FS KKR Capital (FSK) describes itself as a business development company. It mainly invests in the debt securities of private U.S. companies. It recently completed the merger with FSKR to extend its market reach and strengthen the balance sheet as it seeks to become a leader in private credit markets.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Let’s take a look at the company’s latest financial performance, corporate developments, and risk factors.

FS KKR Capital’s Q2 Financial Results

The company generated total investment income of $206 million in Q2 2021, compared to $150 million in the same quarter last year. It posted net investment income per share of $0.77, which beat the consensus estimate of $0.61. The company plans to distribute a quarterly cash dividend of $0.65 per share on October 4. (See FS KKR Capital stock charts on TipRanks).

FS KKR Capital’s Corporate Developments

In connection with the FSKR merger, FS KKR Capital announced a $100 million share repurchase program that is expected to run for one year. It intends to repurchase the shares in the open market.

During Q2, FS KKR Capital raised $400 million through the sale of unsecured notes maturing in 2027. It plans to use the money from the offering for general corporate purposes, including the repayment of some outstanding debts.

FS KKR Capital’s Risk Factors

The new TipRanks Risk Factors tool shows 75 risk factors for FS KKR Capital. Since Q4 2020, the company has updated its risk profile with one new risk factor under the Finance and Corporate category.

FS KKR Capital cautions that it may not achieve the anticipated benefits of the FSKR merger. It tells investors that achieving the benefits depends on successfully integrating FSKR’s investment portfolio, which might be delayed or generate unexpected costs.

The majority of FS KKR Capital’s risk factors fall under the Finance and Corporate category, with 67% of the total risks. That is above the sector average of 58%. FS KKR Capital’s shares have gained about 35% since the beginning of 2021.

Analysts’ Take

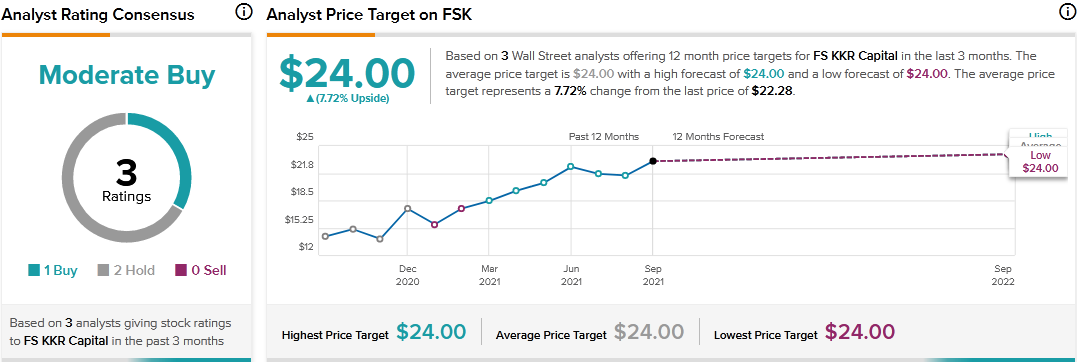

Following FS KKR Capital’s Q2 report, RBC Capital analyst Kenneth Lee reiterated a Hold rating on FSK stock with a price target of $24. Lee’s price target suggests 7.72% upside potential.

Consensus among analysts is a Moderate Buy based on 1 Buy and 2 Holds. The average FS KKR Capital price target of $24 implies 7.72% upside potential to current levels.

Related News:

Microsoft Hikes Quarterly Dividend, Announces Share Repurchase Program

A Look at ABM Industries’ Risk Factors Amid Able Services Acquisition

What Do John Bean Technologies’ Newly Added Risk Factors Reveal?