Shares of Accenture Plc jumped 6.9% on Thursday after the consulting services company reported stellar 1Q results that topped analysts’ expectations. Further, Accenture raised its fiscal year revenue forecast and provided upbeat 2Q guidance.

Accenture’s (ACN) 1Q earnings of $2.17 per share increased 8% year-over-year and surpassed the Street’s estimates of $2.02 per share. The company’s 1Q revenues rose 4% year-over-year to $11.76 billion and exceeded the consensus estimates of $11.28 billion. Its new bookings grew 25% to $12.9 billion in the reported quarter.

Meanwhile, Accenture’s CEO Julie Sweet said, “I am pleased that we delivered first-quarter revenues above our expectations, with broad-based improvement across industries and geographic markets, reflecting the relevance of our services, the strength of our growth strategy and the advantages of our scale in digital, cloud and security.”

Following the strong 1Q performance, Accenture raised its FY21 revenue growth outlook to 4% to 6% from the earlier expectation of 2% to 5%. Further, it projects adjusted EPS to be in the range of $8.02 to $8.25, representing year-over-year growth of 8% to 11%.

As for 2Q, the company expects revenues in the range of $11.55 billion to $11.95 billion, higher than the Street’s estimates of $11.39 billion. (See ACN stock analysis on TipRanks)

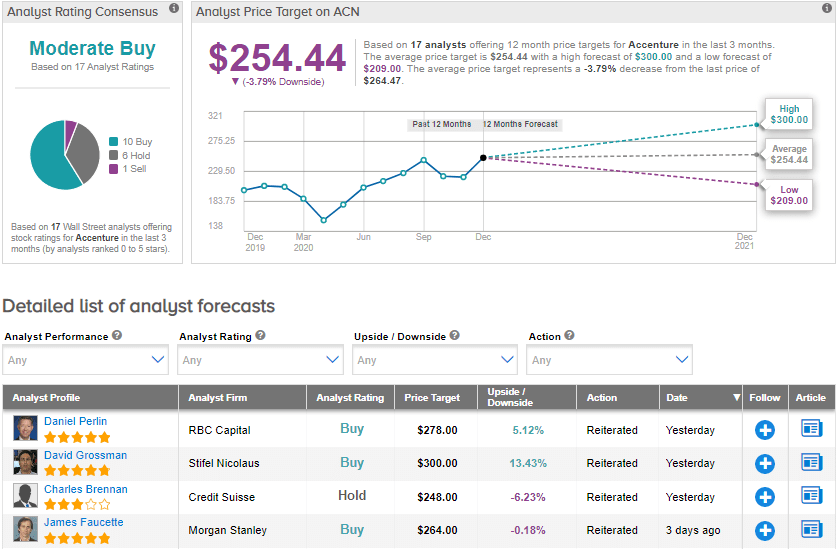

On Dec. 17, RBC Capital analyst Daniel Perlin raised the price target on Accenture stock to $278 (5.1% upside potential) from $233 and maintained a Buy rating on the solid “beat and raise.” Besides Perlin, a couple of analysts also raised their price targets on the stock following the better-than-expected 1Q results.

Meanwhile, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 10 Buys, 6 Holds and 1 Sell. The average price target stands at $254.44 and implies downside potential of about 3.8% to current levels. Shares have gained 25.6% year-to-date.

Related News:

Accenture To Buy Myrtle To Improve Supply Chain Capabilities

ABM Dips 4% On 4Q Profit Miss; Street Sees 19% Upside

Lennar Beats 4Q Profit Estimates Amid Housing Demand; Shares Gain 4%

Questions or Comments about the article? Write to editor@tipranks.com