MSC Industrial (MSM) is one of the largest industrial equipment providers in the United States.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Let’s take a look at the company’s financial performance and what has changed in its key risk factors that investors should know. (See MSC Industrial stock charts on TipRanks)

Risk Factors

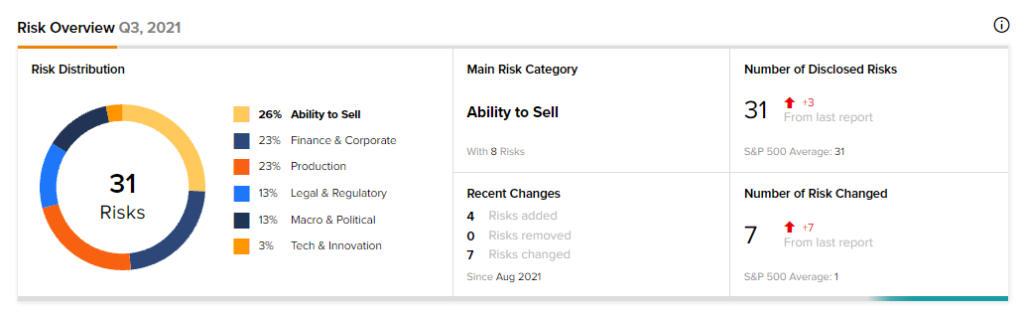

According to the new Tipranks Risk Factors tool, MSC Industrial’s main risk category is Ability to Sell, which accounts for 26% of the total 31 risks identified. The next two major risk factor contributors are Finance & Corporate and Production, which stand at 23% each.

MSC Industrial has added two risk factors under the Production and Macro & Political categories each.

Let us discuss the new risk factors:

Under the Production category, the company emphasizes that interruptions in the supply chain caused by events outside the company’s control, such as natural and human-induced catastrophes, may limit the company’s ability to procure items or fulfill customer delivery dates, severely impacting its business operations.

Further, inaccurate claim predictions linked to healthcare reserves are another risk noted by the business in this category. According to the MSC Industrial, historical claims data and actuarial predictions are used to create insurance-related healthcare reserves. Investors should be aware that the expense of these claims may not be correctly assessed, resulting in skewed outcomes.

Under the Macro & Political category, MSC Industrial highlights that new laws and regulations emerging from climate change concerns may result in a reduction in demand for the company’s products and services, particularly in specific industries.

MSC Industrial further stated that requiring all employees to be immunized against COVID-19 might result in high staff turnover, hurting the company’s operations.

On a brighter note, the overall sector average for the Finance & Corporate risk category is 52.9%, higher than the average risks in that category for MSM, which is 22.6%.

Financial Performance

Let’s take a look at MSC Industrial’s financial results for the fiscal fourth quarter.

Net sales increased by 11.1% year-over-year to $831 million, while adjusted earnings rose 15.6% year-over-year to $1.26 per share.

MSC repurchased 231,000 shares in the fourth quarter of Fiscal 2021.

Wall Street’s Take

Following the fiscal Q4 earnings release, Robert W. Baird analyst David Manthey reiterated a Buy rating on the stock but increased the price target to $101 from $98. This implies 22.6% upside potential to current levels.

Manthey commented, “We believe the stock’s weakness following the report can be partially explained by an erroneous initial slide deck showing lower implied F2022 guidance (later corrected).

He further added, “We see a good setup for F2022, with high-single-digit growth, flattish gross margin, and cost takeout driving ~mid-teens earnings growth.”

On TipRanks, MSC Industrial has a Strong Buy analyst consensus rating based on 3 Buy ratings and 1 Hold rating in the last three months.

As for price targets, the average MSM price target is $97.25, reflecting 12-month upside potential of 18% from current levels.

Related News :

AT&T Posts Strong Q3 Results on Customer Growth

Taking Stock of E2open’s Risk Factors

Taking Stock of Iridium Communications’ Risk Factors