In major news on Australian stocks, Qantas Airways Limited (AU:QAN) has reached an agreement to pay a penalty of AU$120 million ($79 million) to settle the “ghost flights” fiasco. It includes a fine of AU$100 million for breaching Australian Consumer Law over the alleged sale of thousands of tickets for already cancelled flights. Along with this, the airline will also pay AU$20 million as compensation to more than 86,000 customers in restitution for flight cancellations.

The airline further clarified that these payments are in addition to any alternative flights or refunds already issued to customers. Qantas shares traded up by 0.34% today.

Qantas Airways Limited is Australia’s national airline and boasts the largest fleet and international flight operations.

The Backdrop

In August 2023, the ACCC (Australian Competition and Consumer Commission) launched a legal action against Qantas, alleging that it promoted and sold tickets for over 8,000 flights even though it was aware of their cancellation. The ACCC accused the airline of engaging in false, misleading, and deceptive practices through the marketing of already-cancelled tickets between May 21, 2021 and July 7, 2022.

Qantas Faces Consequences

The ACCC stated that Qantas has acknowledged misleading its consumers by promoting seats on cancelled flights. The ACCC’s chair, Gina Cass-Gottlieb, described these actions by the airline as “egregious and unacceptable.”

Qantas has been facing severe backlash over lost luggage, steep airfares, and diminishing service standards following the easing of COVID-related travel restrictions. The settlement signals a fresh initiative by the airline to put an end to errors made in the aftermath of the pandemic. Nevertheless, the legal saga has significantly tarnished the reputation of the airline.

Is Qantas a Good Share to Buy Now?

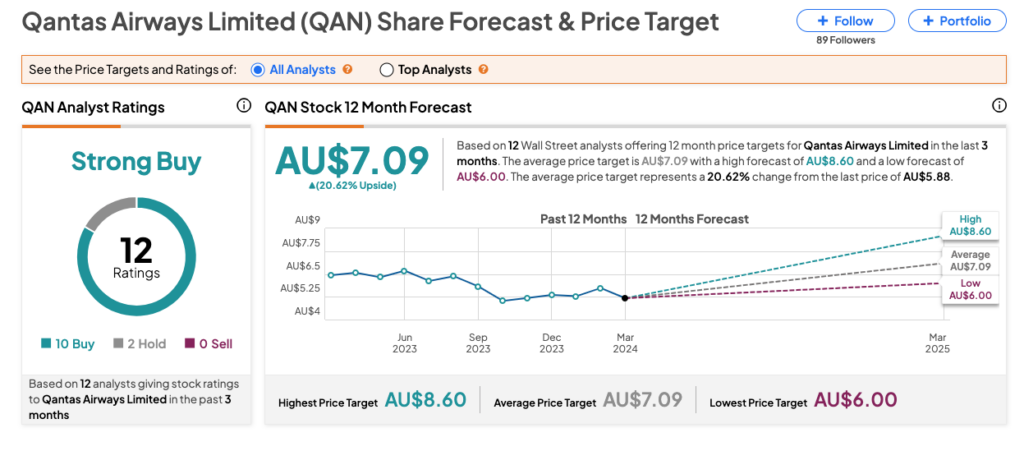

According to TipRanks, QAN stock has received a Strong Buy rating, backed by 10 Buy and two Hold recommendations.

Qantas shares have rebounded by more than 20% since reaching their lowest point in October 2023. Moving ahead, the Qantas share price prediction is AU$7.09, which represents an upside of about 21% from the current price level.