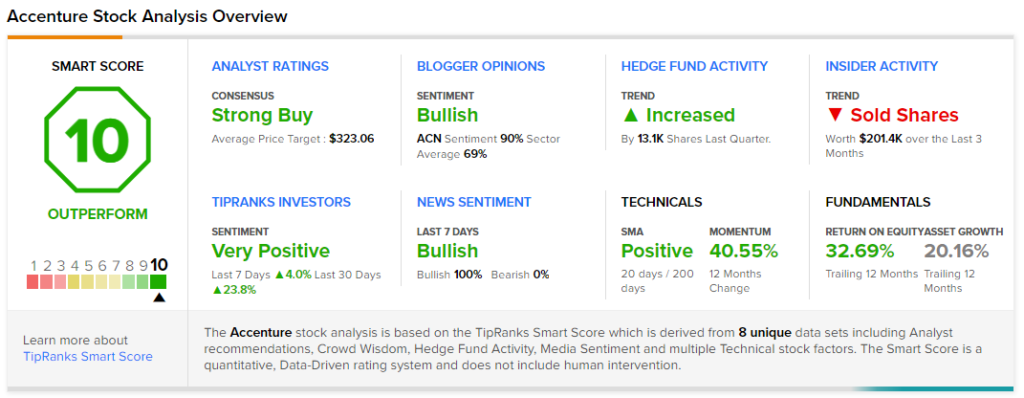

Overall, the stock has a Strong Buy consensus rating based on 14 Buys and 4 Holds. The average Accenture price target of $323.06 implies 9.6% upside potential. The company’s shares have gained 37.4% over the past year.

According to TipRanks’ Smart Score rating system, Accenture scores a “Perfect 10”, suggesting that the stock is likely to outperform market averages.

Related News:

Constellation Brands Q1 EPS Rises 3%, Tops Estimates

PayPal Launches Omnichannel Platform Zettle

XPeng Prices Global Offering, Expects to Raise HK$14B