Nvidia’s (NASDAQ:NVDA) quarterly reports are not announced at the same time as most of its big tech brethren. While all the tech giants dial in their earnings roughly during the same period, Nvidia’s fiscal quarter always ends a month later, resulting in a late entry to the earnings game.

While not intentional, in this AI-focused environment, making everyone wait for the stock market’s current darling to announce its latest financials, is kind of fitting.

In fact, with the company readying to report F1Q25 results once the market action comes to a close next Wednesday (May 22nd), Deutsche Bank’s Ross Seymore, an analyst rated in the top 1% of Street stock experts, reminds investors that it represents a one-year anniversary since Nvidia delivered its “market-changing” May-2023 report.

With the latest print about to hit, the analyst sees another strong readout in the offing.

“We expect the co to continue its trend of delivering healthy multi-billion dollar beats/raises on still healthy demand for AI compute,” said the 5-star analyst. “While on the margin some may be paring back orders ahead of the launch of Blackwell, we still expect aggregate demand trends to remain healthy (i.e. unlikely to impact the co’s near-term outlook).”

Seymore expects Nvidia will generate April quarter revenues of $24.5 billion, “slightly above” the $24 billion midpoint of the guide and the same as the Street’s forecast. On the bottom-line, the analyst expects PF EPS of $5.54, just edging ahead of consensus at $5.53.

For F2Q25 (July quarter), reflecting “increased supply and still-strong demand,” Seymore sees revenue climbing by 97% year-over-year to $26.5 billion, roughly in-line with the Street’s forecast of $26.7 billion. Given Nvidia’s track record of beating Street expectations, Seymore also thinks the risk to this estimate is “once again skewing to the upside.” At the other end of the equation, Seymore is calling for EPS of $6.00, almost identical to the Street’s $5.99 forecast.

The interesting part here, though, is that despite Seymore expecting strong results while singing Nvidia’s praises, he remains amongst a very small group not wholly enamored with the stock right now.

“Overall, we remain impressed by NVDAs best-in-class technology roadmap and believe AI fervor by its customers is likely to be sustained (see still strong capex commentary from META, MSFT), yielding yet another strong quarter/ guide,” he explained. “However, investors apparently have become more discerning of AI-driven upside in earnings season QTD, and we believe continued fundamental strength is already well understood.”

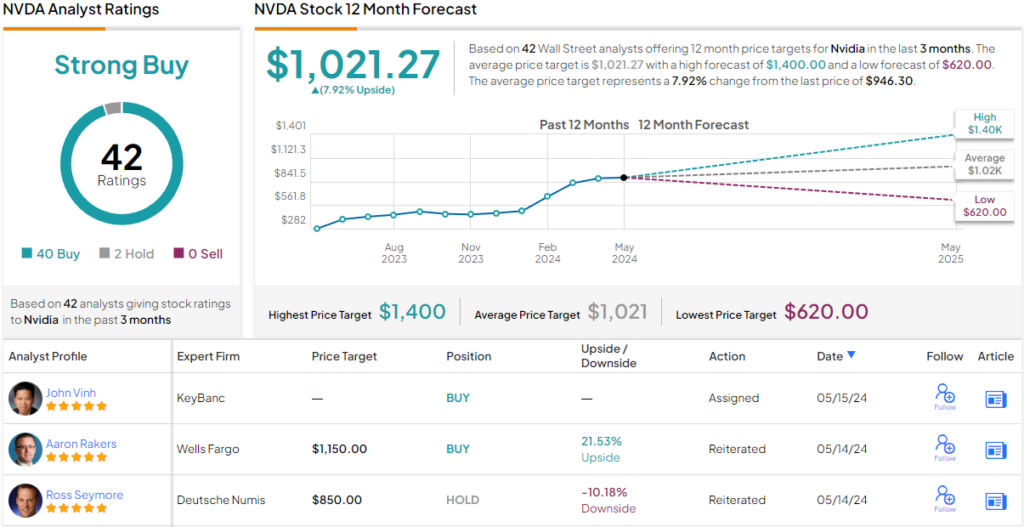

As such, seeing the stock as “fully valued,” Seymore keeps his Hold (i.e., Neutral) rating as is, while his $850 price target suggests the shares have 10% downside in them over the next year. (To watch Seymore’s track record, click here)

So, that’s Deutsche Bank’s view, what does the rest of the Street have in mind? One other analyst joins Seymore on the fence with an additional Hold rating, but they are countered by 40 Buys, all naturally resulting in a Strong Buy consensus rating. Going by the $1,021.27 average target, a year from now, the shares will be changing hands for ~8% premium. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.