Electric Vehicle (EV) maker Rivian Automotive (NASDAQ:RIVN) delivered mixed first-quarter financial results. The company’s wider-than-expected net loss irked investors, leading to a 5.6% decline in its stock in Tuesday’s after-hours trading.

Before digging deeper, it’s worth noting that Rivian temporarily closed its production facility to enhance its assembly line, aiming for a long-term cost reduction. However, this factory retooling added costs in the first quarter and weighed on its bottom line.

Factory Retooling a Positive Step

While the production facility upgrade added incremental costs in Q1, the move is a positive step as it will enable Rivian to remove substantial costs from its vehicles and boost profitability in the long term. For instance, through this tooling upgrade, RIVN introduced new technologies and cost-focused material changes into its vehicle platform, which should improve manufacturing processes.

In addition, the company improved the flow of materials and inventory in the plant. These changes are expected to improve cycle time, utilization, and cost.

With this background, let’s jump to Q1 performance.

Rivian’s Q1 Performance

Rivian delivered total revenue of $1.2 billion in Q1, up over 82% year-over-year. The company’s top line surpassed Street’s forecast of $1.17 billion. This growth was driven by the delivery of 13,588 vehicles in Q1, up from 7,946 vehicles in the prior-year quarter.

The EV maker generated a gross loss of $527 million in Q1, compared to a loss of $535 million in the prior-year period. It benefitted from increased vehicle production and deliveries, reductions in material costs, and higher average selling prices. However, the factory upgrade activity adversely impacted its gross profit per vehicle and incurred an incremental cost of $171 million in Q1.

Rivian delivered a net loss of $1.45 billion in Q1, which widened from a loss of $1.35 billion in the prior-year quarter. Moreover, the company reported an adjusted loss of $1.24 per share, which was greater than analysts’ loss estimate of $1.15 per share.

Outlook

The company plans to reduce its gross inventory balance by more than 25% in 18 months, generating a working capital benefit. Further, the company’s production plant upgrade will reduce variable and semi-fixed costs as the year progresses. Thus, the company expects its adjusted operating expenses for the year to be down slightly compared to 2023.

The company reiterated its 2024 production guidance of 57,000 vehicles and expects total deliveries to grow by low single digits.

Is Rivian a Buy, Sell, or Hold?

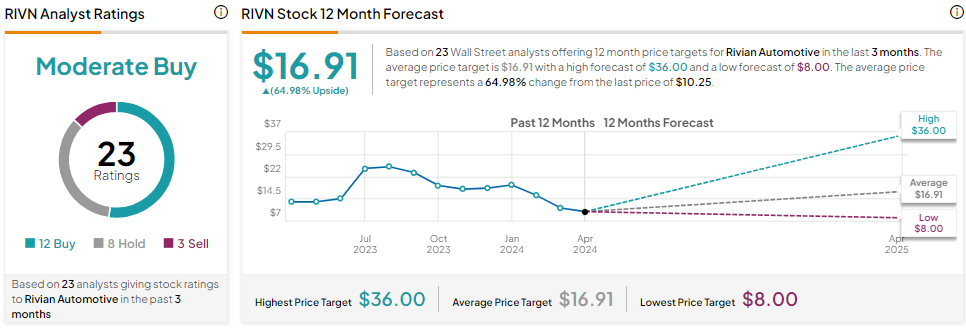

Rivian stock is down over 56% year-to-date, reflecting industry-wide demand softness in the EV market. Meanwhile, Wall Street is cautiously optimistic about RIVN stock.

With 12 Buys, eight Holds, and three Sells, Rivian stock has a Moderate Buy consensus rating. Analysts’ average price target on RIVN stock is $16.91, implying 64.98% upside potential.