NeoGenomics (NEO) provides cancer genetics testing services. It helps doctors diagnose and treat cancer and supports pharmaceutical companies in drug development and clinical trials.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Let’s take a look at the company’s latest financial performance, corporate developments, and risk factors.

NeoGenomics’ Q2 Financial Results and 2021 Guidance

The company reported a 40% year-over-year increase in revenue to $122 million for Q2. It made a profit of $76 million compared to a loss of $7 million in the same quarter last year. NeoGenomics ended the quarter with $373 million in cash and cash equivalents.

For the full year 2021, the company anticipates revenue in the range of $490 million – $510 million. It expects to make a loss of between $65 million and $70 million. (See NeoGenomics stock charts on TipRanks).

NeoGenomics’ Corporate Developments

The company has turned to acquisitions to accelerate its growth. During Q2, it acquired Trapelo Health and Inivata. Trapelo is a specialist in precision oncology. NeoGenomics bought the business for $65 million in a cash and stock deal. For the acquisition of Inivata, NeoGenomics paid $399 million in cash.

NeoGenomics’ Risk Factors

The new TipRanks Risk Factors tool shows 44 risk factors for NeoGenomics. Since December 2020, the company has updated its risk profile to add two new risk factors under Finance and Corporate and Legal and Regulatory categories.

NeoGenomics says it has begun the process of migrating Trapelo and Inivata, the recently acquired businesses, to its internal control systems. It says that it may encounter challenges in the migration. Therefore, it may need to allocate substantial resources toward improving the accounting systems of the businesses. It cautions that this could adversely impact its operations, financial condition, and stock price.

Further, NeoGenomics tells investors that Trapelo and Inivata may carry liabilities that are currently unknown. If currently unknown liabilities associated with the businesses are discovered in the future, its business could be adversely affected in a significant way.

Legal and Regulatory is NeoGenomics’ main risk category, accounting for 30% of the total risks. That is above the sector average at 20%. NeoGenomics’ shares have declined about 5% since the beginning of 2021.

Analysts’ Take

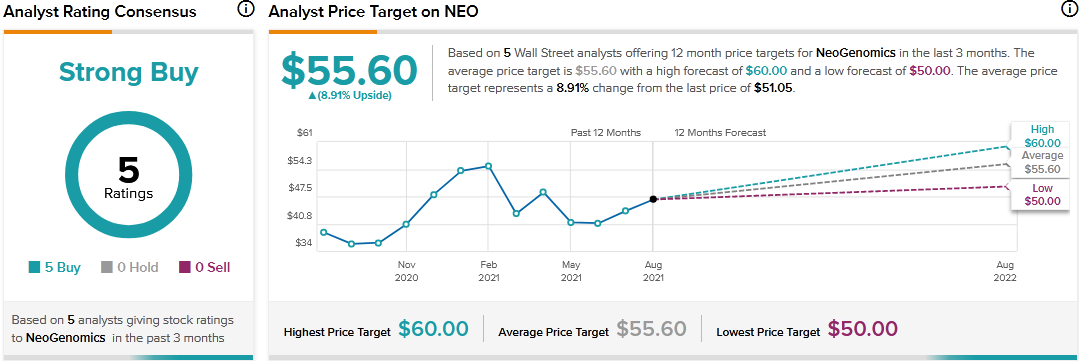

Benchmark Co. analyst Bruce Jackson recently reiterated a Buy rating on NeoGenomics stock and raised the price target to $50 from $46. Jackson’s new price target suggests 2.06% downside potential. The analyst notes that NeoGenomics stands to benefit over the long-term from new products coming from the recently acquired Inivata.

Consensus among analysts is a Strong Buy based on 5 Buys. The average NeoGenomics price target of $55.60 implies 8.91% upside potential to current levels.

Relates News:

Ciena Q3 Earnings Beat Estimates; Shares Pop 3%

Patterson Shares Jump 6.6% on Solid Q1 Beat

Fubo Gaming Bags License For Mobile Event Wagering in Arizona