The U.S. Food and Drug Administration (FDA) has granted Breakthrough Therapy Designation (BTD) to biopharmaceutical company AbbVie, Inc.’s (ABBV) investigational telisotuzumab vedotin (Teliso-V) to treat patients suffering from advanced/metastatic epidermal growth factor receptor (EGFR) wild type, nonsquamous non-small cell lung cancer (NSCLC).

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

The BTD program expedites the development and review of investigational medicines that have demonstrated preliminary clinical evidence of substantial improvement over existing therapies on at least one clinically significant endpoint.

The Vice-President and Global Head of Oncology Clinical Development at AbbVie, Mohamed Zaki, said, “Patients with non-small cell lung cancer have a high unmet need and Teliso-V has the potential to provide them with an additional treatment option to manage their disease.”

Teliso-V’s BTD designation is based on data from an ongoing Phase 2 study, LUMINOSITY. The study is designed to identify the target NSCLC populations with high levels of c-Met overexpression and for whom Teliso-V monotherapy is best suited in the second- or third-line setting.

About AbbVie

Based out of Illinois, AbbVie is focused on therapeutic areas like immunology, oncology, neuroscience, eye care, virology, women’s health and gastroenterology. Its subsidiary Allergan Aesthetics develops, manufactures and sells products, including facial injectables, body contouring, plastics, and skincare, among others.

Wall Street’s Take

Recently, Bernstein analyst Aaron Gal reiterated a Buy rating on the stock and raised the price target to $155 from $130 (14.7% upside potential).

Additionally, Christopher Raymond, an analyst with Piper Sandler (PIPR), maintained a Buy rating on AbbVie and increased the price target from $129 to $160 (18.4% upside potential).

In a research note to investors, Raymond said, “ABBV remains a top pick for me in 2022 amid continued commercial momentum from Skyrizi and Rinvoq. AbbVie also has an emerging neurology franchise as well as continued outperformance from the legacy Allergan aesthetics business.”

Overall, the stock has a Strong Buy consensus rating based on 12 Buys and 3 Holds. The average ABBV stock forecast of $136.79 implies 1.2% upside potential. Shares have gained 34.2% over the past year.

Investors’ Opinion

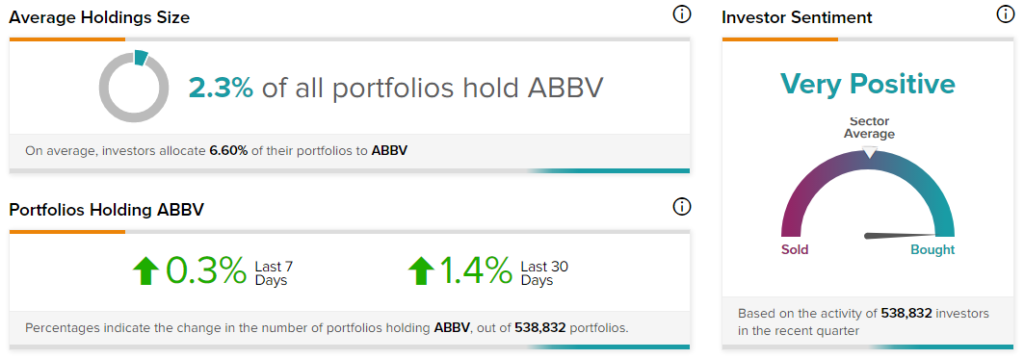

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on AbbVie with 1.4% of investors on TipRanks increasing their exposure to the stock over the past 30 days.

Download the TipRanks app now, available on iOS and Android.

Related News:

Genpact Acquires Hoodoo Digital, Expands Experience Business

Toyota Plans to Launch Automotive Software for Autonomous Driving – Report

Beyond Meat’s Plant-Based Fried ‘Chicken’ Now at KFC – Report