Chicago-headquartered AZEK Company Inc. (AZEK) makes outdoor living products. It serves both the residential and commercial buildings segments. Let’s take a look at the company’s latest financial performance and risk factors.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

AZEK’s Fiscal Q3 Financial Results and Q4 Outlook

The company reported a 46.4% year-over-year increase in net sales to $327.5 million for the Fiscal 2021 third-quarter ended June 30. Revenue topped consensus estimates of $291.53 million. Adjusted EPS rose to $0.26 from $0.05 in the same quarter last year and beat consensus estimates of $0.23. (See AZEK Company stock charts on TipRanks).

The company ended Q3 with $220.5 million in cash and about $145.6 million under its revolving credit facility. It has $467.7 million in debt.

For Fiscal Q4, AZEK anticipates revenue growth of between 22% and 27% year-over-year. The company raised its Fiscal 2021 full-year revenue growth guidance to a range of 28% – 30%. The previous guidance called for revenue growth in the range of 23% – 26%.

AZEK Company’s Risk Factors

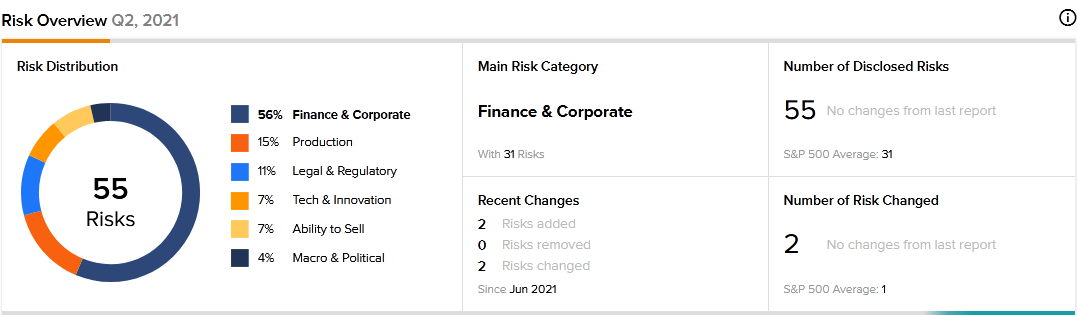

The new TipRanks Risk Factors tool reveals 55 risk factors for AZEK. Since its Fiscal 2020 full-year filing, the company has revised its risk profile to introduce two new risk factors, all under the Finance and Corporate category.

The company tells investors that certain stockholders recently sold their stakes, resulting in an ownership change as defined under IRS rules. Therefore, AZEK wants investors to know that its ability to use operating loss carryforwards to reduce its tax liability may be limited.

Additionally, AZEK cautions of potential conflicts of interest between itself and its sponsors. The company says that although the sponsors no longer own a majority of its outstanding shares, they may continue to influence its affairs and policies. It says the interests of the sponsors may be at odds with those of other shareholders. For example, the sponsors may impede a merger or takeover that may be otherwise favorable to the company.

Finance and Corporate is AZEK’s top risk category, accounting for 56% of the total risks. That is above the sector average at 39%. AZEK’s shares have gained about 9% since the beginning of 2021.

Analysts’ Take

J.P. Morgan analyst Michael Rehaut recently reiterated a Hold rating on AZEK stock and raised the price target to $51 from $50. Rehaut’s new price target suggests 21.92% upside potential.

Consensus among analysts is a Strong Buy based on 3 Buys and 1 Hold. The average AZEK Company price target of $53 implies 26.70% upside potential to current levels.

Related News:

What Does Open Text’s Newly Added Risk Factor Tell Investors?

Pfizer to Acquire Trillium for $2.26B

Kadant Acquires Balemaster for $54M