These are the 3 Best Mid-Cap stocks to buy in April 2024, as per Wall Street analysts. Mid-cap stocks belong to companies whose market capitalization ranges between $2 billion and $10 billion. These stocks are generally less volatile than small-cap stocks. At the same time, they offer greater potential for growth and share price appreciation compared to large-cap stocks. Meanwhile, certain companies that have backtracked from the large-cap category could also fall into this bracket.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Mid-cap stocks can offer good diversification to your portfolio due to the mixed features of both small-caps and large-caps. In times of economic downturns, these companies tend to fall slower than their small-cap counterparts. Alternatively, in times of economic expansion, mid-caps tend to outperform the large-cap companies. With this background in mind, let’s look at three mid-cap stocks that have been assigned a Strong Buy consensus rating by analysts and have an above 40% upside potential.

#1 Academy Sports and Outdoors (NASDAQ:ASO)

Texas-based Academy Sports and Outdoors is an American full-line sporting goods and outdoor recreation retailer. ASO’s offerings include hunting, fishing, and camping equipment and gear, sports and leisure products, footwear, and apparel.

ASO missed earnings and revenue estimates in its most recent results for the fourth quarter ending February 3, 2024. The news dragged down ASO stock by 12% on March 21. Shares are down 9.9% so far in 2024. On the positive side, ASO hiked its quarterly dividend by 22% to $0.11 per share, carrying a yield of 0.64%.

The demand for ASO’s products came to a standstill during the pandemic. It has been under pressure in recent quarters owing to the inflationary and high interest rate environment.

To counter the macro headwinds and accelerate its growth, ASO targets to open 15-17 new stores in Fiscal 2024. Plus, it will focus on growing omnichannel sales, customer data acquisition and utilization, and improving the supply chain. For FY24, ASO expects net sales to be between $6.07 and $6.35 billion, marginally above FY23 sales of $6.16 billion. Diluted earnings per share (EPS) is projected in the range of $5.90 to $6.90, compared to $6.70 reported in FY23.

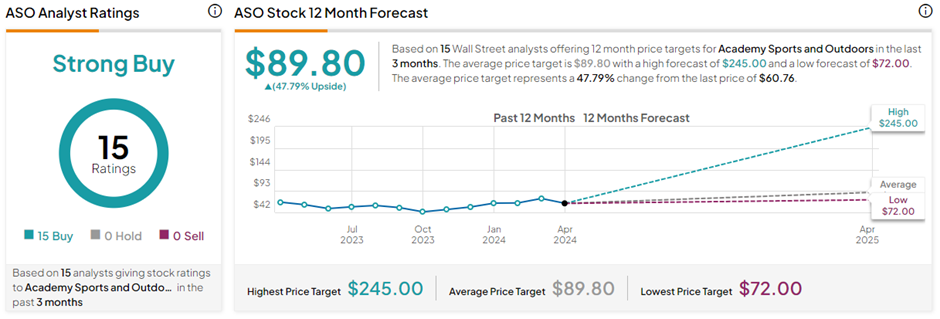

Is ASO a Good Stock to Buy?

Analysts expect an inflection in outdoor activities this year. With 15 unanimous Buy recommendations, ASO stock has a Strong Buy consensus rating on TipRanks. The average Academy Sports and Outdoors price target of $89.80 implies 47.8% upside potential from current levels.

#2 NEXTracker Inc. (NASDAQ:NXT)

NEXTracker manufactures intelligent, integrated solar trackers and software solutions for utility-scale and distributed generation solar projects around the world. NXT’s products enable solar panels to follow the sun’s movement across the sky and optimize plant performance.

In the past year, NXT shares have gained 42.9%, backed by a major transition toward renewable energy sources and decarbonization efforts. NXT is set to release its Q4 and FY24 results on May 14, after the market closes. The company boosted its annual guidance for FY24 based on the continued demand momentum for solar trackers. NXT forecasts revenue in the range of $2.425 to $2.475 billion and adjusted EPS in the range of $2.55 to $2.75.

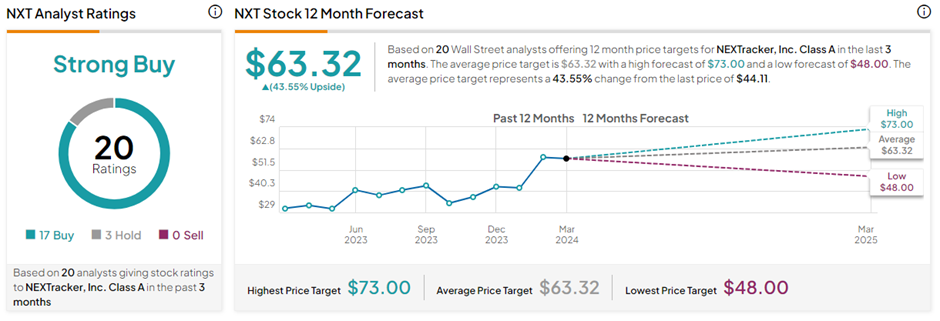

Is NXT Stock a Buy?

Several analysts cut their price target on NXT stock based on a slower installation perceived for Q2 but maintain their bullish view. Overall, NXT has a Strong Buy consensus rating on TipRanks, backed by 17 Buys and three Hold ratings. The average NEXTracker price target of $63.32 implies 43.6% upside potential from current levels.

#3 Darling Ingredients, Inc. (NYSE:DAR)

Darling Ingredients is a consumer defensive play. The company collects materials from the animal agriculture and food industries and processes them into high-quality fats and proteins, which are then used to feed animals and crops and fuel the world with renewable energy.

In its Q1 FY24 results announced on April 25, DAR’s net sales fell 20.7% year-over-year to $1.4 billion. Moreover, diluted EPS more than halved to $0.50 from $1.14 reported in Q1 FY23. Darling Ingredients cited a sharp decrease in fat prices and weaker earnings within its renewable fuel joint venture, Diamond Green Diesel (DGD), as the reasons for its lower earnings.

The company is working on navigating the business cycle by making adjustments to the purchase process and reducing operating costs to improve its margins. Looking ahead, management is optimistic about a reversal in its core specialty business, while the DGD unit’s performance is expected to improve.

Is DAR a Good Stock to Buy?

Five analysts reiterated their Buy view on DAR stock after the results. These analysts are optimistic about DAR’s progress toward 2025 and an expected ramp-up in its Sustainable Aviation Fuel (SAF) production. Plus, the DGD unit’s performance is expected to strengthen in the coming quarters, adding more room to grow.

Overall, DAR has a Strong Buy consensus rating based on ten Buys and two Hold ratings. The average Darling Ingredients price target of $63 implies 42.5% upside potential from current levels.

Key Takeaways

The three mid-cap stocks discussed above could be considered for diversifying your portfolio. These companies boast growing businesses with brighter future prospects and analysts’ bullish reviews.