Accenture (ACN) is a multinational professional services company. It provides consulting and IT services. (See Analysts’ Top Stocks on TipRanks)

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Let’s take a look at the company’s latest financial performance, corporate updates, and risk factors.

Fiscal Q4 Financial Results and Q1 2022 Outlook

Accenture reported a 24% year-over-year increase in revenue to $13.4 billion for its Fiscal 2021 fourth quarter ended August 31. Revenue matched the consensus estimate. It posted EPS of $2.20, compared to $1.99 in the same quarter last year, and beat the consensus estimate of $2.19.

Accenture plans to distribute a quarterly cash dividend of $0.97 per share on November 15. The company repurchased $915 million of its shares in Q4.

For Fiscal Q1 2022, Accenture anticipates revenue in the band of $13.90 billion to $14.35 billion, implying year-over-year growth of up to 22%. The company has $6.3 billion remaining under its existing share repurchase program. (See Accenture stock charts on TipRanks).

Corporate Updates

Accenture has secured a role to help Piraeus Bank in migrating its technology infrastructure to Microsoft’s (MSFT) cloud platform. In addition to helping with the cloud migration process, Accenture will also help the bank introduce new cloud-based services.

Accenture has completed several strategic acquisitions recently as it seeks to bolster its various capabilities. It has bought product consulting firm BENEXT to expand the global capabilities of its cloud-focused division, and Argentina-based e-commerce solutions provider Glamit. Accenture has also bought Germany-based engineering consulting and services provider Umlaut. Furthermore, it has bagged enterprise asset management software provider Advoco.

In continuing its strategic acquisition strategy, Accenture has agreed to purchase India-based artificial intelligence and analytics provider BRIDGEi2i. Accenture expects the BRIDGEi2i acquisition to enhance its analytics, data, and artificial intelligence business.

Risk Factors

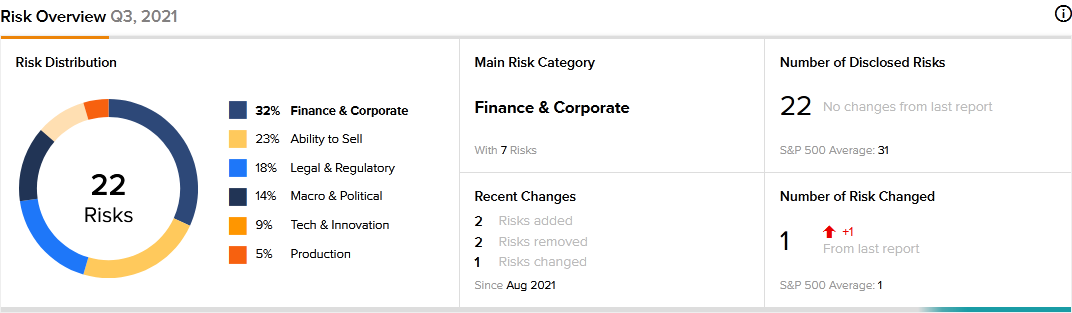

A total of 22 risk factors have been identified for Accenture, according to the new TipRanks Risk Factors tool. Since August 2021, the company has updated its risk profile to add two new risk factors and remove two old ones.

In a newly added risk factor, Accenture tells investors that its global operation exposes it to many legal and regulatory requirements. It warns that a failure to comply with the complex regulatory requirements could harm its business.

Accenture says in another new risk factor that the COVID-19 pandemic has had an unfavorable impact on its business. It cautions that the pandemic could continue to adversely affect its operations.

The company dropped the risk factor that warned that its contracts could become less profitable if it fails to accurately anticipate costs, or if external partners fail to meet their commitments.

The majority of Accenture’s risk factors fall under the Finance and Corporate category, with 32% of the total risks. That is below the sector average of 50%. Accenture’s shares have gained about 30% since the beginning of 2021.

Analysts’ Take

Following Accenture’s Q4 earnings report, Barclays analyst Ramsey El-Assal reiterated a Buy rating on Accenture stock and raised the price target to $384 from $335. El-Assal’s new price target suggests 12.34% upside potential.

Consensus among analysts is a Strong Buy based on 12 Buys and 2 Holds. The average Accenture price target of $380.15 implies 11.21% upside potential to current levels.

Related News:

Sensient Technologies Hikes Dividend By 5.1%; Shares Rise 4.8%

Steel Dynamics to Acquire Minority Interest in New Process Steel

RBC Finds Canadian Couples Talk More About Money