Ryanair Holdings (NASDAQ:RYAAY) (GB:0A2U) reported a 34% jump in after-tax profits to €1.92 billion for FY24, beating analysts’ expectations of €1.90 billion. On the back of its solid results, the company announced a buyback worth €700 million, which will start later this week. Upon completion, this buyback will raise the funds that Ryanair has returned to shareholders since 2008 to over €7.8 billion.

Following the results, 0A2U stock was trading down by 0.32% as of writing. Meanwhile, Dublin-listed shares lost 1.3%.

Ryanair Holdings is a budget airline company with a presence in approximately 40 countries in Europe. The airline operates a vast network, with over 3,000 daily flights.

Highlights from Ryanair’s FY24 Results

In its FY24 results, Ryanair reported a 25% increase in its revenue to €13.4 billion as compared to the previous fiscal year. Furthermore, the company’s revenue per passenger increased by 15%, accompanied by a 21% growth in average fare over the year.

The increased revenues enabled the airline to mitigate its higher costs, as the fuel bill surged by 32%, amounting to an additional €1.25 billion, reaching a total of €5.14 billion. The total operating costs increased by 24% to €11.38 billion. Nonetheless, for FY25, Ryanair’s over 70% of fuel requirements are hedged, leading to approximately €450 million in fuel savings.

During the year, the company’s passenger traffic grew by 9% to 184 million, despite delivery delays on its new Boeing planes. Moving forward, Ryanair anticipates an 8% growth in FY25 traffic, aiming to increase passenger numbers from 198 million to 200 million. However, this remains contingent upon Boeing deliveries returning to contracted levels before the year’s end.

It further stated that summer demand was favorable, with bookings surpassing last year’s figures. But, the company anticipates that summer 2024 fares will remain steady or slightly exceed those of summer 2023.

Are Ryanair Shares a Good Buy?

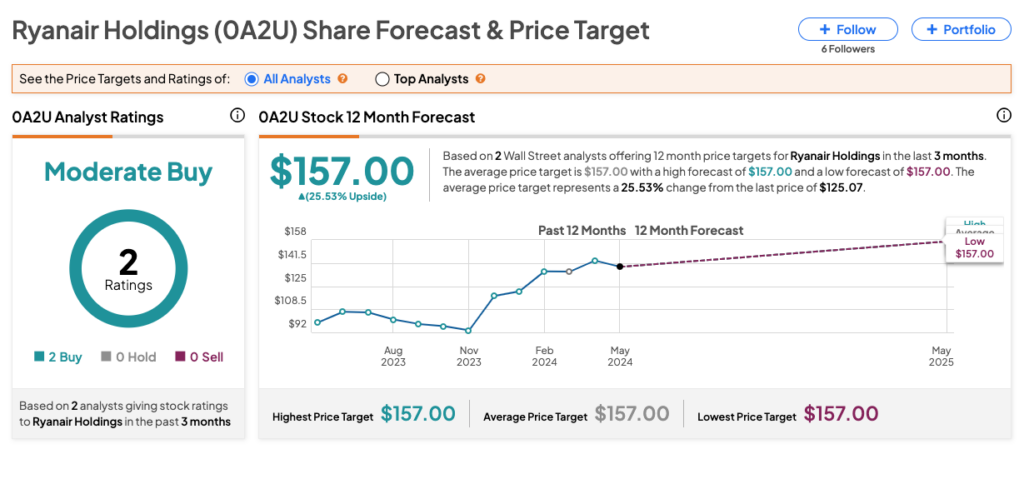

0A2U stock has received a Moderate Buy rating on TipRanks, backed by two Buy recommendations. The Ryanair share price forecast is $157, which is 26% above the current level. These analyst ratings are likely to change following RYAAY’s result report today.