Block, CleanSpark, and MicroStrategy are the 3 Best Cryptocurrency Stocks to buy in May 2024, according to Wall Street analysts. We used the TipRanks Comparison Tool for Crypto Stocks to determine the three stocks that have scored analysts’ “Strong Buy” consensus rating.

Bitcoin (BTC-USD) prices have rallied over 69% so far in 2024, hovering around $69,535 as of May 21. BTC has retreated 2.8% from its all-time high of $73,337.76 seen on March 14, 2024. Following the Bitcoin halving event on April 19, the rewards for crypto miners have halved to 3.125 Bitcoins. The halving event is modeled to reduce the supply of bitcoin in the system and tame inflation, while pumping out rogue miners. Looking ahead, easing inflation and potential interest rate cuts could drive Bitcoin and crypto stocks higher.

Let’s look at the three cryptocurrency stocks that are highly favored by analysts.

#1 Block (NYSE:SQ)

Jack Dorsey’s Block is a financial technology company offering solutions through platforms like Square, Cash App, Spiral, TIDAL, and TBD. The company’s services encompass financial solutions, peer-to-peer payment, open-source projects advancing the adoption of Bitcoin, and the building of an open developer platform to make Bitcoin access easier.

Block is one of the largest Bitcoin investors, with roughly 8,038 BTC ($573 million) on its balance sheet as of March 31. It has committed to investing 10% of its monthly gross profit from BTC products in Bitcoin purchases.

The fintech company exceeded both revenue and earnings per share (EPS) estimates for Q1 FY24. At the same time, it raised the full-year Fiscal 2024 outlook, reflecting confidence in performance for the remainder of the year. Block has $591 million remaining under its current share repurchase program.

Is SQ a Good Stock to Buy?

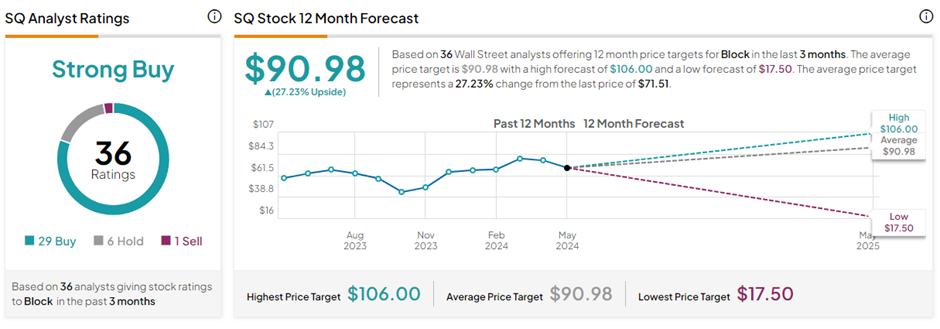

With 29 Buys, six Holds, and one Sell rating, SQ stock has a Strong Buy consensus rating on TipRanks. The average Block price target of $90.98 implies 27.2% upside potential from current levels. SQ shares have gained nearly 18% in the past year.

#2 CleanSpark (NASDAQ:CLSK)

CleanSpark is a Bitcoin mining company that uses a sustainable energy mix, including nuclear, hydroelectric, solar, and wind, to power its mining operations. The company owns and operates data centers that run on low-carbon power. CleanSpark has multiple mining facilities in Georgia, New York, and Mississippi.

As of April 30, CLSK had a hashrate of 17.3 EH/s (exahash per second). It produced 721 BTC and held 5,739 BTC as of April end. CleanSpark is set to acquire two Bitcoin mining sites in Wyoming, having 75 MW of power, for $18.75 million in cash. The agreement includes the potential to expand the capacity of these sites by an additional 55 MW. The acquisition is expected to boost CLSK’s hashrate by 4 EH/s once the sites are fully operational.

In Q2 FY24, CleanSpark’s revenue jumped 163% year-over-year to $111.8 million, outpacing consensus of $106.62 million. Also, earnings from continuing operations came in at $0.58 per share, significantly better than the $0.07 expected by analysts. In comparison, CLSK had reported a loss from continuing operations of $0.23 per share in Q2 FY23.

Is CleanSpark a Good Stock to Buy?

On TipRanks, CLSK stock has a Strong Buy consensus rating based on three Buys and one Hold rating. The average CleanSpark price target of $19.55 implies 6.1% upside potential from current levels. In the past year, CLSK shares have zoomed 315.8%.

#3 MicroStrategy (NASDAQ:MSTR)

MicroStrategy develops and provides industry-leading artificial intelligence (AI)-powered enterprise analytics software solutions, mobile software, and cloud-based services. Alongside this business model, MSTR is a big believer in Bitcoin, accumulating massive BTC reserves and using its software development capabilities to develop Bitcoin applications. As of April 26, MSTR held 214,400 bitcoins, valued at $7.54 billion.

Although MSTR missed analysts’ EPS and revenue estimates by wide margins in Q1 FY24, institutions continue to hoard MSTR stock purely because of its huge BTC reserves. Also, MSTR’s inclusion in the MSCI World Index, effective May 31, makes it a bullish play in the Bitcoin space. Interestingly, MSTR shares have skyrocketed nearly 463% in the past year.

What is the Future price of MSTR Stock?

Despite the weaker-than-expected quarterly results, analysts remain highly optimistic about MicroStrategy stock. With four unanimous Buy ratings, MSTR stock has a Strong Buy consensus rating on TipRanks. The average MicroStrategy price target of $1,678.75 implies 1.4% upside potential from current levels.

Key Takeaways

The anticipation of lower interest rates, cooling inflation, and the launch of spot Bitcoin ETFs have all boosted BTC prices this year. After witnessing the lowest lows during the pandemic, crypto company stocks are expected to move higher in the coming quarters. Analysts are highly bullish about the above three crypto stocks. Investors can consider investing in them after thorough research.