The U.S. dollar is flexing its muscles, hitting multi-decade highs, and showing no signs of retreat. This surge is fueled by a potent cocktail of factors, including the Federal Reserve’s tightening grip on the monetary policy, a robust U.S. economy compared to its global peers, and simmering geopolitical tensions. Importantly, a mightier dollar can translate into a boom for certain stocks.

The implications for investors are significant. While large multinationals have enjoyed a period of dominance, the strengthening dollar could introduce headwinds for their bottom lines. This is because a strong dollar makes U.S.-made exports more expensive for foreign buyers, potentially leading to a decline in sales or profit margins for the companies.

However, not all companies are subject to these implications. Some stand to benefit from a mightier dollar. These companies, by virtue of their business models, either through heavy reliance on imports or a strong domestic customer base, can ride a tailwind from a rising dollar.

In the following sections, we’ll delve into six such stocks that could potentially thrive in this environment, by offering investors a strategic edge during this pivotal shift in currency flows and valuations.

Strong Dollar Stock Picks: A Look at 6 Potential Winners

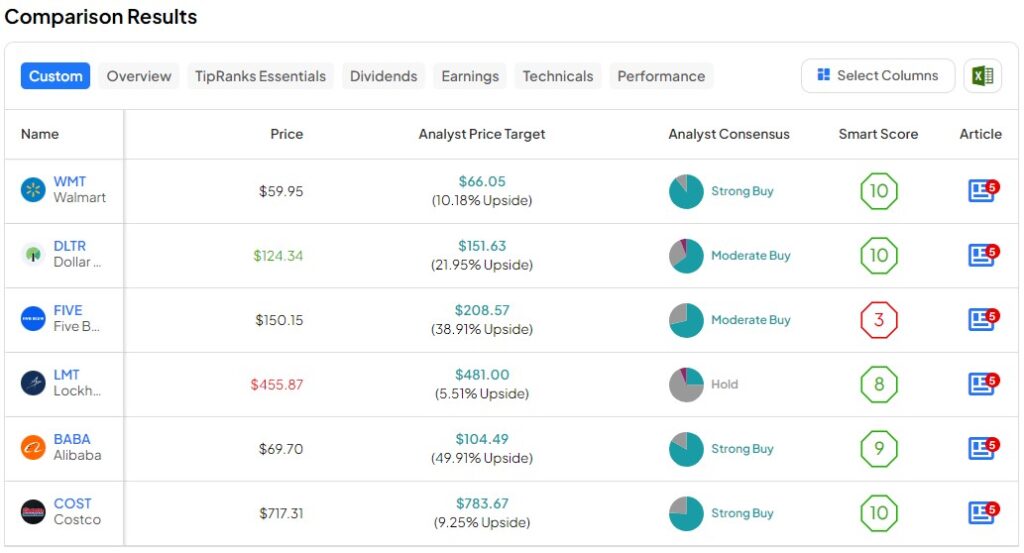

Keeping the economic backdrop in mind, let’s delve into six stocks that possess factors to perform fairly well in a strengthening dollar environment, then run them through the TipRanks Comparison Tool to discover the Wall Street Analyst consensus on these half dozen possibilities:

1. Walmart (NYSE:WMT) Retail giant Walmart is known for its low prices and global sourcing strategy. A strong dollar could help them reduce import costs and potentially boost their profit margins.

2. Dollar General (NYSE:DLTR) Similar to Walmart, Dollar General focuses on offering everyday essentials at low prices. Their reliance on imported goods could benefit from a stronger dollar, allowing them to maintain their affordability.

3. Dollar Tree (NYSE:FIVE) Another discount retailer, Dollar Tree, also sources a significant portion of its merchandise from overseas. A rising dollar could translate into lower import costs and potentially improve their bottom line.

4. Lockheed Martin (NYSE:LMT) While a defense contractor like Lockheed Martin might not seem like an obvious choice, it’s important to consider their international sales. A strong dollar could make their U.S.-made weapons systems more attractive to foreign buyers.

5. Alibaba (NYSE:BABA) This Chinese ecommerce giant might seem counterintuitive, but here’s the twist, a stronger dollar can make Chinese goods sold on Alibaba’s platform more affordable for international buyers, potentially increasing sales.

6. Costco (NASDAQ:COST) The big box retailer known for its bulk-buying model, sources a significant amount of its merchandise internationally. A strong dollar could lead to lower import costs, potentially benefiting profit margins and allowing Costco to offer better deals to members.

Investor Tip

The TipRanks Stock Screener makes it easy to filter through the universe of stocks and ETFs and find only those with attributes the investor finds desirable in the current economic climate.