3M Company posted solid August sales results and announced an upbeat 3Q sales outlook that surpassed analysts’ estimates. Shares of the company are rising over 1% in Tuesday’s pre-market trading.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

3M’s (MMM) August sales increased 2% year-over-year to $2.7 billion, primarily driven by health care sales growth of 23% year-over-year. Safety and industrial sales also rose 6% while consumer sales grew 3%. However, transportation and electronics sales declined 11% year-over-year in August. The company pointed out that August sales were impacted by only 21 days in the month this year versus 22 days last year

The industrial company estimates that 3Q sales will generate between $8.2 billion to $8.3 billion, compared with $8 billion in the year-ago quarter. 3Q sales guidance was also above analysts’ estimates of $8.08 billion. The company is set to report 3Q earnings results on Oct. 27. (See MMM stock analysis on TipRanks).

On July 28, 3M reported 2Q earnings of $1.78 per share, missing the Street estimates of $1.80 per share. Revenues of $7.18 billion also lagged analysts’ expectations of $7.32 billion in 2Q, due to a plunge in demand across its business units amid the pandemic.

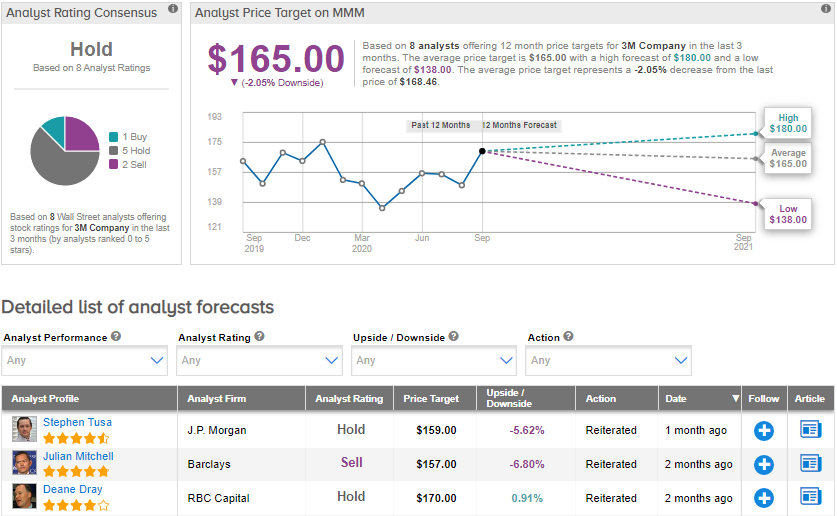

Despite the 2Q performance, JPMorgan analyst Stephen Tusa last month lifted the price target on 3M to $159 (5.6% downside potential) from $154, saying that the shares are “cheap.” He said that the company performed well in 2Q amid a tough environment, and a “stronger-than-expected bounce back” in July is positive. He maintained a Hold rating on the stock.

Like Tusa, the Street is sidelined the stock with a Hold analyst consensus. The average price target of $165 implies downside potential of about 2.1% to current levels. Shares have declined about 4.5% year-to-date.

Related News:

Monolithic Power Rises In Pre-Market On 3Q Sales Outlook

NextEra Soars 6% After-Hours On Guidance Boost, Stock-Split

Lennar’s 3Q Profit Jumps 33% On Robust Housing Demand