These are the 3 Best Renewable Energy Stocks to buy in May 2024, as per Wall Street analysts. The world is moving towards cleaner and greener energy solutions, with stringent targeted decarbonization goals set by several countries. Sustainable energy solutions, such as wind, solar, and hydropower, are driving the way forward and are expected to generate massive electricity outputs in the years to come.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Consequently, companies are developing newer technologies to harness power from these renewable energy sources. We scanned the market to find three highly ranked renewable energy companies that have won analysts’ support. Let’s delve right into them.

#1 Sunnova Energy International Inc. (NYSE:NOVA)

Sunnova Energy is an adaptive energy services company that makes clean energy more accessible, reliable, and affordable for homeowners and businesses. It provides energy storage and EV charging solutions. Also, Sunnova was selected as The Home Depot’s (NYSE:HD) exclusive national solar and battery storage services provider. As of March 31, 2024, Sunnova had 438,500 customers.

In its Q1 FY24 results, Sunnova missed both sales and earnings per share (EPS) estimates. Sunnova’s sales fell marginally to $160.9 million owing to a decline in both inventory sales and service revenues. However, the top line gained from growth in the power purchase agreement (PPA), lease, Solar Renewable Energy Certificate (SREC), loan, and cash sales revenues.

Also, loss per share of $0.57 improved by 18.6% compared to Q1 FY23 due to higher interest income and a larger diversified customer loan portfolio. Nonetheless, Sunnova lowered its full-year Fiscal 2024 customer addition guidance to the range of 140,000 to 150,000.

Is Sunnova Energy a Good Stock to Buy?

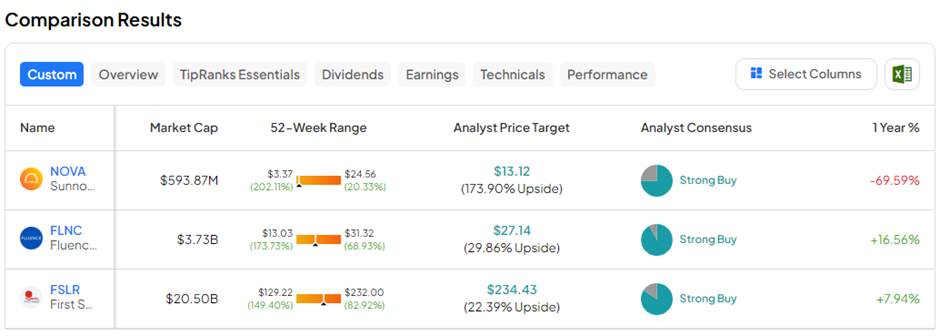

With 12 Buys and four Hold ratings, NOVA stock has a Strong Buy consensus rating on TipRanks. The average Sunnova Energy International price target of $15.57 implies a massive 225% upside potential from current levels. In the past year, NOVA stock has lost 69%.

#2 Fluence Energy Inc. (NASDAQ:FLNC)

Fluence Energy is on a mission to enable the global clean energy transition with energy storage products and services and cloud-based software (digital applications) for renewables and energy storage. It was formed by industry stalwarts Siemens (DE:SIE) and AES Corp. (NYSE:AES) in 2018.

Fluence is scheduled to report its Q2 FY24 results on May 8, after the market closes. The Street expects the company to post a diluted loss of $0.07 per share on revenue of $538.42 million. It is interesting to note that for the year ending December 31, 2023, Fluence recorded an all-time high order intake of $1.13 billion, which is expected to translate into higher revenue for FY24.

Also, FLNC expects to start its own battery module manufacturing, with domestic content at the Utah site in the summer, which will enhance its competitive position. This will also benefit both the company and its customers under the Inflation Reduction Act (IRA) of 2022.

Is FLNC a Good Stock to Buy?

On TipRanks, FLNC stock has a Strong Buy consensus rating, backed by 12 Buys and one Hold rating. The average Fluence Energy price target of $27.14 implies 29.9% upside potential from current levels. FLNC shares have gained 10.9% in the past year.

#3 First Solar, Inc. (NASDAQ:FSLR)

First Solar is one of the largest manufacturers of solar panels and thin film photovoltaic (PV) solar modules. FSLR’s panels are designed with cadmium telluride solar modules, which offer high efficiency at a lower cost compared to traditional PV panels.

In Q1 FY24, First Solar reported diluted EPS of $2.20 on net sales of $794.12 million. Sales jumped 44.8% year-over-year while net income ballooned 456% to $236.62 million compared to the prior year quarter. However, on a sequential basis, both sales and net income registered a decline.

First Solar had an expected sales backlog of 78.3 GW as of March 31, 2024. For the full-year Fiscal 2024, the company guided for net sales between $4.4 and $4.6 billion and diluted earnings in the range of $13.00 to $14.00 per share.

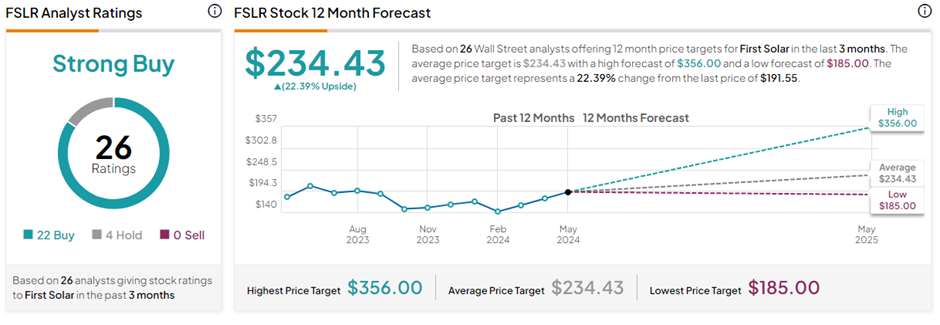

Is FSLR a Good Investment?

Analysts have awarded FSLR stock a Strong Buy consensus rating based on 22 Buys and four Hold ratings. The average First Solar price target of $234.43 implies 22.4% upside potential from current levels. FSLR shares have gained 7.9% in the past year.

Ending Thoughts

The renewable energy sector is poised for robust growth in the years ahead as the reliance on cleaner energy sources increases. Some of the factors benefiting the sector include declining costs, favorable government policies, and advancement in infrastructure. Given the global ambition to reduce greenhouse gas emissions, the renewable energy sector seems to be very lucrative. The above three renewable energy companies are expected to benefit from the ongoing energy transition and could be considered by investors after thorough research.