Shares of industrial, safety, and consumer products provider 3M Company (MMM) have declined 11.1% so far this year. 3M’s recent fourth-quarter numbers came in ahead of expectations on both its top-line and bottom-line fronts.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Despite supply chain challenges, revenue increased 0.3% year-over-year to $8.6 billion, beating estimates of $8.58 billion. While earnings per share dropped 4% year-over-year to $2.31, the figure was still better than expectations of $2.02.

Additionally, on February 14, the company announced it anticipates total sales growth of 1% to 4% for 2022. Earnings per share are expected to land between $10.15 and $10.65. Further, 3M has made a $1 billion ESG commitment over 20 years, focusing on carbon neutrality, lowering water use, improving water quality, and decreasing plastic use.

With these developments in mind, let us take a look at the changes in 3M’s key risk factors that investors should know.

Risk Factors

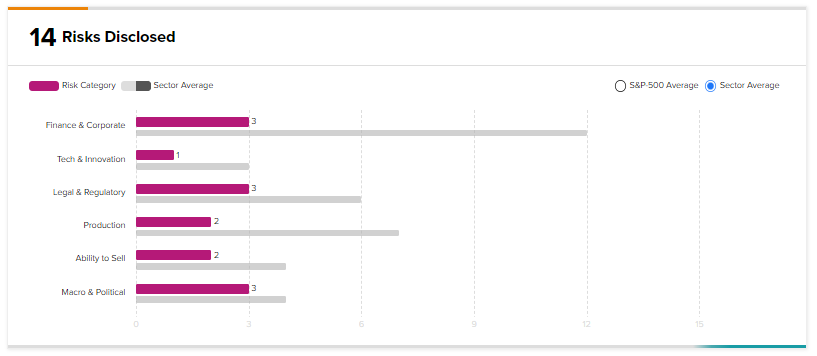

According to the TipRanks Risk Factors tool, 3M’s top three risk categories are Finance & Corporate, Legal & Regulatory, and Macro & Political, contributing 3 each to the total 14 risks identified for the stock.

In its recent report, the company has changed one key risk factor under the Production risk category.

3M highlighted that it depends on sourcing a number of components, compounds, raw materials, and energy from suppliers for manufacturing its products. Supply of products could be interrupted due to varying factors such as shortages, climate impacts, disasters, government actions, or other disruptive events. Such an event could lead to an adverse impact on 3M’s business.

Meanwhile, compared to a sector average of 12 risk factors, 3M has 3 risk factors under Finance & Corporate category.

Hedge Fund Activity

According to TipRanks data, the Wall Street’s top hedge funds have decreased holdings in 3M by 967.1 thousand shares in the last quarter, indicating a negative hedge fund confidence signal in the stock based on activities of 7 hedge funds.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Copper Mountain Mining Posts Lower Q4 Production

Mr. Cooper Group Gains 19% on Q4 Earnings Beat & New Partnership

Transdigm Group Updates 1 Key Risk Factor