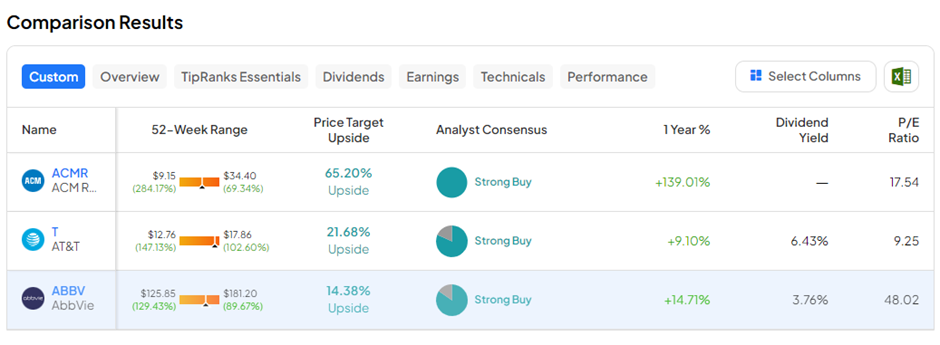

ACM Research, AT&T, and AbbVie are the 3 Best Value Stocks to buy in May 2024, as per Wall Street analysts. We used the TipRanks Best Value Stocks tool to unearth the value companies that analysts are highly optimistic about. Value stocks belong to those companies whose share prices are currently trading at a perceived lower price compared to their fundamentals.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Investors often use various ratios such as P/E (price/earnings per share), P/S (price/sales), or P/B (price/book value) to find undervalued stocks. A lower ratio compared to the sector average or the stock’s own historical average signals undervaluation.

Value stocks often offer high dividend yields since these companies reward shareholders from the high cash flows generated instead of reinvesting them in the business. With these positives in mind, let’s dive right into the 3 value stocks.

#1 ACM Research (NASDAQ:ACMR)

ACM Research caters to the burgeoning semiconductor industry, including verticals such as IC (integrated circuit), compound semi, wafer-level packaging, and wafer manufacturing markets. ACMR develops, manufactures, and sells production equipment and provides service solutions for single-wafer or batch wet cleaning, electroplating, stress-free polishing, Plasma-enhanced chemical vapor deposition (PECVD), track, and thermal processes.

Currently, ACMR trades at a P/E ratio of 17.5x, 40.6% lower than the industry average and 63.6% below its own 5-year average P/E. Similarly, its P/B of 1.8x is significantly below its averages.

In Q1 FY24, ACMR posted adjusted EPS of $0.52 on revenues of $152.19 million. The company delivered a 104.9% revenue growth and a staggering 246.7% jump in adjusted EPS compared to Q1 FY23 figures. Based on the current momentum, ACMR maintained its full-year Fiscal 2024 revenue guidance of $650 million to $725 million.

Importantly, ACM Research is set to begin initial production at the Lingang, Shanghai facility this year. It will continue investing in its U.S. and Korean operations to strengthen its global foothold.

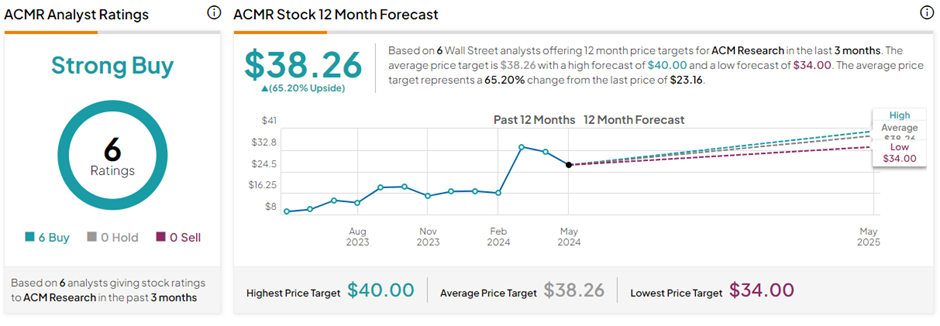

Is ACMR a Good Stock to Buy?

With six unanimous Buy recommendations, ACMR stock commands a Strong Buy consensus rating on TipRanks. The average ACM Research price target of $38.26 implies 65.2% upside potential from current levels, even after the stock’s 139% gain in the past year.

#2 AT&T (NYSE:T)

Texas-based AT&T is considered one of the world’s largest telecommunications companies. It is well-positioned to benefit from the growing adoption of 5G and fiber technology. T stock pays an attractive dividend of $0.28 per share, carrying an above-average yield of 6.43%.

AT&T’s trailing twelve months (TTM) P/E of 9.2x is 49.3% lower than the sector average. At the same time, its P/S ratio of 1.01x trades 20.5% lower than the sector average and 8.5% lower than its own 5-year average.

For Q1 FY24, T reported mixed results, with earnings beating but revenue missing estimates. The company’s revenue fell 0.4% year-over-year to $30 billion, while adjusted EPS of $0.55 declined by $0.05 from Q1 FY23.

Interestingly, AT&T recorded 349,000 postpaid phone net additions and 252,000 AT&T Fiber net adds, reflecting growing momentum in Mobility and Consumer Wireline connectivity businesses. For FY24, AT&T expects adjusted EPS in the $2.15 to $2.25 range. Further, it expects Wireless service revenue growth is projected in the 3% range and Broadband revenue growth of more than 7%.

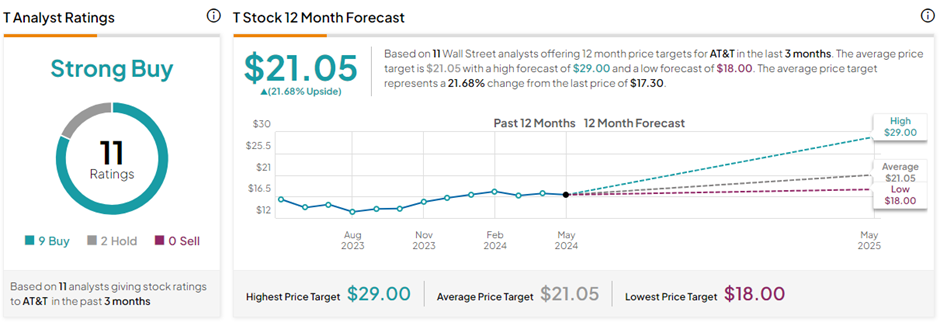

What is the Future of AT&T Stock?

T stock has a Strong Buy consensus rating on TipRanks, backed by nine Buys and two Hold ratings. The average AT&T price target of $21.05 implies 21.7% upside potential from current levels. Meanwhile, T shares have gained 2.06% in the past year.

#3 AbbVie Inc. (NYSE:ABBV)

Illinois-based AbbVie is an American biopharmaceutical company that focuses on immunology, oncology, neuroscience, eye care, virology, women’s health, and gastroenterology. AbbVie pays a quarterly dividend of $1.55 per share, reflecting an above-sector average yield of 3.76%.

ABBV trades at a P/E Non-GAAP (TTM) ratio of 14.72x, 24.1% lower than the sector median, but 35.26% higher than the stock’s own five-year average. Moreover, its forward PEG (Price/Earnings-Growth) Non-GAAP ratio of 1.74x trades at a 6.45% discount to the sector average and an 82.87% discount to its five-year average. The PEG provides a better picture of the company’s earnings growth. For AbbVie, the expected performance of pipeline drugs is reflected in the PEG ratio, making it a better gauge.

In Q1 FY24, Abbvie posted better-than-expected adjusted EPS of $2.31 and revenue of $12.31 billion. The company even raised its FY24 adjusted EPS forecast to the range of $11.13 to $11.33. As of date, AbbVie’s pipeline boasts over 90 compounds, devices or indications in development, individually or under collaboration or license agreement. In Q1, AbbVie spent 15.8% of its net revenues on research & development (R&D).

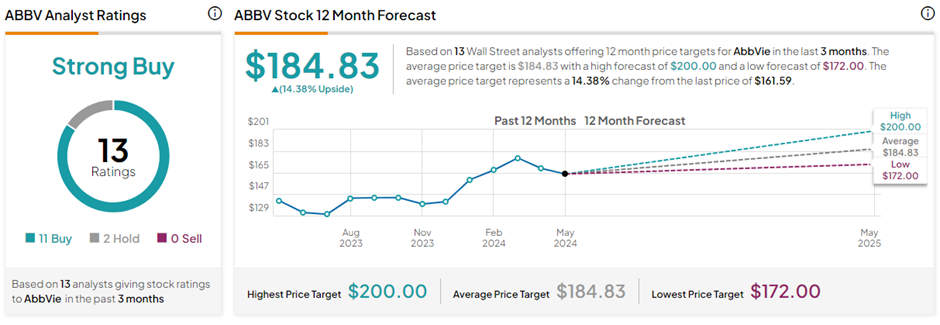

Is AbbVie a Buy or Hold?

With 11 Buys versus two Holds, ABBV stock has a Strong Buy consensus rating on TipRanks. The average AbbVie price target of $184.83 implies 14.4% upside potential from current levels. In the past year, ABBV shares have gained 10.2%.

Ending Thoughts

Wall Street analysts are highly bullish on the above three value stocks and consider them as great buys at current prices. Value stocks are considered low-risk investments and cheaper bets as they belong to well-established larger companies with sound financials.