These are the 3 Best Healthcare stocks to buy in April 2024, as per Wall Street analysts. The healthcare sector is considered a defensive play and tends to outperform the market in times of macro uncertainty. Investors could consider including a few healthcare stocks in their portfolios to shield them from macro fluctuations, as the demand for healthcare offerings is perennial.

With the earnings season in full swing, we checked for companies that posted stellar results for the March quarter and had a “Strong Buy” consensus rating. Based on these criteria, we sorted three healthcare stocks with high potential in the next twelve months. Analysts are bullish about these three drug makers as they have a solid pipeline of drugs and robust growth prospects.

#1 Abbott Laboratories (NYSE:ABT)

Illinois-based Abbott Laboratories is an American multinational healthcare and medical devices company. Abbott has created breakthrough products in the realm of diagnostics, medical devices, nutrition, and branded generic pharmaceuticals. It is a Dividend Aristocrat, having raised its dividends for 52 consecutive years. Currently, ABT offers an above-average dividend yield of 1.93%, paying quarterly dividends of $0.55 per share.

On April 17, Abbott reported better-than-expected Q1 FY24 results, beating both the top and bottom line expectations. Abbott’s organic sales growth for the underlying base business (excluding foreign exchange, acquisitions, and COVID-19-related testing products) jumped 10.8% year-over-year, mainly driven by solid sales in Medical Devices and Established Pharmaceuticals.

Moreover, the company raised the midpoint of its full-year Fiscal 2024 sales and earnings per share (EPS) guidance. Adjusted EPS is forecasted between $4.55 and $4.70 and organic sales growth is projected in the range of 8.5% to 10.0%.

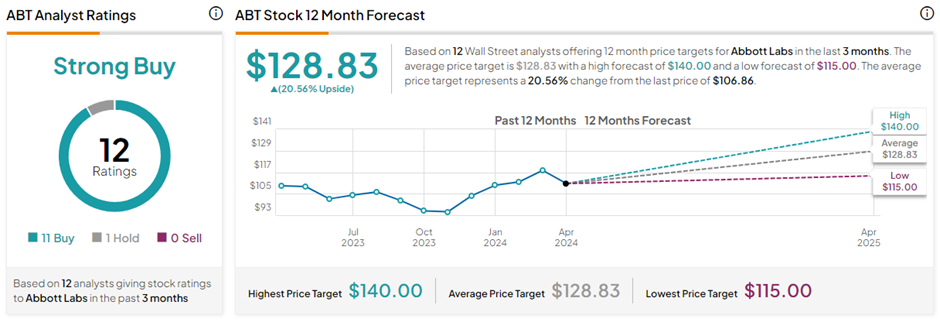

Is Abbott a Buy or Sell?

Seven analysts reiterated their Buy views on ABT stock after its solid Q1 print. Overall, ABT stock has a Strong Buy consensus rating based on 11 Buys and one Hold rating. The average Abbott Laboratories price target of $128.83 implies 20.6% upside potential from current levels. In the past year, ABT shares have lost 1.7%.

#2 UnitedHealth Group, Inc. (NYSE:UNH)

UnitedHealth Group is one of the world’s largest health insurance companies by revenue. It offers a diverse range of healthcare coverage products and benefits through its UnitedHealthcare segment and technology-enabled health services through its Optum unit. UNH pays a regular quarterly dividend of $1.88 per share, carrying a yield of 1.49%.

On April 16, UNH posted strong Q1 FY24 results, exceeding the consensus on both revenue and earnings front. The company’s revenues grew by $8 billion compared to the prior year, reflecting continued momentum at Optum and UnitedHealthcare units. Looking ahead, UNH maintained its adjusted EPS guidance range of $27.50 to $28.00.

The unfortunate cyberattack on UNH’s Change Healthcare system in February 2024, has disrupted the wellbeing of its customers and practitioners alike. To date, UNH has provided advance funding and interest-free loans totaling over $6 billion to support care providers impacted by the cyber incident. The attack also impacted UNH’s bottom line by $0.74 per share in Q1. The company anticipates that for the full year, the impact will be in the range of $1.15 to $1.35 per share.

UNH CEO Andrew Witty will appear before the House Energy and Commerce Subcommittee on Oversight and Investigation on May 1, to discuss the potential impact and the steps taken to remediate the situation.

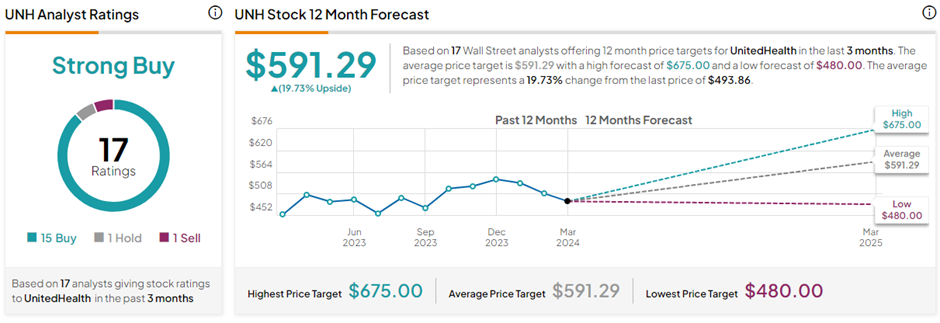

What is the Price Target for UNH?

Ten analysts reiterated their Buy views on UNH post its Q1 print. The average UnitedHealth Group price target of $591.29 implies 19.7% upside potential from current levels. Overall, UNH has a Strong Buy consensus rating on TipRanks, backed by 15 Buys, one Hold, and one Sell rating. UNH shares have gained 2.3% in the past year.

#3 AstraZeneca Plc (NASDAQ:AZN)

UK-based AstraZeneca is a multinational pharmaceutical company with a focus on developing treatments for cancer, gastrointestinal, cardiovascular, neuroscience, respiratory and inflammation, and other infectious diseases. As of date, AZN has 182 projects in its pipeline, reflecting a strong potential for future growth. In February, AZN’s board hiked the annual dividend by 7%. Accordingly, AZN pays a semi-annual dividend of $0.96 per share, carrying an above-average yield of 2.07%.

On April 25, AZN posted stellar Q1 FY24 results, outpacing revenue and earnings estimates. Total revenue jumped 19% (at constant exchange rates) year-over-year, primarily driven by an 18% increase in Product Sales and continued growth in Alliance Revenue from partnered medicines.

For the full year 2024, AZN reiterated its guidance for total revenue and core EPS, with both metrics expected to grow by a low double-digit to low teens percentage.

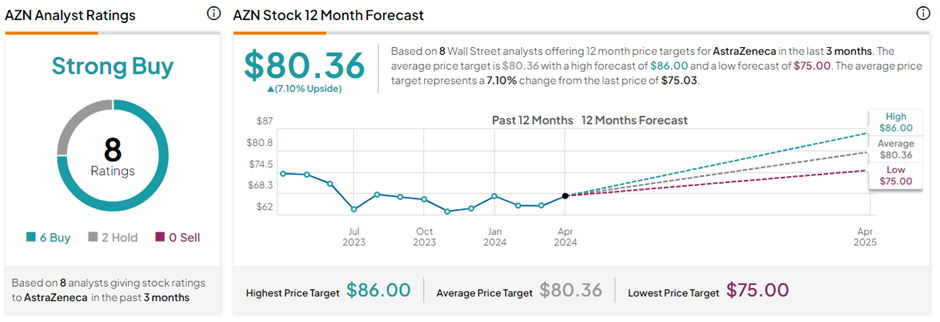

Is AstraZeneca a Buy or Sell?

So far, only TD Cowen analyst Steve Scala has reaffirmed a Buy view on AZN stock post the Q1 beat. Overall, AZN stock commands a Strong Buy consensus rating based on six Buys and two Hold ratings. The average AstraZeneca price target of $80.36 implies 7.1% upside potential from current levels. AZN shares have gained 1.9% in the past year.

Key Takeaways

The above three healthcare stocks have won a Strong Buy consensus view from analysts, backed by solid financial performance and promise of future potential. Investors seeking exposure to the defensive healthcare sector can consider these three stocks for their portfolios after thorough research.