Ride-share giant Uber (UBER) has seen its shares rally strongly after delivering an across-the-board beat for the June quarter. After dipping below $60 at the start of August, UBER is trading above $70, reigniting bullish momentum with solid metrics across nearly every level. I’m still bullish on Uber as a long-term investment, and in this article, I’ll outline four reasons why investors might want to share that sentiment.

1. Strong Growth Across Key Segments

Uber’s most recent Q2 earnings results offer even more reasons than four to be optimistic about the company’s investment potential.

One of the key metrics for Uber investors is gross bookings, which reveal how many people are using the platform and how much they’re spending. In Q2, mobility gross bookings jumped by 23% to $20.6 billion, while delivery gross bookings increased by 16% year-over-year to $18.1 billion. This growth shows strong consumer demand and a solid rebound in mobility services as the economy improves. Contrary to expectations, delivery demand hasn’t waned as the economy reopened, indicating that consumers value Uber’s convenience.

Uber’s expanding customer base has also been a major growth driver. The number of monthly active platform customers surged to 156 million, up from 137 million in the same quarter last year. This increase in users directly boosts gross bookings, as each new customer contributes to more transactions across Uber’s services, including ride-hailing and food delivery.

Looking ahead, Uber expects gross bookings to range between $40.25 billion and $41.75 billion for the next quarter, reflecting a strong 18% to 23% year-over-year growth rate.

2. Uber’s Improved Profitability and Cash Flow

The second point that strengthened Uber’s bullish outlook after Q2 was its improved profitability and cash flow, which are directly tied to its operating results. As gross bookings and the customer base expand, Uber’s income from operations and cash flow have seen significant boosts.

Uber’s income from operations surged to $796 million, up by $326 million from the previous year. This substantial improvement reflects better operational efficiency and effective cost management. The company has reduced consumer promotions and incentives, moved to a more sustainable business model, increased prices, and tapped into new advertising revenue. It’s noteworthy that, since its IPO in 2019, Uber achieved its first annual profit (income from operations) of $1.1 billion in 2023.

While the adjusted EBITDA forecast of $1.58 billion to $1.68 billion for Q3 was slightly below market expectations, this is a temporary headwind attributed to foreign exchange rates rather than a demand issue, so I see no cause for concern.

Another key factor of the bullish thesis is Uber’s asset-light business model. Since Uber doesn’t own the assets used in its core services, it can scale its operations without a proportional increase in capital expenditure. This approach allowed Uber to generate $1.7 billion in free cash flow. With this model, the cash flow can be returned to shareholders, which is why Uber authorized up to $7 billion in stock repurchases earlier this year. So far, Uber has repurchased $325 million worth of shares, and this trend is expected to continue.

3. Segment Expansion and Strategic Initiatives

The third key factor bolstering Uber’s positive outlook is its future strategic prospects.

First, Uber’s advertising business generates substantial extra revenue. This segment has hit a revenue run rate of over $1 billion and is proving highly profitable. Since Uber doesn’t need to share ad revenue with restaurants or drivers, this boosts profit margins compared to its core delivery and mobility services.

Another exciting development is Uber’s partnership with BYD, which was announced in July, to add 100,000 new electric vehicles (EVs) to its platform globally. This deal also includes plans to work together on autonomous vehicle technology. This partnership could lower operational costs and give Uber a competitive edge.

In a previous article, I mentioned concerns that robotaxis might threaten Uber’s future. Tesla (TSLA) plans to operate a fleet of robotaxis, and Elon Musk has compared this project to a mix of Airbnb (ABNB) and Uber. However, Uber’s CEO, Dara Khosrowshahi, seems untroubled by this. He believes that Tesla’s robotaxi project will need resources Uber already has to make it financially viable.

Overall, Uber’s push to integrate autonomous vehicles into its platform with BYD seems like a more practical approach to reducing noise in the evolving ride-share and transportation landscape.

4. Uber Looks Attractively Priced for a Growth Stock

The icing on the cake for the Uber investment thesis is its valuation. As a growth stock, Uber is also at the forefront of disruptive technologies with its mobility app and autonomous vehicle projects, which are poised to become major trends in the future.

At first glance, Uber might seem overvalued, with a forward P/E ratio of 33x compared to an average of 19x for its peers. However, this valuation needs to be viewed through the lens of growth potential. Uber’s 3 to 5-year CAGR (Compound Annual Growth Rate) consensus estimate is 46%, which gives it a forward PEG ratio of 0.72x – almost 60% below the industry average. This suggests that considering Uber’s expected long-term growth, the stock might be undervalued at its current price.

Is UBER A Buy, According to Wall Street Analysts?

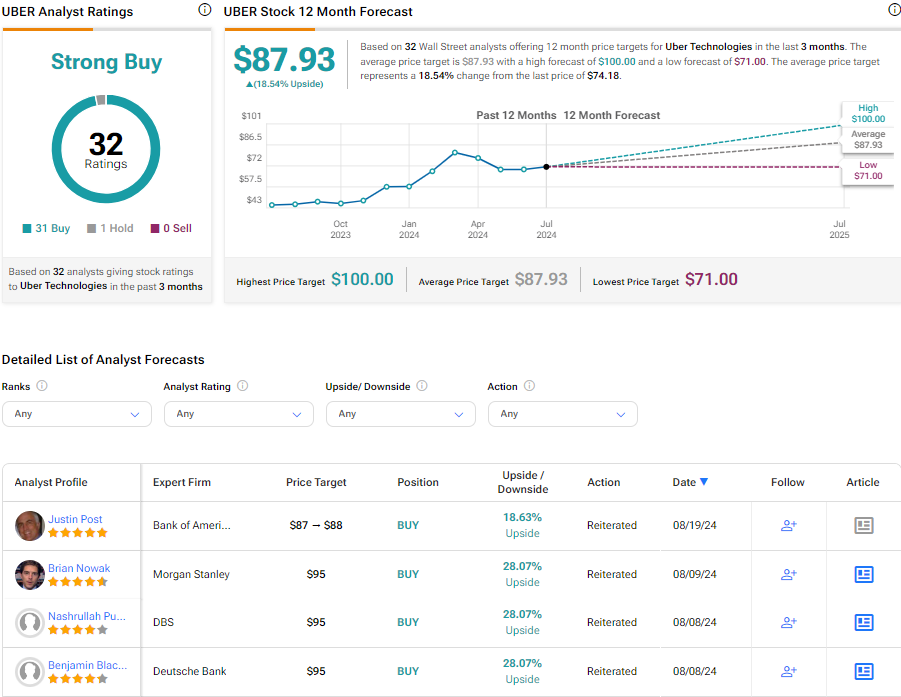

Wall Street analysts aren’t just bullish on UBER stock, they’re also forecasting significant upside potential for the San Francisco-based company. With a “strong-buy” rating from 31 bullish analysts and only 1 analyst on the fence, the average price target of $87.93 suggests an upside potential of 22.06% based on the latest share price.

Key Takeaways

Uber’s Q2 results show strong booking growth and a growing user base. Better profitability and cash flow, along with smart investments in autonomous vehicles, boost its future outlook. Even though the P/E ratio is high, the low forward PEG suggests the stock might be undervalued, given its growth potential. According to the consensus, there could still be room for upside, even after the positive post-Q2 reaction.