Looking in from the outside, Intel (INTC) seems to have been the star of its own disaster movie. Even when good news or a glimmer of hope arrives, something bad happens and takes the company a step backward. Nevertheless, in those types of movies, the protagonists usually survive in the end, so Intel’s fortunes could be the same.

Two months have passed since the company posted its second-quarter earnings, sending its stock into a spiral and losing 27% in a day. In addition, the company announced the termination of 15,000 to 19,000 employees, and more importantly, its products seemed outdated.

We’ve decided to recap some of the recent events surrounding the company for the readers so everyone is up to date.

Our writer at Tipranks, Steve Anderson, has followed the company closely. You can read about it more extensively here, here, and here.

- Ongoing Challenges: Since the last quarterly results, Intel has been set to invest all its tokens in creating a chip foundry that will make it an ” all-in-one” company that doesn’t have to rely on other companies like TMSC (TSM) for its chip manufacturing. Intel is doing surprisingly well in this respect, with its new 18A chip getting some good feedback. INTC has also decided to invest $25 billion in a microchip foundry in Israel. However, competition is stiff, and restoring the industry’s faith in the company will be hard if its reputation is damaged. Meanwhile, the chipset giant is doing all it can to revive its competitive edge. It recently signed a multi-year, multi-billion-dollar co-investment with Amazon Web Services (AWS) to design custom AI chips.

- AI Playground: In other positive developments, Intel has launched an AI Playground to display its AI capabilities. This platform can make pictures from words, improve image quality, answer questions, summarize documents, and translate text.

- Investors Are Worried: With respect to Intel’s AI Playground, long-term strategy, and ambitious targets, investors still feel anxiety over the short-term financial implications. The company posted a $1.61 billion net loss, a heavyweight debt of $53 billion, and a negative cash flow of $12.58 billion in the trailing twelve months.

- Mother Nature Takes a Shot: We all heard about Hurricane Helene’s exploits, but for microchip companies like INTC, this force of nature has been disastrous. Hurricane Helene severely affected the supply of ultra-pure quartz from Spruce Pine, North Carolina, and disrupted the quartz supply chain altogether. There are other quartz mines worldwide, but not with the quality of Spruce Pine mines. In the aftermath of Hurricane Helene’s disastrous results, INTC stock dropped another 2.5%.

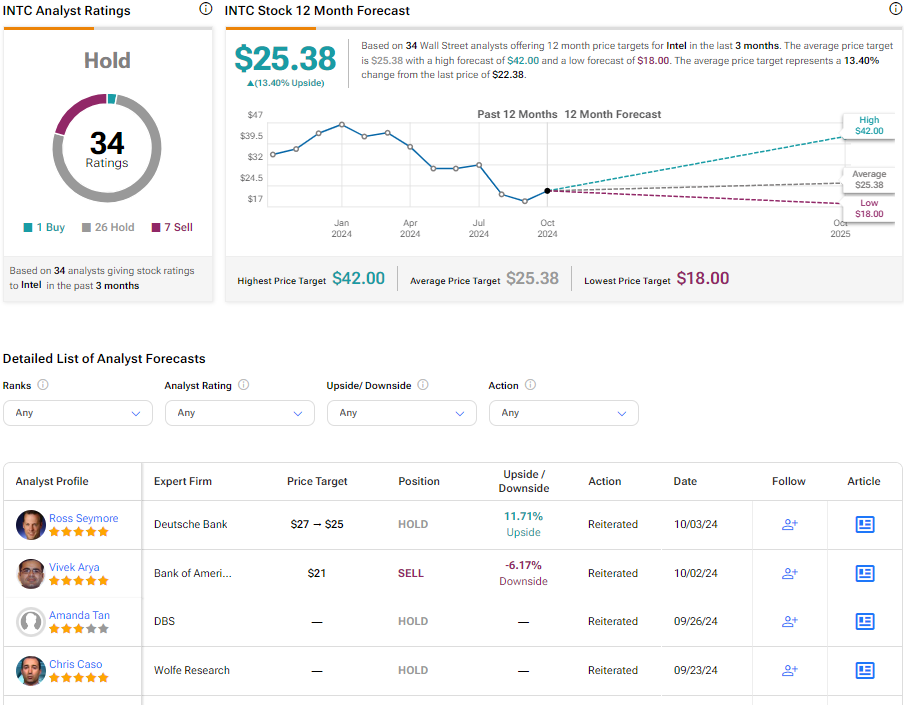

INTC’s Price Target on Wall Street

On Wall Street, INTC stock is a Hold, with one analyst declaring it a Buy, 26 a Hold, and 6 Sell. The average price target for INTC stock is $25.38, signaling an upside of 13.40%.

To be Continued

Intel’s ongoing saga and attempts to regain its status as an industry leader will continue. The strategy and even good reviews for its new developments are there, but financial struggles and Mother Nature present challenges and setbacks at every turn. If it wants to survive this epic crash, it feels like INTC will have to improvise as it goes, just like a hero in any disaster movie.