Abbott (NYSE:ABT) announced better-than-expected earnings in Q1. The medical devices and healthcare company announced adjusted earnings of $0.98 per share, which reflected a decline of 4.9% year-over-year but surpassed consensus estimates of $0.95 per share.

The company generated sales of $9.96 billion in the first quarter, marking a 2.2% year-over-year increase, and beating analysts’ estimates of $9.88 billion. The rise in revenues was primarily driven by the company’s medical devices business, which saw sales of $4.45 billion. This was an increase of 14.2% year-over-year.

In addition, ABT declared a quarterly dividend of $0.55 per share payable May 15 to shareholders of record at the close of business on April 15, 2024.

Looking forward, the company has projected adjusted diluted earnings in the range of $4.55 to $4.70 per share. Analysts are estimating FY24 earnings of $4.60 per share.

What Is the Future of ABT Stock?

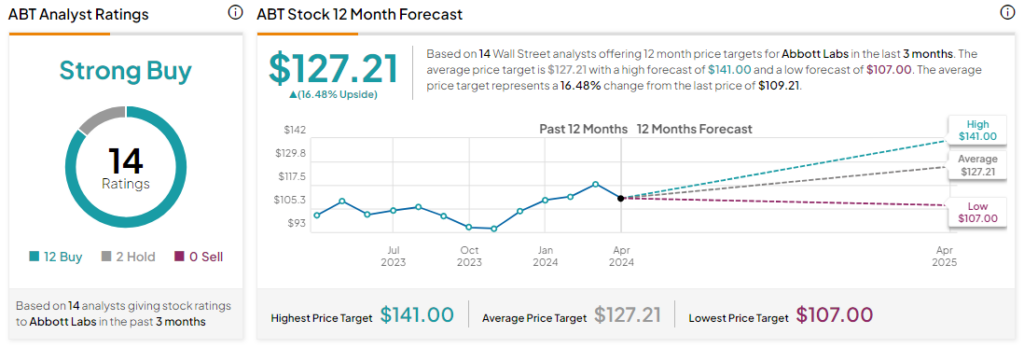

Analysts are bullish about ABT stock, with a Strong Buy consensus rating based on 12 Buys and two Holds. Over the past year, ABT has increased by more than 6%, and the average ABT price target of $127.21 implies an upside potential of 16.5% from current levels. However, these ratings are likely to change following ABT’s Q1 results.

Questions or Comments about the article? Write to editor@tipranks.com