Shares of automotive parts and accessories provider Advance Auto Parts (NYSE:AAP) are sliding lower today after the company announced lower-than-expected first-quarter numbers.

Revenue inched up 1.5% year-over-year to $3.42 billion but missed expectations by $10 million. EPS at $0.72 too fell short of estimates by about $1.84. In Q1, comparable store sales fell by 0.4% with the company experiencing an unfavorable product mix.

Further, AAP has slashed its dividend by nearly 83% while also scaling back its guidance. The cash dividend of $0.25 per share is payable on July 28 to investors of record on July 14.

For the full year 2023, AAP now expects net sales between $11.2 billion and $11.3 billion (earlier expectations between $11.4 billion and $11.6 billion). EPS for the year is now seen landing between $6 and $6.50 (versus earlier estimates between $10.20 and $11.20).

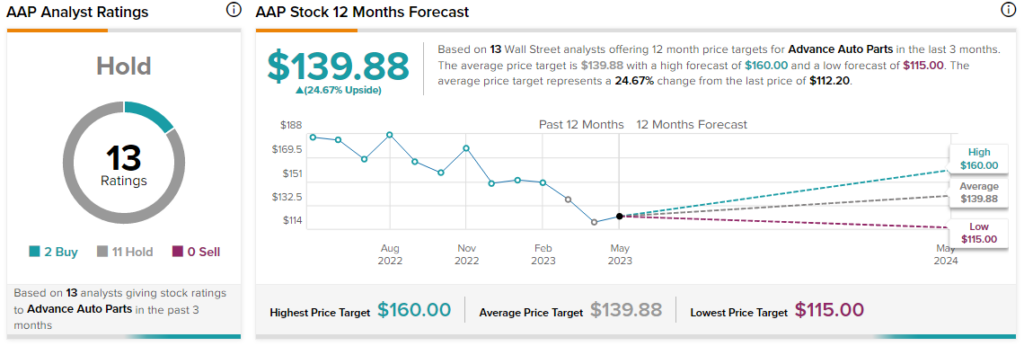

Overall, the Street has a $139.88 consensus price target on AAP alongside a Hold consensus rating. Today’s price decline comes on top of nearly 41% price erosion in AAP shares over the past year.

Read full Disclosure