With cryptocurrency prices exploding lately, let us look at the 5 best crypto ETFs to buy in March 2024, as per analysts. The price of Bitcoin (BTC-USD), the most widely traded cryptocurrency, hit a fresh 52-week high on March 9, mainly driven by the Bitcoin halving event expected to occur in mid-April 2024. Experts are forecasting the crypto industry to reach record highs in 2024.

Investors who are hesitant to invest directly in crypto stocks or cryptocurrencies due to a lack of understanding can consider investing in crypto ETFs. Exchange Traded Funds (ETFs) are investment vehicles that form a pool of companies from a specific sector, asset class, commodity, currency, or investment strategy.

ETFs can be traded as easily as stocks on an exchange and offer an appealing diversification option to investors. Our 5 Best Crypto ETFs today invest in companies involved in blockchain technology or those that directly hold a large number of cryptocurrencies on their balance sheets. The average price targets of the ETFs are calculated based on the individual price targets of the component companies.

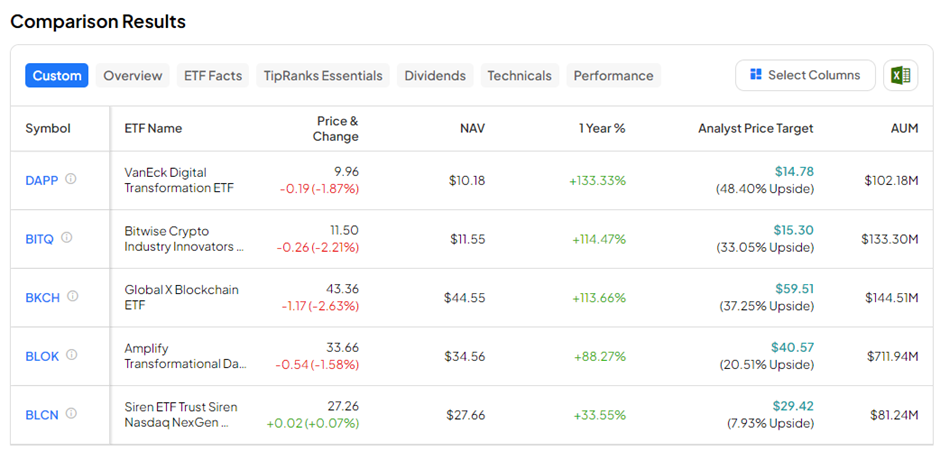

#1 VanEck Digital Transformation ETF (NASDAQ:DAPP)

The VanEck Digital Transformation ETF tracks a market-cap-weighted index of the MVIS Global Digital Assets Equity Index, which tracks the performance of global companies that are involved in the digital asset economy. DAPP’s investment strategy lies in the fact that these companies are forerunners in the crypto world and have the potential to generate at least 50% of revenue from digital assets. DAPP includes crypto exchanges, miners, and blockchain infrastructure companies.

Launched in March 2021, DAPP has lost roughly 33% since its inception. However, in the past year, DAPP has gained 134%. The equity-focused ETF holds 21 investments as of date with a total value of $102.18 million. Its top five major holdings include MicroStrategy (MSTR), Coinbase Global (COIN), CleanSpark (CLSK), Block (SQ), and Marathon Digital Holdings (MARA), constituting roughly 49.31% of the total portfolio.

Is DAPP a Good Buy?

On TipRanks, DAPP has a Moderate Buy consensus rating based on 15 Buys versus six Hold recommendations. The average VanEck Digital Transformation ETF price target of $14.33 implies 43.8% upside potential from current levels.

#2 Bitwise Crypto Industry Innovators ETF (NYSEARCA:BITQ)

BITQ invests in pure-play crypto players that generate maximum revenue from crypto business activities. The ETF tracks the Bitwise Crypto Innovators 30 Index and includes companies from the bitcoin and crypto-trading venues, crypto-mining and mining equipment firms, and service providers.

Launched in May 2021, BITQ has lost 44% of its value since inception but gained 114.5% in the past year. Currently, BITQ holds 30 companies valued at $133.30 million. Its top five holdings include MicroStrategy, Coinbase Global, Marathon Digital Holdings, Galaxy Digital Holdings (TSE:GLXY), and Bitfarms (TSE:BITF), representing 56.78% of the total holdings.

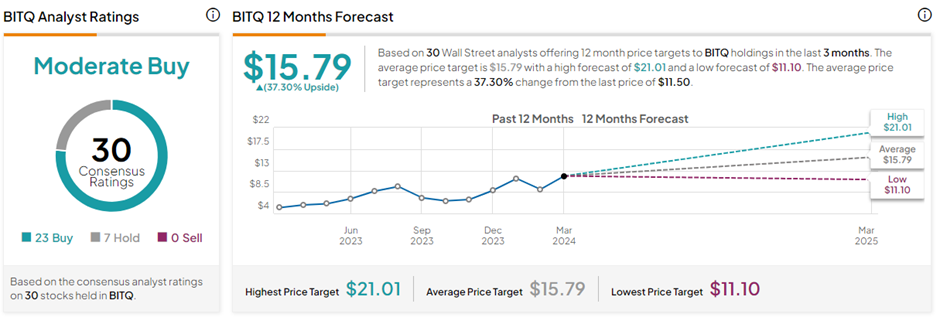

Is BITQ ETF a Good Investment?

With 23 Buys and seven Hold ratings, BITQ has a Moderate Buy consensus rating on TipRanks. The average Bitwise Crypto Industry Innovators ETF price target of $15.79 implies 37.3% upside potential from current levels.

#3 Global X Blockchain ETF (NASDAQ:BKCH)

As the name suggests, the Global X Blockchain ETF seeks to invest in companies deemed to benefit from the increased adoption of blockchain technology, including companies in digital asset mining, digital asset transactions, blockchain applications, blockchain, and digital asset hardware, and blockchain and digital asset integration. BKCH tracks the Solactive Blockchain Index.

BKCH was launched in December 2021, with the aim to provide high growth potential to investors in the global blockchain market. BKCH has 26 holdings valued at $144.51 million.

Since its inception, BKCH has lost 49.1% of its value. That said, the ETF has gained 113.7% over the past year. Its top five holdings include Coinbase Global, CleanSpark, Marathon Digital Holdings, Riot Platforms (RIOT), and Bitfarms. These five account for 66.8% of the total portfolio.

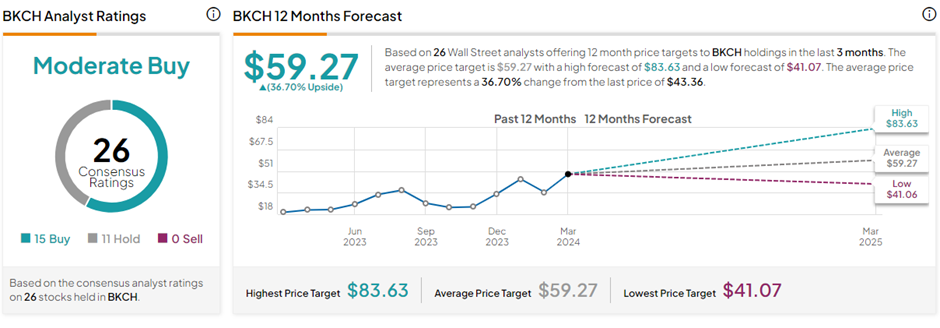

What is the Forecast for BKCH?

With 15 Buys and 11 Hold ratings, BKCH has a Moderate Buy consensus rating on TipRanks. The average Global X Blockchain ETF price target of $59.27 implies 36.7% upside potential from current levels.

#4 Amplify Transformational Data Sharing ETF (NYSEARCA:BLOK)

BLOK is an actively managed ETF that invests at least 80% of its net assets in stocks of companies that are “actively involved in the development and utilization of blockchain technologies.”

One of the oldest funds to date, BLOK has gained 104% since its launch in January 2018, including 82% in the past year. BLOK can be considered a more diversified ETF, with 54 holdings valued at $711.94 million.

BLOK’s top five holdings include Galaxy Digital Holdings, Coinbase Global, MicroStrategy, Beyond Inc. (BYON), and CleanSpark. These five holdings constitute 24.81% of the total portfolio.

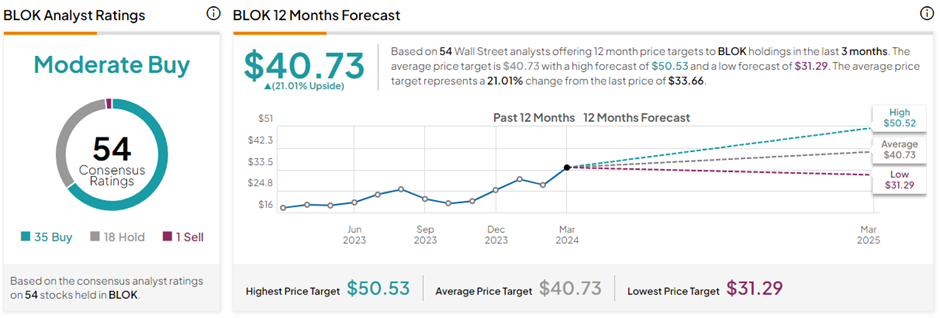

Is BLOK a Good Stock to Buy?

On TipRanks, BLOK has a Moderate Buy consensus rating based on 35 Buys, 18 Holds, and one Sell rating. The average Amplify Transformational Data Sharing ETF price target of $40.73 implies 21% upside potential from current levels.

#5 Siren Nasdaq NexGen Economy ETF (BLCN)

BLCN seeks to replicate the returns of the NASDAQ Blockchain Economy Index. It aims to earn long-term growth by investing in companies focused on developing, researching, or utilizing blockchain technologies.

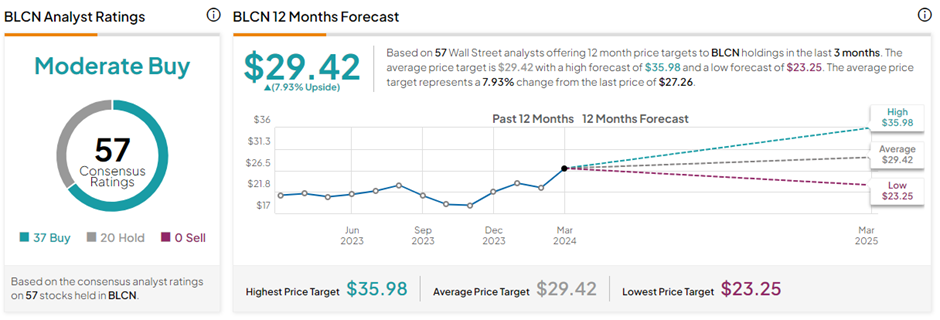

BLCN was also launched in January 2018 and has gained 13.3% since then. It has advanced 34.6% in the past year. The ETF has 57 holdings currently, valued at $81.24 million. Its top five holdings include MicroStrategy, Coinbase Global, Block, Mastercard (MA), and Microsoft Corp (MSFT). They represent only 19.53% of the total portfolio.

Is BLCN a Good Buy?

On TipRanks, BLCN has a Moderate Buy consensus rating based on 37 Buys and 20 Hold recommendations. The average Siren Nasdaq NexGen Economy ETF price target of $29.42 implies 7.9% upside potential from current levels.

Key Takeaways

The above 5 crypto ETFs have solid potential to outperform once the crypto sector picks momentum. Investors seeking to gain exposure to the crypto world can consider these ETFs as a safer and less expensive way to obtain diversification.