As a prudent investor, it is important to follow what corporate insiders are buying. Today, we will look at the five stocks that insiders are buying in March to enable you to make an informed investment decision.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Corporate insiders have the best knowledge about the company’s happenings and are in the best position to fathom the upcoming challenges and opportunities. Hence, when a C-suite executive or key insider makes an informative buy it means he/she sees solid potential on the stock going forward.

We used TipRanks’ Top Insiders Stocks tool to learn which stocks insiders are buying currently.

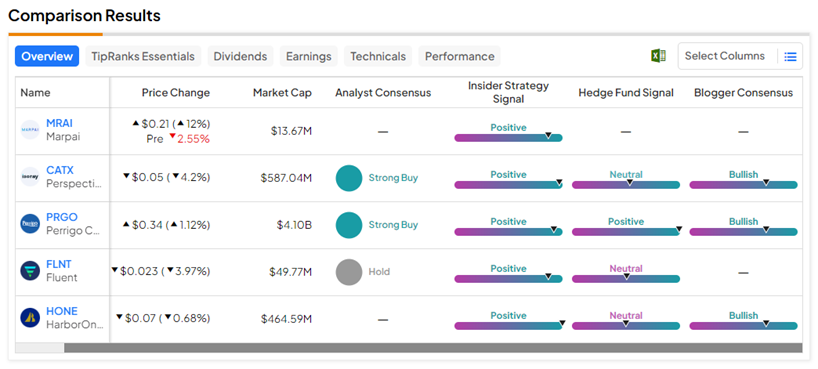

# Marpai Inc (NASDAQ:MRAI)

Marpai is a health plan company that enables corporates to offer affordable, customized healthcare and medical service plans to their employees. Marpai runs a cutting-edge technology-powered TPA (third-party administrator) platform that helps employers with self-funded health plans.

On March 7, Marpai CEO Damien Lamendola bought 910,000 shares at an average price of $1.65 per share for a total sum of $1.50 million. Following the latest share purchase, Lamendola, who is also the Director and more than 10% owner of the company, now owns 3,992,980 common shares of Marpai through direct and indirect ownership. MRAI shares gained 11.4% yesterday following the news of the insider share purchase.

The CEO’s purchase comes on the heel of the company reporting its unaudited preliminary Q4 and Fiscal 2023 results on March 6. Revenue for the quarter rose 14% year-over-year to $8.7 million while net loss stood at $3.9 million, including a one-time goodwill impairment charge of $3 million. The final results are scheduled for March 26, 2024.

Overall, Marpai has a Very Positive Insider Confidence Signal, implying insiders are optimistic about the company’s growth potential. Based on Marpai’s current Ownership structure, corporate insiders own 85.15% of the company. MRAI stock has lost 46.5% in the past year.

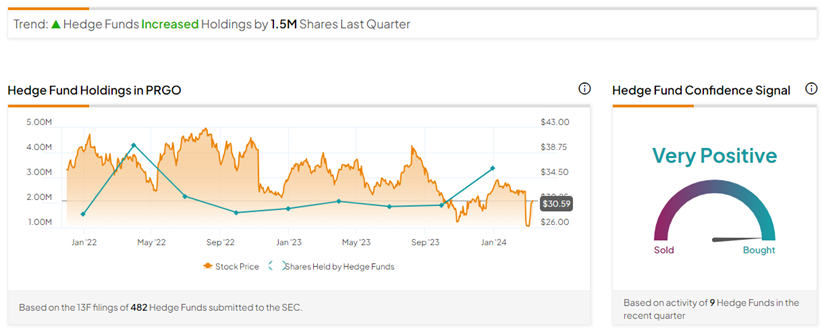

# Perspective Therapeutics Inc (NYSE:CATX)

Perspective Therapeutics focuses on treating cancer using radiation, radiopharmaceuticals, and imaging technologies. It is the sole producer of Cesium 131 brachytherapy radioisotope seeds that are designed to treat a variety of difficult cancers. Perspective Therapeutics was formed in February 2023 through the merger of Isoray and Viewpoint Molecular Targeting.

On March 6, Lantheus Alpha Therapy, LLC, a strategic partner and more than 10% owner of Perspective, bought 60,431,039 shares of CATX at a price of $0.95 per share worth $57.4 million. Following the latest purchase, Lantheus now owns 116,773,394 shares of Perspective Therapeutics.

On TipRanks, CATX has a Very Positive Insider Confidence Signal as corporate insiders are optimistic about the strategic deal with Lantheus. Insiders own 25.08% of Perspective as per the current Ownership structure.

Meanwhile, CATX stock has a Strong Buy consensus rating on TipRanks, backed by three unanimous Buys. The average Perspective Therapeutics share price target of $1.30 implies 14% upside potential from current levels.

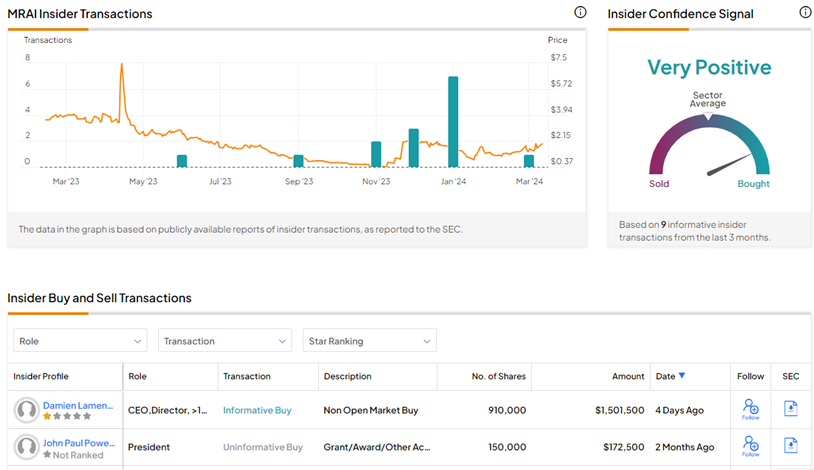

# Perrigo Company PLC (NYSE:PRGO)

Perrigo is an American Irish healthcare company, domiciled in Ireland but earning most of its revenues from the U.S. Perrigo engages in the acquisition, manufacture, and sale of consumer healthcare and wellness products.

On March 6 and 7, EVP and President Svend Anderson bought 3,788 and 5,468 shares of Perrigo for an average price of $28.09 and $29.69, respectively, for a total consideration of $268,750. Following the latest purchase, Anderson now holds 209,921 shares of PRGO stock via direct and indirect modes.

For Fiscal 2023, Perrigo reported double-digit growth in gross profit, operating income, and earnings per share. Meanwhile, net sales grew 4.6% to $4.7 billion compared to the prior year.

Not just corporate insiders, PRGO also earns a Very Positive Hedge Fund Confidence Signal on TipRanks. Nine hedge funds increased their holdings of the stock by 1.5 million shares in the last quarter. PRGO stock has lost 13.3% in the past year.

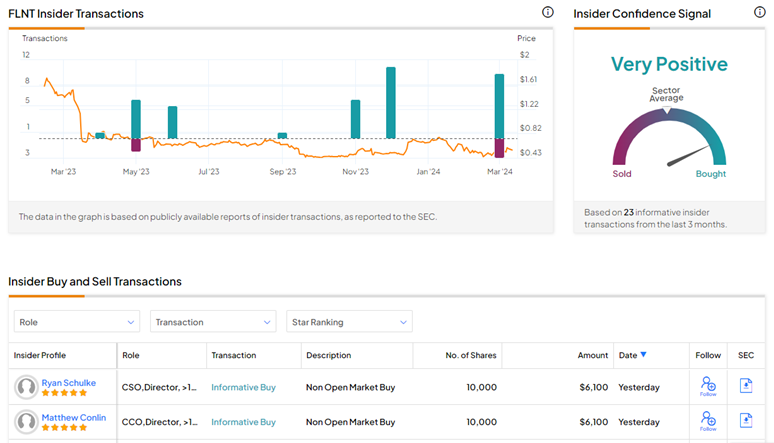

# Fluent, Inc. (NASDAQ:FLNT)

New York-based Fluent is a digital marketing company providing scalable, data-driven performance marketing and customer acquisition services.

On March 8, Chief Strategy Officer and Director Ryan Schulke bought 10,000 shares of FLNT at a price of $0.6187 per share. Following the recent purchase, Schulke (more than 10% owner) now owns 10,754,528 shares of Fluent.

In its preliminary Q4 results, Fluent posted a 14% year-over-year decline in revenues but net loss narrowed to $1.9 million from $67.5 million in the comparable quarter of the previous year. FLNT stock has lost 55.5% in the past year.

On TipRanks, FLNT has a Very Positive Insider Confidence Signal as corporate insiders made informative buys worth $101.2 million in the last three months.

# HarborOne Bancorp (NASDAQ:HONE)

HarborOne Bancorp is a bank holding company that provides co-operative banking services to consumers, businesses, and municipalities throughout Eastern Massachusetts and Rhode Island. The company operates through its subsidiary HarborOne Bank.

On March 1, President and CEO Joseph Casey purchased 17,142 shares of HONE at a price of $10.18 per share, amounting to $174,506. Following the recent purchase, Casey now owns 571,810 shares of HarborOne. HONE has a Very Positive Insider Confidence Signal on TipRanks following a series of both informative and uninformative buy and sell transactions.

For Fiscal 2023, HarborOne’s net interest income (NII) fell 15.2% and non-interest income declined 27% compared to the prior year. The bank’s results were materially impacted by a goodwill impairment charge of $10.8 million at the Harbor One Mortgage LLC unit. Record-high mortgage rates and housing market challenges impacted the company’s business in 2023.

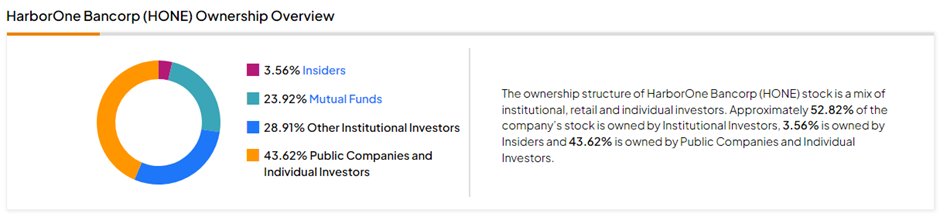

HarborOne’s current ownership structure shows that insiders own only 3.56% of the company. Public companies and Individual Investors own the maximum of 43.62%, followed by Other Institutional Investors at 28.91% and Mutual Funds at 23.92%.

Ending Thoughts

Investors can take a hint about a company’s upcoming performance from corporate insider trading activity. A frenzy of buys signals positive times ahead and vice versa for a series of sell calls. Based on the latest activities, the above five companies have a Very Positive Insider Confidence Signal which can be used to leverage your investment decisions.