Dividends are payouts from companies that share their profits with their investors. They offer a regular source of income that can increase over time. This makes them particularly attractive for long-term investments. Even a small dividend yield can result in impressive returns after many years. Dividends can offer protection against market volatility, which is another reason that investors include these stocks in their portfolios.

Strong & Moderate Buy Dividend Stocks

Using the TipRanks Dividend Calendar, we searched for top stocks with an ex-dividend date in January 2023 Investors need to own the stock by the ex-dividend date to receive the next payout. We focused on top dividend stocks with a Buy analyst rating consensus, at least a 5% yield, and an ‘Outperform’ Smart Score of at least eight out of 10, based on our data-driven stock score. We found five top stocks that match these criteria.

Top 5 Dividend Stocks

Physicians Realty Trust (NYSE:DOC)

Dividend yield: 6.25%

Ex-dividend date: Jan 03, 2023

Payout ratio: 173.58%

Payout date: Jan 18, 2023

Physicians Realty Trust is a healthcare-focused Real Estate Investment Trust. DOC stock has received two Buy and five Hold recommendations for a Moderate Buy consensus rating. Further, analysts’ average price target of $16.07 implies 11.21% upside potential over the next 12 months. Physicians Realty Trust has a positive signal from hedge fund managers who bought 57.7K shares last quarter. TipRanks’ data insiders are also bullish about its prospects and acquired DOC stock worth $368.1K. Overall, DOC stock sports an Outperform Smart Score of eight out of 10.

Main Street Capital Corporation (NYSE:MAIN)

Dividend yield: 7.01%

Ex-dividend date: Jan 05, 2023

Payout ratio: 96.78%

Payout date: Jan 13, 2023

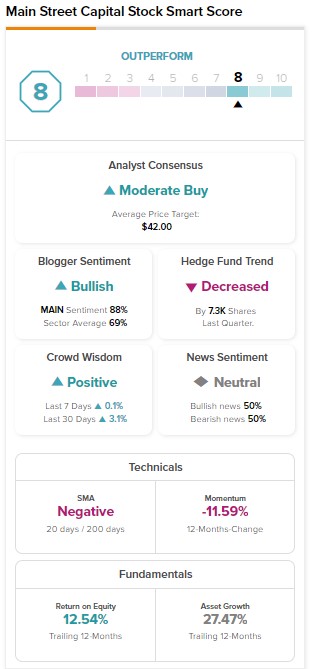

Main Street is an investment firm that primarily offers debt and equity capital to lower-middle market corporations. Its stock commands a Moderate Buy consensus rating on TipRanks based on two Buy and two Hold recommendations. Moreover, analysts’ average price target of $42 implies 13.24% upside potential. Our data shows that hedge funds sold 7.3K MAIN stock last quarter. However, 3.1% of investors holding portfolios on TipRanks have increased their holdings in MAIN stock in the last 30 days. MAIN stock has an Outperform Smart Score of eight out of 10.

AT&T (NYSE:T)

Dividend yield: 6.09%

Ex-dividend date: Jan 09, 2023

Payout ratio: 50.20%

Payout date: Feb 1, 2023

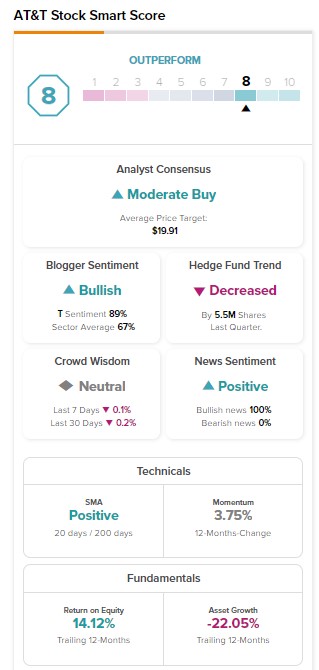

AT&T is a diversified telecom company. Its stock has a Moderate Buy consensus rating on TipRanks based on six Buy, eight Hold, and one Sell recommendations. Moreover, these analysts’ average price target of $19.91 implies 7.91% upside potential. AT&T stock has a positive signal from bloggers. However, hedge funds sold 5.5M AT&T stock last quarter. AT&T carries an Outperform Smart Score of eight out of 10.

EOG Resources (NYSE:EOG)

Dividend yield: 7.04%

Ex-dividend date: Jan 13, 2023

Payout ratio: 57.60%

Payout date: Jan 31, 2023

EOG Resources is engaged in the exploration and production of oil and natural gas. EOG stock has received 16 Buy and four Hold recommendations for a Strong Buy consensus rating. Further, analysts’ average price target of $156.65 implies 21.78% upside potential. Our data shows insiders sold $1.7M worth of EOG stock last quarter. However, hedge funds bought 1.1M EOG stock. EOG Resources sports a “Perfect 10” Smart Score on TipRanks.

Pembina Pipeline (NYSE:PBA)(TSE:PPL)

Dividend yield: 5.78%

Ex-dividend date: Jan 24, 2023

Payout ratio: 61.66%

Payout date: Feb 15, 2023

Pembina Pipeline is a Canada-based energy infrastructure company. It has a Moderate Buy consensus rating on TipRanks based on six Buy and five Hold recommendations. Meanwhile, analysts’ average price target of $37.77 implies 11.35% upside potential. Per TipRanks, hedge funds bought 27.9K PBA stock last quarter. However, insiders sold PBA stock worth $190.7K. Pembina Pipeline stock has an Outperform Smart Score of nine out of 10.

Dividend Yield & Dividend Payout

Companies determine dividend amounts per share. This can make it difficult for investors to compare the best dividend stocks. Imagine you invest $1,000 in 2 companies. One has shares that trade for $10, and the other has shares that trade for $500. Both offer investors $2 per share in dividend payments. The solution to comparing the companies’ dividends is dividend yield, which shows dividend payment relative to the share price as a percentage.

See Also: Dividend Yield Calculator

It is worth knowing the payout ratio of a dividend stock. This is the proportion of earnings a company pays out as dividends. If the ratio is over 100% this may mean that there is a possibility that a company will reduce its dividends.

See which other stocks have an ex-dividend date in January 2023.

Disclaimer: The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.