Chip giant Intel (INTC) has faced significant struggles this year, marked by a poor outlook, steep margin contractions, and a dividend halt. These three headwinds made me adopt a Sell stance on the stock. The possibility of splitting Intel’s product design and manufacturing businesses could potentially lead to a turnaround in the short to medium term. However, this potential opportunity remains speculative and lacks sufficient strength to alter my investment thesis.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Intel stock has been disastrous and has fallen over 59% so far this year. The current scenario still suggests much more uncertainty regarding a potential turnaround. I will delve into these concerns in this article.

Intel’s Outlook Indicates a Slower-than-Expected Recovery

Looking at the reasons for a bearish outlook on Intel, particularly in the short term, we start with the company’s Q3 guidance. The company’s outlook fell significantly short of expectations. This shortfall led to a dramatic sell-off in Intel’s stock on August 2, marking its worst day in over 50 years.

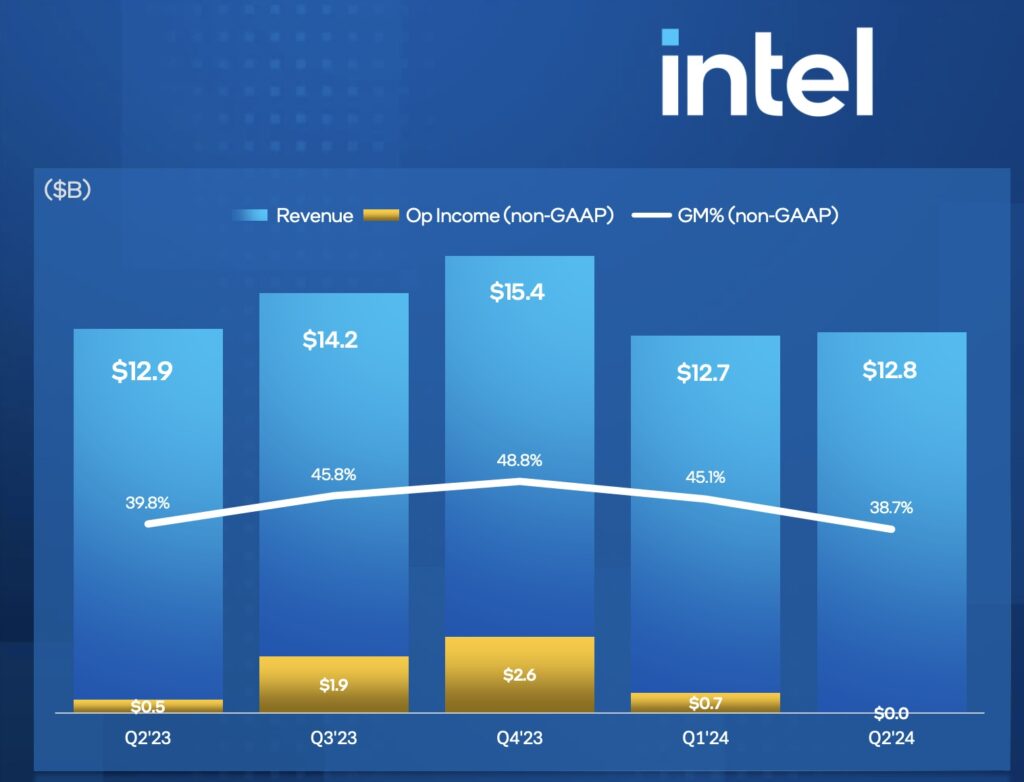

Intel’s management revised its growth expectations for the latter half of 2024, contradicting its earlier forecast that the second half of the year would outperform the first. For Q3 2024, Intel expects revenue to be between $12.5 billion and $13.5 billion. At the midpoint, this would represent a year-over-year decline of 8%, indicating the lowest growth rate since the second quarter of last year.

The weaker demand is primarily attributed to intense competition from Nvidia (NVDA) in the AI chip market and AMD (AMD) in both the server and PC markets. This weakness highlights that Intel’s current offerings are not as competitive as those of its rivals.

Typically, Intel’s revenue grows by 0% to 5% from Q3 to Q4. This year, the company expects to achieve the higher end of this range due to anticipated product launches, such as the Intel 20A, at the end of the year. However, given the underwhelming expectations for Q3, this anticipated recovery may have a limited impact on the overall performance for the year.

Ongoing Concerns over INTC’s Margins

Intel is struggling with not only weak short- to medium-term expectations but also ongoing skepticism surrounding its profitability. In Q2, Intel reported a gross margin of 38.7%, near the lowest level in the company’s history. For context, pre-pandemic margins were over 60%, while Nvidia currently boasts a gross margin of above 75%.

This decline in Intel’s profitability is largely attributed by management to an “unfavorable product mix” and increased competitive pricing due to the accelerated rollout of the company’s AI PC products. Additionally, management has forecasted even lower margins for Q3, expecting them to drop to 38%.

However, this margin contraction isn’t a recent issue but rather a trend that’s been developing over the past few years. One major factor contributing to this trend is Intel’s aggressive push to expand its manufacturing capabilities. The biggest problem is that while the company is sacrificing margins for long-term gains, it’s been a huge struggle.

While competitors like TSMC (TSM) have advanced to more cutting-edge manufacturing nodes (such as 5nm and 3nm), Intel has had trouble making the jump to 7nm and beyond. This struggle has caused delays in product launches and raised doubts about Intel’s long-term competitiveness in chip manufacturing and the possibility of improvement in its margins.

Dividend Suspension Adds to Intel Investors’ Woes

To emphasize my bearish thesis, the contraction in Intel’s profitability has also strained the company’s cash flows. Adding to the negative sentiment for Intel investors, the company announced last month that it would suspend its dividend from Q4. Although Intel wasn’t known for high dividend yields, it has been offering a yield of around 2.27%, thanks to its historically strong cash flows.

The dividend suspension is a clear sign of serious trouble ahead. Intel has been pouring tens of billions of dollars into a major business transition and expanding manufacturing capacity, which has significantly reduced its cash flow. For instance, Intel’s cash from operations fell 25.7% in FY23. As a result, management is now focused on quickly reducing leverage and aims to achieve positive adjusted free cash flow in FY25.

Intel’s Potential Strategic Realignment

After all the bearish reasons raised above, I want to bring attention to the main factor that could potentially counter the negative outlook for Intel: the company’s exploration of a possible split between its product design and manufacturing businesses. It’s plausible that splitting Intel’s core chip business (Integrated Design Manufacture or IDM) from its Foundry operations could address some of the investors’ concerns.

Currently, IDM and Foundry face conflicting priorities, leading to inefficiencies. A separation would allow IDM to focus solely on product innovation and development, while the Foundry could concentrate on expanding manufacturing capabilities without internal competition. This could enhance operational efficiency, attract targeted investments, and strengthen Intel’s competitive position. However, the success of this split would depend on effective execution and clear strategic focus for both entities.

Although this plan is not yet a formal proposal and remains speculative, Intel shares surged approximately 9% during the August 30th trading session following news of CEO Patrick Gelsinger’s intentions to streamline operations and reduce capital spending. Interestingly, this move contrasts with other major tech companies that are ramping up their capex.

Is INTC Stock a Buy, According to Analysts?

The consensus on Wall Street on INTC stock is less than encouraging. Of the 32 analysts covering the stock, 26 have a Hold rating. However, despite this skepticism, Intel’s average price target of $26.09 indicates about 30% upside potential from the current level.

Key Takeaways

Intel is diverging from its competitors in the AI gold rush, which supports my Sell rating on the stock. While a potential split of its product design and manufacturing businesses might offer some short-term upside, the company’s current challenges, particularly in the highly competitive chip market, are significant.

A slower-than-expected recovery, ongoing profitability issues, and the recent suspension of its dividend contribute to a bearish momentum, which is likely to persist in the near term and casts serious doubts on Intel’s long-term turnaround.