These are the 3 Best Olympic Stocks to buy in July 2024, according to Wall Street analysts. Olympic stocks refer to shares of companies that are connected with the Olympic Games by being their advertisers, partners, or sponsors. These companies have a high probability of benefiting from the Olympic Games as their brand visibility increases and sales grow.

Therefore, the advent of the 2024 Summer Olympic Games could be a good time to invest in these stocks. We leveraged the TipRanks Stock Comparison tool to select three Paris 2024 Olympic – Sponsors and Partners stocks that have earned a “Strong Buy” consensus rating and have reasonable share price appreciation potential in the next twelve months.

In our last article titled “Buy These Olympic Stocks, Say Wall Street Analysts,” we explored three U.S. companies. Today, we will look at three European companies that have partnered with the 2024 Paris Olympic Games.

#1 Orange SA (FR:ORA)

Orange SA is a French telecommunications giant offering mobile, landline, and internet services across the globe. Its offerings include fiber, 4G, 5G, submarine cables, and satellite communication services to businesses.

Orange is a premium partner and official supplier of the Paris 2024 Olympic and Paralympic Games. Orange will be the sole service provider to deliver live coverage of the games to billions of people worldwide. The company has installed high-speed broadband networks at the venues, enabling optimal quality of service. Orange will singlehandedly connect 878 sporting events, 120 official venues, and 15,000 athletes. Moreover, Orange is also the official sponsor of the Marathon pour Tous (Mass Participation Marathon).

Orange is set to release its Q2FY24 results on July 24. The Street expects the company to post adjusted earnings per share (EPS) of €0.13 on sales of €10.04 billion. The sales expectations are lower compared to the prior-year period figure of €10.93 billion. Notably, ORA paid an annual dividend of €0.72 per share for FY23 and has plans to increase the dividend to €0.75 per share for Fiscal 2024.

Should I Buy Orange Stock?

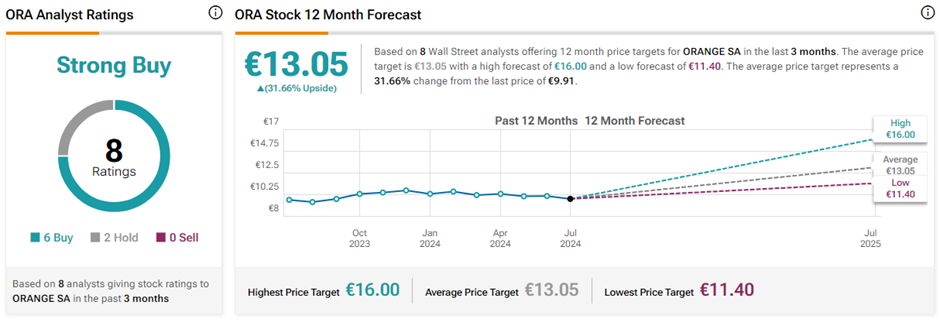

On TipRanks, ORA stock has a Strong Buy consensus rating based on six Buys and two Hold ratings. The average Orange SA price target of €13.05 implies 31.7% upside potential from current levels. Year-to-date, ORA shares have remained flat.

#2 Accor SA (FR:AC)

Accor SA is a French multinational hospitality company that owns, manages, and franchises hotels and resorts across the globe.

Accor is one of the premium partners of the Paris 2024 Olympic and Paralympic Games. Accor Group will be one of the first hotel operators to oversee the accommodation of athletes. Accor is set to offer 16,000 keys (rooms) to the two villages, with 700 team members deployed full-time during the duration of the Games. Plus, it will be welcoming guests at its 1,700 hotels across France.

Accor will report its first half of Fiscal 2024 results on July 25. The Street expects Accor to post diluted EPS of €1.14 on sales of €2.61 billion, showing an 8.7% year-over-year growth in total sales. Accor also pays an annual dividend of €1.18 per share, reflecting an attractive yield of 3.03%.

What is the Price Target for Accor Stock?

On TipRanks, the average Accor SA price target is €46.58, which implies a nearly 18.3% upside potential from current levels. Also, AC stock commands a Strong Buy consensus rating backed by seven Buys and one Hold rating. In the meantime, AC shares have gained 17.2% so far in 2024.

#3 Allianz SE (DE:ALV)

Germany-based Allianz SE is one of the world’s largest insurance and asset management companies. Under its insurance arm, the company offers property-casualty, life, and health insurance products.

Allianz is the worldwide Olympic and Paralympic Insurance Partner from 2021 through 2028. Allianz will offer insurance solutions and services to the Organising Committees for the Olympic Games, the National Olympic Committees, and their Olympic teams and athletes. The company is even the official sponsor of several athletes at the Olympic and Paralympic Games.

Allianz is scheduled to release its Q2 and first half of Fiscal 2024 results on August 8. The Street expects Allianz to post Q2 core EPS of €6.09, better than the year-ago figure of €5.97. The company initiated a share buyback program of 1 billion euros, of which 0.5 billion euros were completed in Q1FY24. Plus, ALV pays an annual dividend of €13.8 per share, reflecting an above-sector average yield of 5.27%.

Is Allianz Stock a Buy?

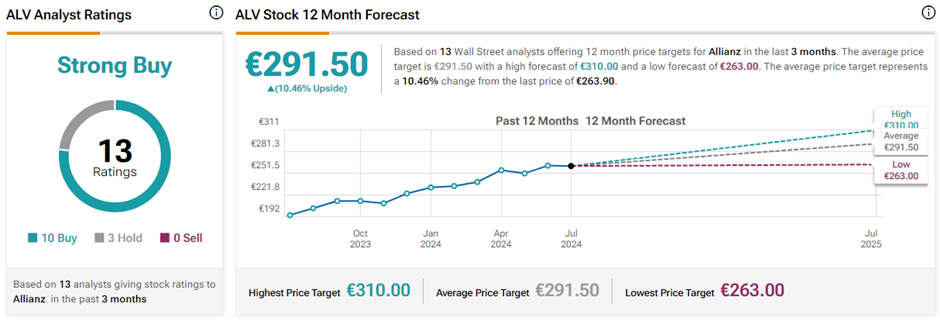

On TipRanks, ALV stock has a Strong Buy consensus rating backed by ten Buys and three Hold ratings. The average Allianz SE price target of €291.50 implies 10.5% upside potential from current levels. Meanwhile, ALV shares have gained 14.9% so far this year.

Ending Thoughts

The 2024 Summer Olympic Games are approaching soon. The Olympic Games happen once every four years, allowing companies to promote their businesses and attract more customers from across the globe. Investors keen to gain exposure to companies related to the Games can consider the aforementioned three Olympic stocks to enhance their portfolio.