Billionaire investor David Tepper, founder of Appaloosa Management, says he’s bullish on “everything” in China. ETFs are an effective way to gain diversified exposure to the Chinese market, and there are many options for doing so.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Some of the popular ways to invest via ETF include the iShares MSCI China ETF (MCHI), the iShares Large Cap China ETF (FXI), and the KraneShares China CSI Internet ETF (KWEB).

I’m bullish on these China ETFs as a whole, due to cheap valuations of Chinese stocks despite decent growth prospects, Tepper’s glowing recommendation, and China’s recently announced economic stimulus plan. But let’s take a closer look at them and decide which is the best one for investors looking to tap into the China opportunity.

Why is Tepper so Bullish on China?

The renowned investor has been bullish on China in the past, and earlier this year he doubled down on positions in large-cap Chinese stocks like Alibaba (BABA), Baidu (BIDU) and PDD Holdings (PDD).

In a recent interview with CNBC, Tepper said that he would buy “everything” in China, stating “Futures…..I would do ETFs…..everything“.

Tepper announced his bullish outlook for China following the recently announced economic stimulus. Tepper points out that these stocks are attractive based on their single-digit P/E multiples and double-digit earnings growth, which are typically some of the key ingredients for a winning investment.

Tepper stated, “You’re sitting there on single digit P/E (multiples) with double-digit growth rates for the big stocks that trade over here, versus (a multiple of) 20x+ on the S&P.”

Tepper is right that many of China’s top stocks are extremely cheap. Look no further than his individual holdings like Alibaba, which trades for just 12x March 2025 consensus earnings estimates, PDD, which trades at an even cheaper 11.2x consensus 2024 earnings estimates, and Baidu, which is the cheapest of them all at just 9.3x consensus 2024 estimates. All of these stocks are projected to grow their earnings over the next year.

There are quite a few effective ways for investors to tap into these cheap growth stocks via ETFs. Let’s take a look at some of the main China-focused ETFs, starting with FLCH.

A Closer Look At Franklin FTSE China ETF (FLCH)

According to Franklin Templeton, the managing firm for FLCH, the ETF “provides access to the Chinese stock market, allowing investors to precisely gain exposure to China at a low cost.” FLCH invests in large-cap and mid-cap Chinese stocks.

FLCH offers investors plenty of diversification, and is easily the most diversified of the major China ETFs. FLCH holds 952 stocks, and its top 10 holdings represent 44.9% of the fund. Below, is an overview of FLCH’s top 10 holdings drawn from TipRanks’ holdings tool.

Among FLCH’s top holdings, you’ll recognize many of China’s large-cap internet and e-commerce stocks, like the fund’s top holding, Tencent (TCEHY), and Tepper’s aforementioned positions like Alibaba and PDD Holdings.

But unlike some of the other China ETFs (more on this below), FLCH goes well beyond these internet giants and invests in all facets of the Chinese market, including automotive manufacturing, construction, banking, and more. I believe FLCH provides investors with a full breadth and depth of exposure to the Chinese economy.

FLCH’s holdings also feature some excellent Smart Scores. The Smart Score is a quantitative stock scoring system created by TipRanks. It assigns stocks a score from one to 10, based on eight key market factors. Scores of eight, nine, or 10 are considered equivalent to an Outperform rating. Nine out of FLCH’s top 10 holdings feature Outperform-equivalent Smart Scores of eight or higher, and an incredible seven out of the 10 have perfect 10 Smart Scores.

FLCH itself features an ETF Smart Score of eight, for an Outperform rating.

Another nice feature of FLCH is its low expense ratio of 0.19%, which makes it by far the cheapest of the major China ETFs. This expense ratio means that an investor in FLCH will pay just $19 in fees per year on a $10,000 investment. FLCH also offers a dividend yield of ~2.4%.

Is FLCH Stock a Buy, According to Analysts?

Turning to Wall Street, the FLCH ETF earns a Moderate Buy consensus rating based on 161 Buys, 778 Holds, and 11 Sell ratings assigned in the past three months. The average FLCH stock price target of $21.76 implies about 7% of potential upside from current levels.

I’m bullish on FLCH’s diversified portfolio of highly-rated Chinese stocks with excellent Smart Scores. Many of these holdings carry inexpensive valuations, and I’m fond of its low expense ratio and 2.4% dividend yield. With just $124.5 million in assets under management (AUM), FLCH is the smallest of the ETFs discussed here, but in my view a real hidden gem.

A Closer Look at iShares MCHI China ETF (MCHI)

With $5.1 billion in AUM, MCHI is a much larger ETF than FLCH.

According to iShares, MCHI’s objective is to “track the investment results of an index composed of Chinese equities that are available to international investors”.

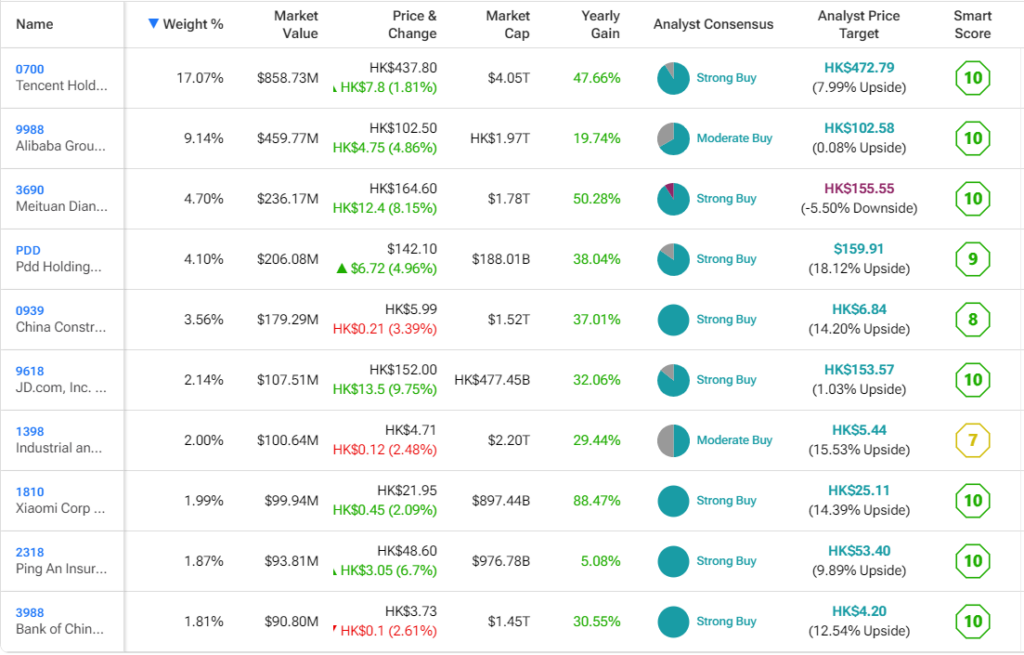

Like FLCH, MCHI offers investors ample diversification. The fund holds 590 stocks, and its top 10 holdings account for 48.4% of the fund. Investors can see an overview of MCHI’s top 10 holdings below using TipRanks’ holdings tool.

Like FLCH, MCHI offers broad exposure to all sectors of the Chinese economy, and like the smaller fund, its portfolio is full of stocks with exemplary Smart Scores. Nine of its top 10 holdings feature Outperform-equivalent Smart Scores of eight or above, and seven of the 10 feature Perfect 10 Smart Scores.

MCHI stock boasts an Outperform-equivalent ETF Smart Score of eight.

MCHI clearly has a lot in common with FLCH, but there is a major difference when it comes to cost. While FLCH charges just 0.19%, MCHI charges an expense ratio of 0.59%, over three times as high.

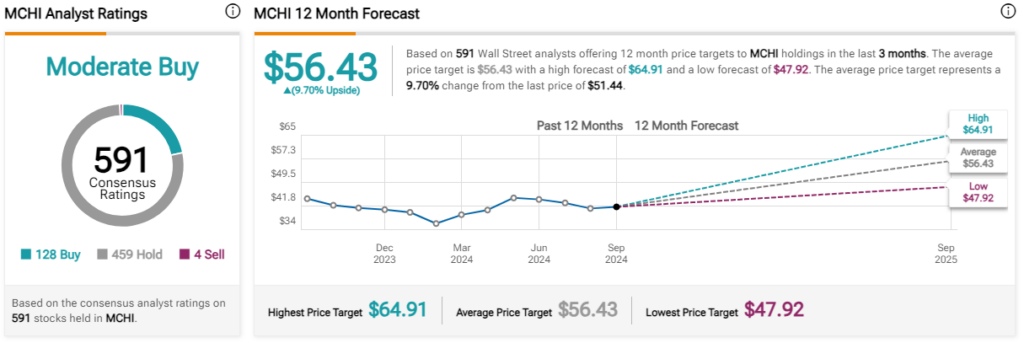

Is MCHI Stock a Buy, According to Analysts?

Turning to Wall Street, MCHI earns a Moderate Buy consensus rating based on 128 Buys, 459 Holds, and 4 Sell ratings assigned in the past three months. The average MCHI stock price target of $56.43 implies about 5% potential upside from current levels.

Overall, I’m bullish on MCHI stock based on its diversified portfolio of attractive Chinese stocks. However, it offers much of the same exposure to China as FLCH, albeit at a much higher price. Thus FLCH is my preferred choice over MCHI.

A Closer Look at KraneShares CSI China Internet ETF (KWEB)

With $5.6 billion in assets under management (AUM), KWEB is the largest and arguably the best known of these China ETFs.

According to KraneShares, KWEB “consists of China based companies whose primary business or businesses are focused on internet and internet-related technology.” These investments give KWEB’s holders “exposure to companies benefitting from increasing domestic consumption by China’s growing middle class.”

KWEB differs from the other two ETFs discussed above in that, rather than broadly investing in the Chinese market, it specifically focuses on China’s internet and e-commerce stocks. Of course, there still remains a great deal of overlap, since those internet and e-commerce stocks are many of China’s largest firms.

Therefore, KWEB is the least diversified of these funds — it holds just 32 stocks, and its top 10 holdings account for 62.2% of the fund. You can check out an overview of KWEB’s top 10 holdings below.

KWEB has an impressive portfolio, and all 10 of its holdings feature Outperform-equivalent Smart Scores. Additionally, seven of its top 10 holdings earn perfect 10 Smart Scores. Among the top holdings, you’ll see plenty of the same names discussed above, like Tencent, Alibaba, PDD Holdings, and Baidu.

KWEB stock has an Outperform-equivalent ETF Smart Score of 9.

I’m bullish on KWEB overall, although it is far less diversified than the other two ETFs discussed here. KWEB’s primary detractor is its expense ratio of 0.70%, which is nearly four times that of FLCH. This expense ratio means that for every $10,000 invested in the fund, an investor will pay $70 in fees each year. KWEB also pays a dividend that yields 1.4%, although this is a lower than FLCH and MCHI.

My Choice ETF for China Exposure

This is an appealing group of ETFs and, like Tepper, I’m bullish on China overall. The component stocks are incredibly cheap, and China’s economic stimulus plan should support them going forward. While I’m bullish on all three ETFs, FLCH is my favored choice. The FLCH ETF is by far the lowest cost option, and offers the most diversified exposure to the broad Chinese economy.